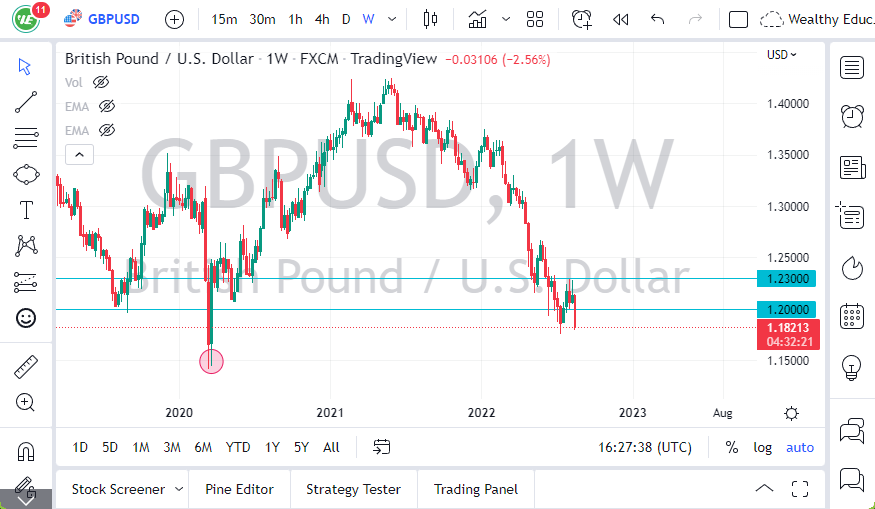

GBP/USD

The British pound has tried to rally during most of the week but felt towards the 1.30 level again. While this is a negative sign, we have a massive amount of support underneath and I think what we are looking at here is a market that continues the bounce around due to headlines coming out of the Brexit. I believe at this point, it’s only a matter of time before the market breaks out of this consolidation range, but for now I expect the 1.30 level offer support while the 1.3250 level will offer a bit of resistance.

EUR/USD

The Euro went back and forth during the week as well but bounced rather significantly on Friday to show signs of life again. The 1.1450 level has offered enough support based upon previous candles that it makes sense that we continue to stay within the consolidation, much like we are going to in my estimation in the British pound. I think the 1.1450 level is a significant amount of support that will be difficult to break through. I think this shows just how much traders are on the sidelines when it comes to the entire Italian debt situation.

