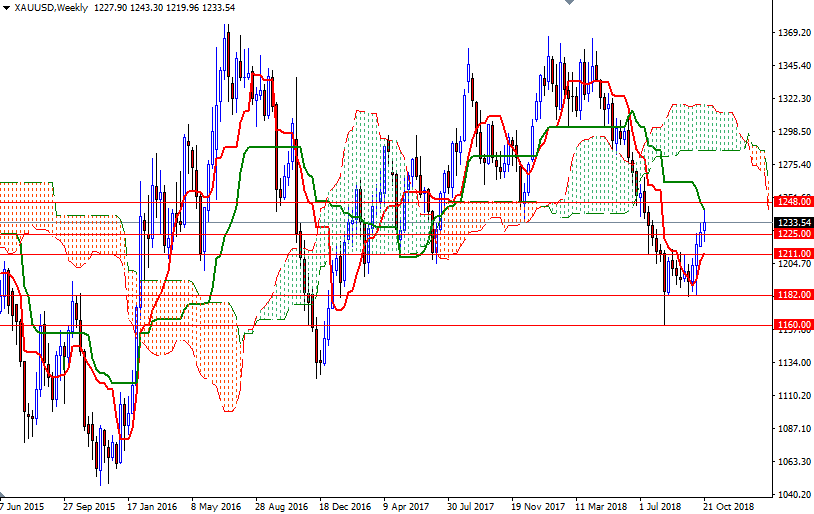

Gold prices settled at $1233.54 an ounce on Friday, scoring a gain of 0.46% on the week, as rising volatility in global equity markets bolstered demand for gold. Stocks have been punished this month by a range of worries, from heightened geopolitical tensions and rising bond yields to China-U.S. trade frictions and corporate earnings. The strong U.S. dollar has been a bearish weight on the precious metals markets recently. The greenback remained strong on perception that the Federal Reserve will lift interest rates once more by the end of the year.

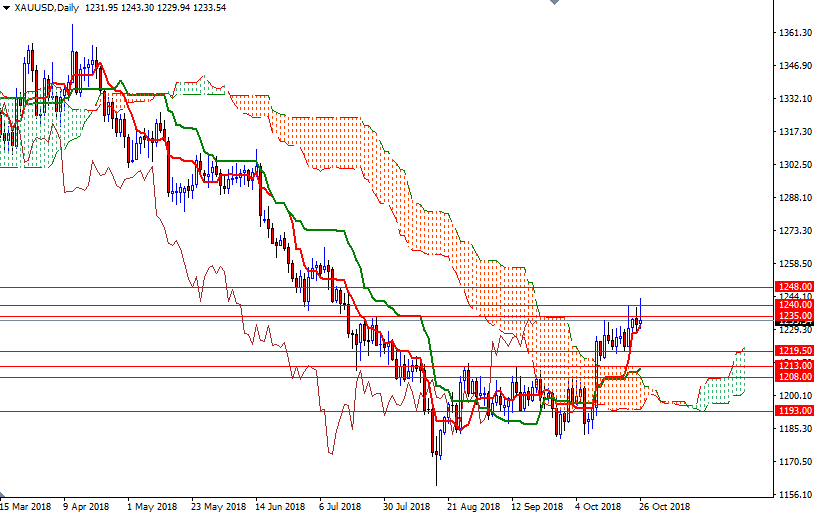

From a chart perspective, the bulls have the near-term technical advantage. XAU/USD is above the daily and the 4-hourly Ichimoku clouds. The Chikou-span (closing price plotted 26 periods behind, brown line) is above prices; plus, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned. However, note that the market tried to break through the anticipated resistance in the 1240/35 area three times last week, failed on each occasion.

If the market can successfully get above this barrier, it has the potential to rise to 1252/48. A break through there could lead to a push up to 1260. The bulls have to produce a daily close above 1260 to gain momentum for 1265. However, if investors start cashing in recent gains, XAU/USD may head to the 4-hourly cloud. In that case, 1225/4 and 1220.50-1219.50 will probably be the next target. Further weakness below 1219.50 could lead to a retest of the 1213/1 area. The bears have to capture this strategic camp to make an assault on the 1208 level.