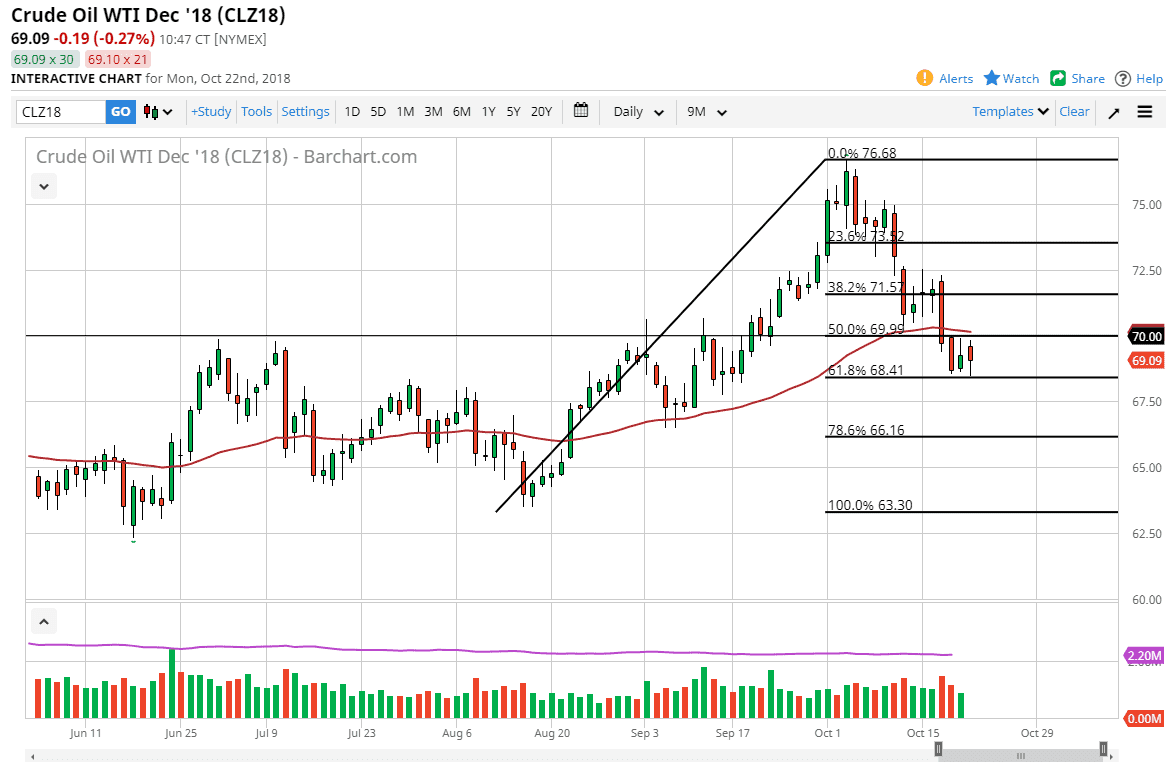

WTI Crude Oil

The WTI Crude Oil market fell rather hard initially during trading on Monday but has found support at the 61.8% Fibonacci retracement level again. Because of this, I believe that the market is trying to form a bit of a stand here and if we can break above the top of the shooting star from Friday, which also coincides nicely with the $70 level and the 50 day EMA, then we could be talking about the beginning of something positive. Alternately, a break down below the $68.40 level for the 61.8% Fibonacci retracement level probably has this market unwinding to the $67.50 level, $67 level, and then eventually $65. Oil begins to look somewhat cheap in this area, but by all means you do not want to be the first person in this trade. Start out slow and build if it works in your favor.

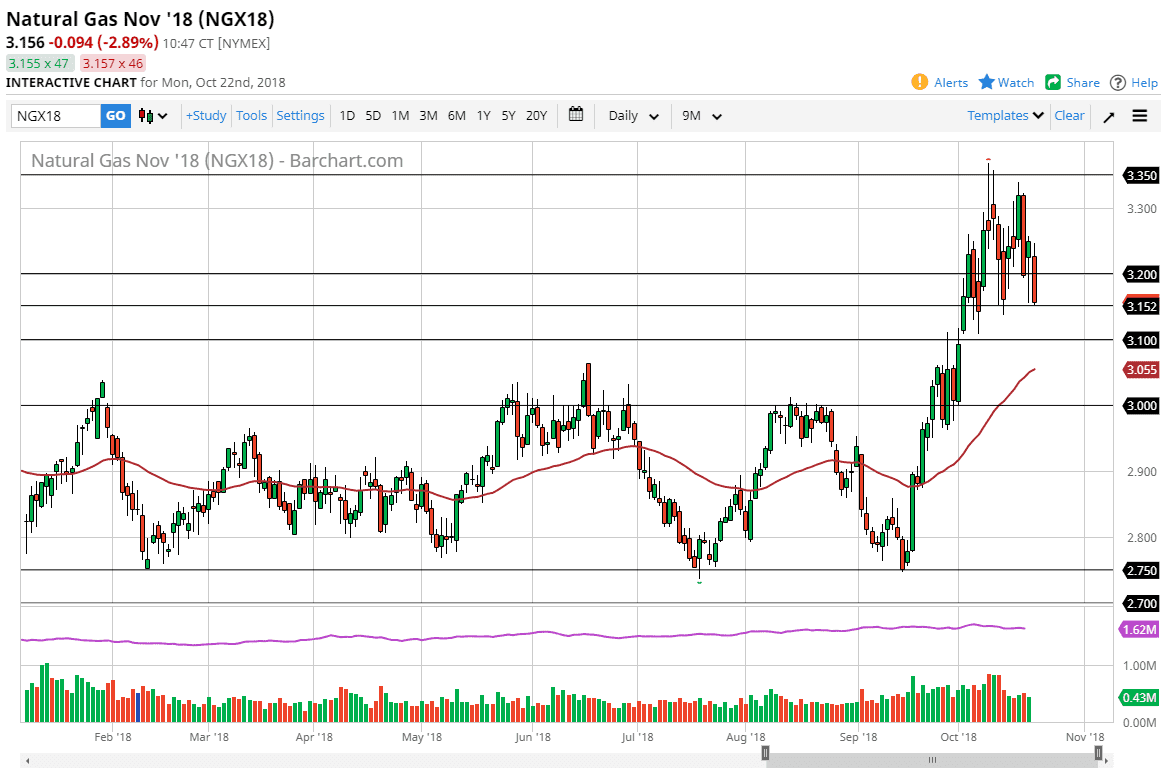

Natural Gas

Natural gas markets fell rather hard during the day on Monday, reaching down to the $3.15 level below. This is an area that has been supported several times but I do think that the market is probably a bit overstretched at this point. I like the idea of buying at lower levels, especially at the $3.10 level, and possibly even the three dollars level. With that in mind, I continue to be bullish but I recognize that being overbought is a condition that we are most certainly in at the moment as well. Natural gas has a seasonal positivity two at this time of year, so don’t be surprised at all if buyers continue to come in and pick up value. I believe that the “floor” is closer to the $3.00 level, and a break down below there would of course change everything in my estimation. One thing to pay attention to, the possibility of an El Niño winter in America.