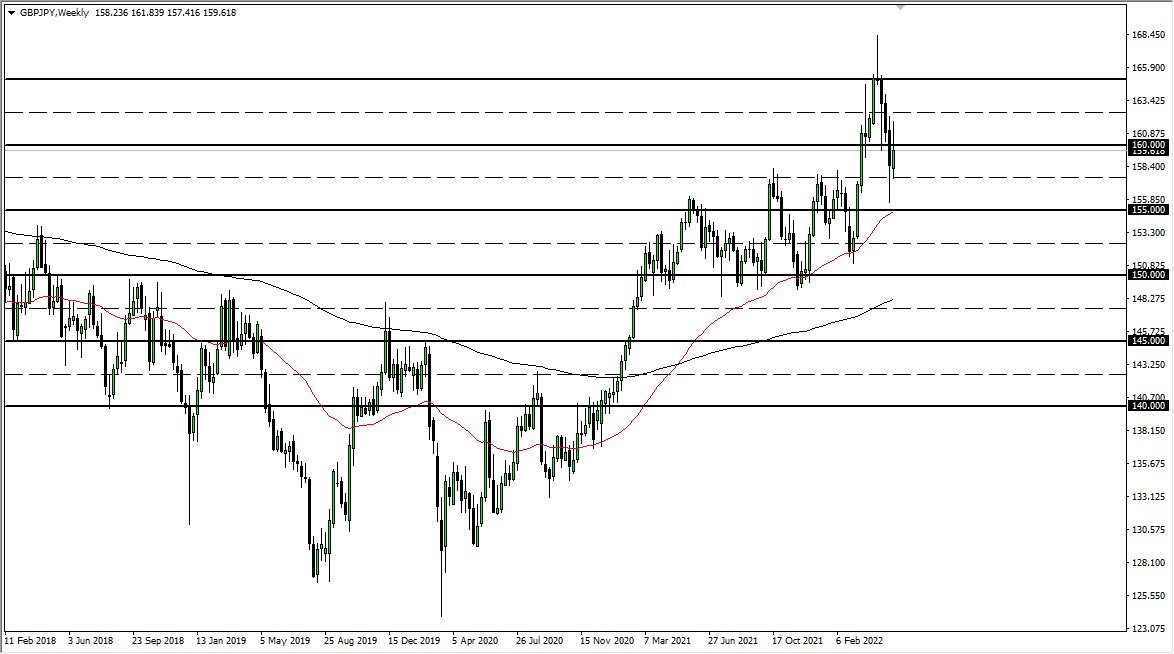

GBP/JPY

The British pound has gone back and forth during the trading week against the Japanese yen, dancing around the ¥146.50 level. I think at this point, we will probably turn around and try to break to the upside, if nothing else because of the resiliency that the British pound continues to show every time it sells off. Ultimately, I believe that we will be able to break above the ¥150 level, but it may take several attempts. Buying the dips continues to work from what I see.

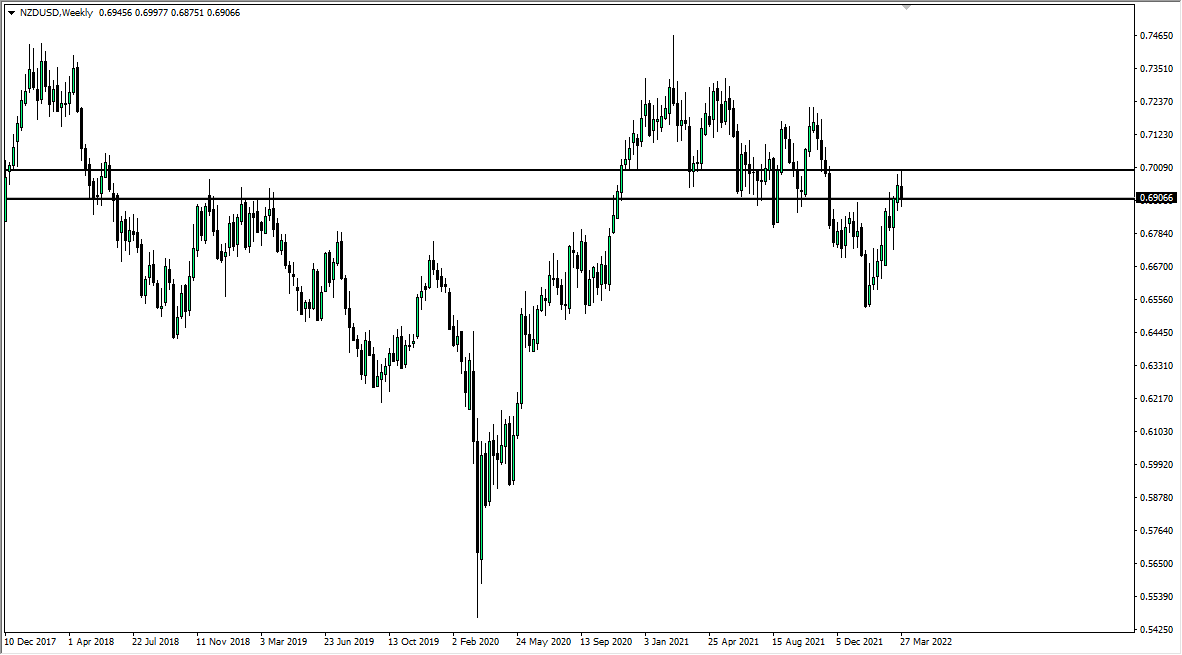

NZD/USD

The New Zealand dollar has rallied rather stringently during the week, reaching above the 0.66 handle. That’s a very good sign, but we are facing a significant amount of resistance just above. Quite frankly, I am not interested in going long of the New Zealand dollar until we can clear the 0.67 handle, which would be a significant turn of events. I think selling the rallies will probably be the best way to go unless of course we get a huge “risk on” move.