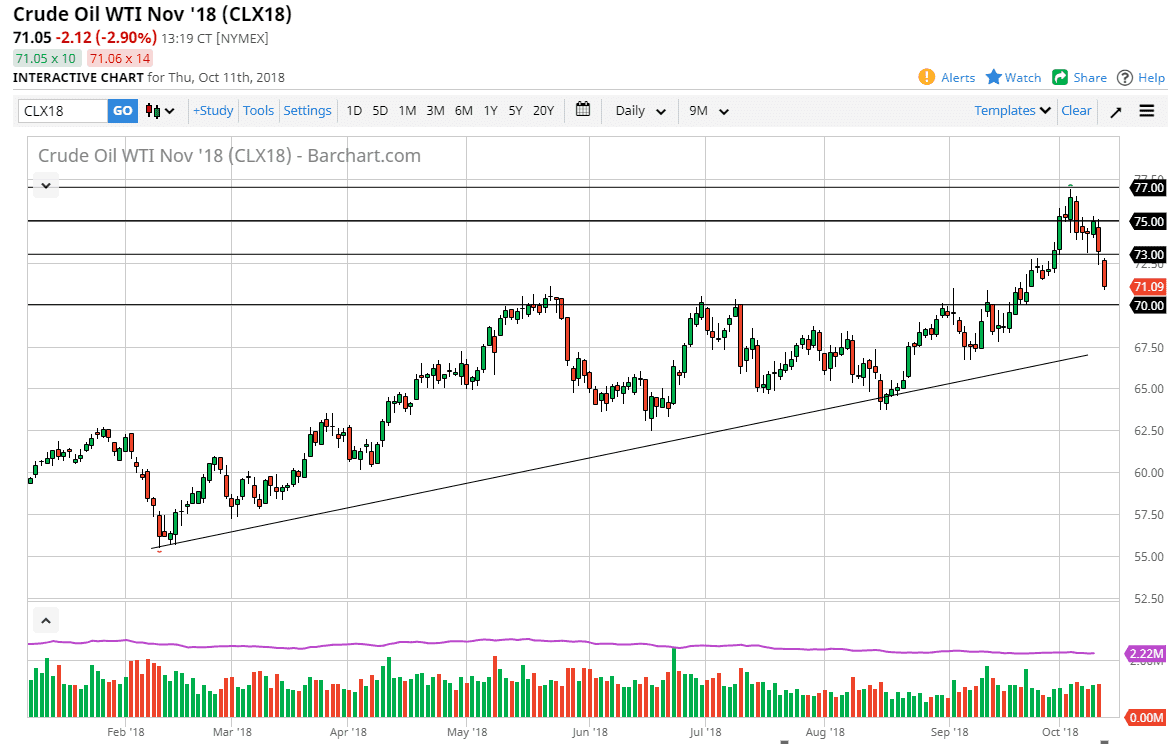

WTI Crude Oil

The WTI Crude Oil market gapped lower and below the $73 level to kick off the day, breaking all the way down to the $71 level. The markets have lost roughly 3%, and I think it is probably only a matter time before we find value hunters, but clearly the inventory build has scared people. The $70 level underneath was massive resistance, and it looks as if we are getting ready to revisit that level to try to find buyers. I would be very interested in going long of this market, but we probably need to wait until Monday before we can start to think about that. The negativity has been brutal, but when you look at the longer-term charts, you can see that we are clearly still in and uptrend, and there should be plenty of support levels underneath. Be patient though, let somebody else be the hero and step in afterwards.

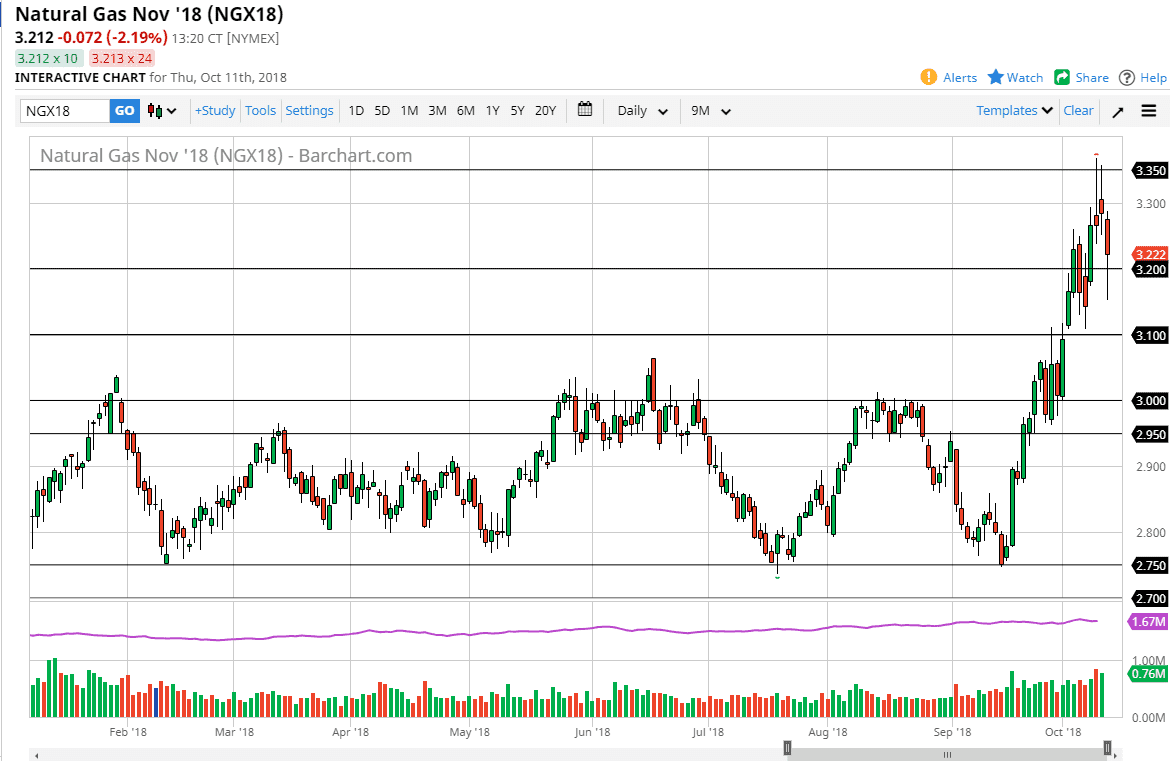

Natural Gas

Natural gas markets broke down rather significantly during the day but did bounce back above the $3.20 level in a sign of strength. I think that shows just how resilient this market is going to be, and that there is still plenty of demand due to the winter months coming in the United States. I think the $3.10 level should be massive in its implications and offers an opportunity to pick up natural gas “on the cheap.” I believe that the $3.00 level is essentially your “floor”, so I don’t think we will break down below there. The last couple of days had formed shooting stars though, so that of course is a very bearish sign but obviously were overextended. Look for value, it’s probably the best thing to happen as pullbacks offer opportunity.