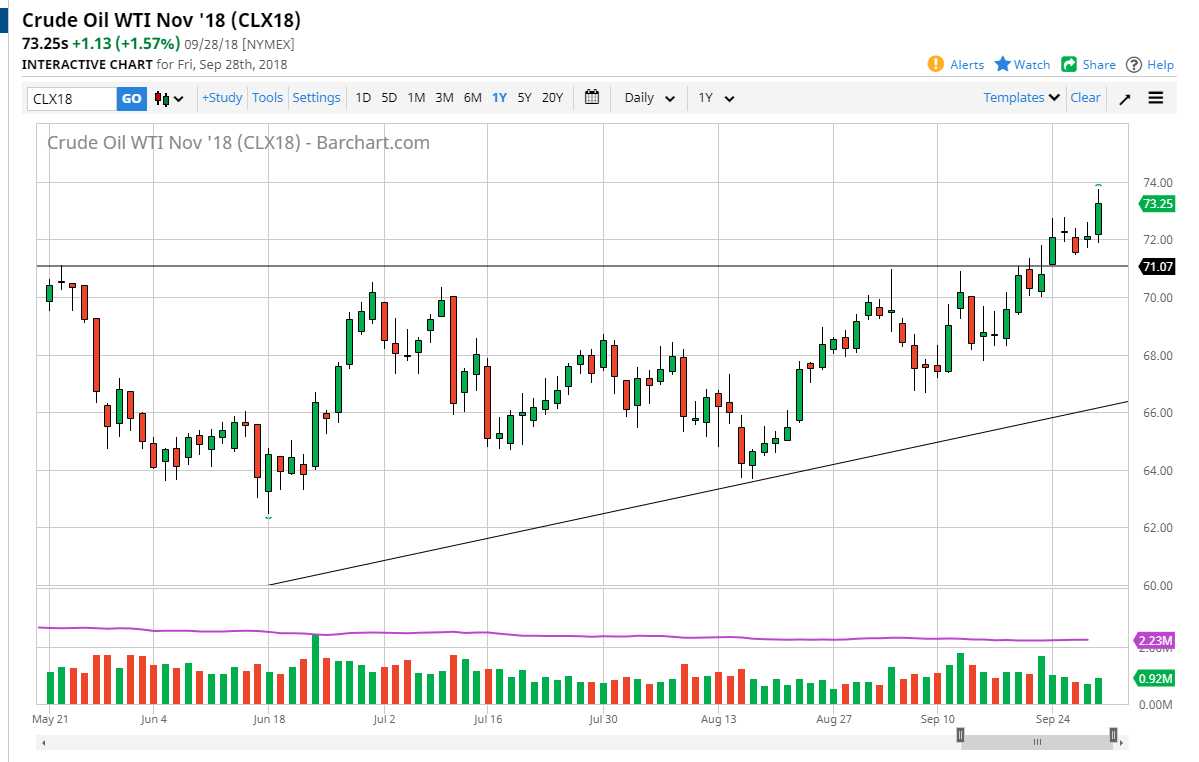

WTI Crude Oil

The WTI Crude Oil market initially pulled back on Friday again but found enough support just below the $72 level to finally turn around and exploded to the upside. This bullish pressure is of course a very good sign and I think it’s only a matter time before buyers will come back into the market on short-term pullbacks. I think it’s difficult to buy up here, but a pullback should offer plenty of value the people will be willing to take advantage of. The $72 level will be supported, and I think it runs down to the $71 level. Ultimately, I believe that the target is $75, but it would make sense for some profit taking after this break out. Regardless, I have no interest in shorting this market, because it has certainly shown its bullish propensity.

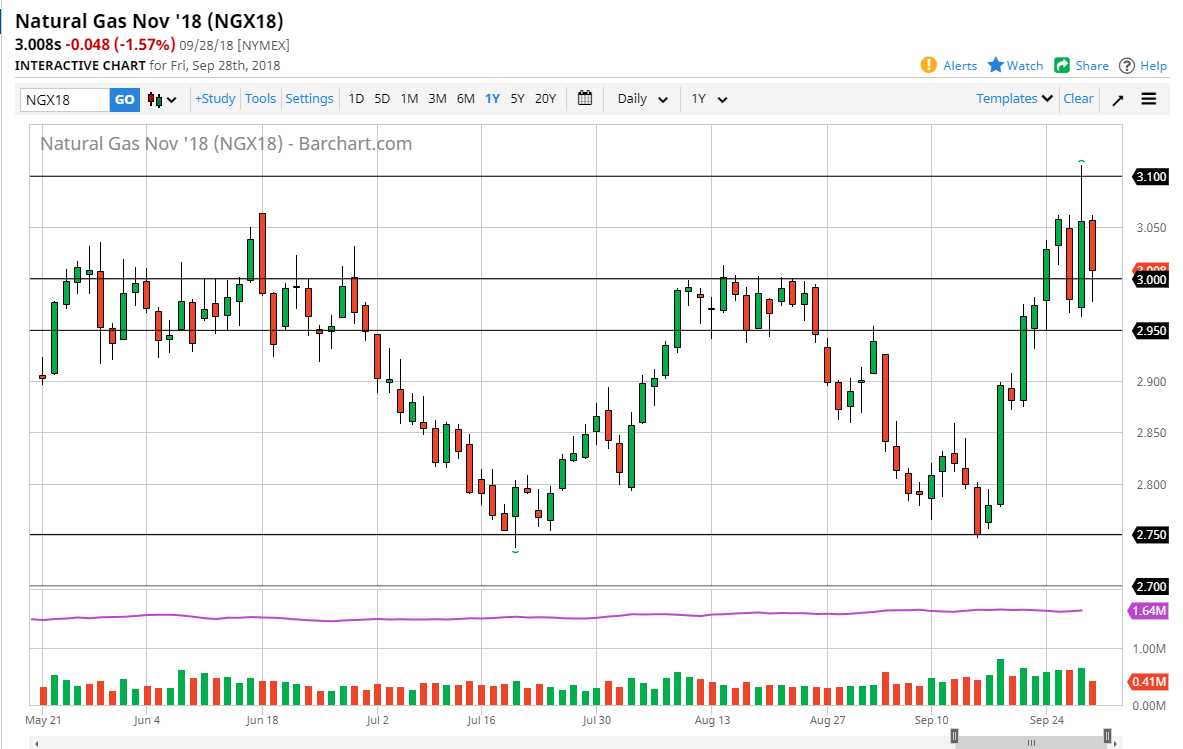

Natural Gas

Natural gas markets broke down during the trading session on Friday, slicing through the $3.00 level. What I find interesting is that the weekly candle stick is a shooting star, and that is a very negative sign. However, I do not short this market until we get below the $2.95 handle, as it would to show that the market is going to go back and within the consolidation area. That could lead all the way down to the $2.75 level quite rapidly. Otherwise, we may see this market going back and forth in this general vicinity, supported at the $2.95 level, and of course resistance at the $3.10 level. It’s likely that the next couple of sessions will be very choppy, but if we do get a sudden mount down below the $2.95 level I will not hesitate to start shorting.