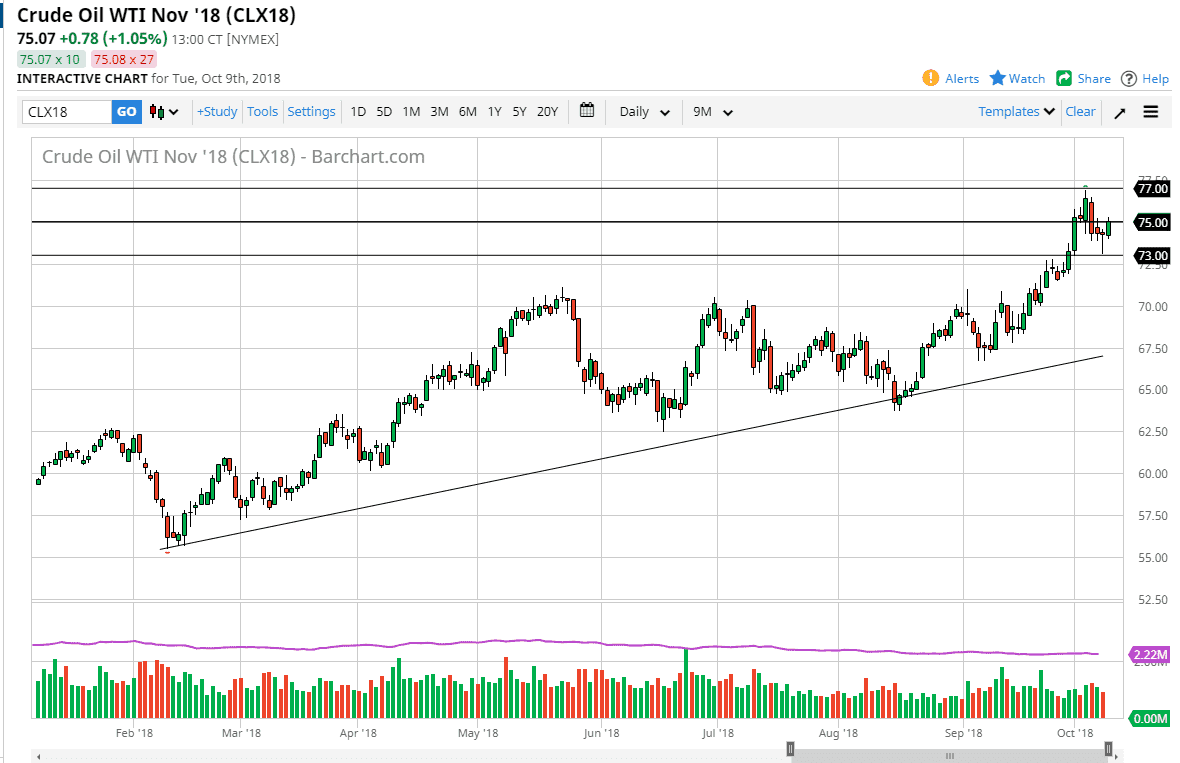

WTI Crude Oil

The WTI Crude Oil market rallied significantly during trading on Tuesday, breaking above the top of the hammer from the Monday session. We slammed into the $75 level, an area that of course will attract some attention. However, the longer-term charts are still very bullish, as the $73 level has shown itself to be very resilient. Overall, I think short-term pullbacks offer buying opportunities and I think that the value hunters will continue to pick up crude oil every time it dips. If we break out above here, I think that the $77 level would be targeted. However, if we turned around to break down below the $73 level, we could reach down to the $70 level after that. Ultimately, I believe that the buyers will continue to return to this market every time we dip, as there are Iranian sanctions coming, and of course we are trading the November contract.

Natural Gas

Natural gas markets initially exploded to the upside during the trading session on Tuesday, reaching towards the $3.35 level above. However, we have turned around of form a massive shooting star and I think we will probably see some type of pullback, reaching towards at least the $3.20 level, possibly even the $3.10 level. We are overbought, and we need to perhaps build up the necessary momentum to continue any uptrend. It makes a lot of sense for a little bit of a pullback from here, as we had gotten far ahead of ourselves. If we broke above the top of that shooting star, that would be a very bullish sign, but we are so overdone at this point only the foolhardy will be buying up here. Looking for value at a lower level might make more sense.