WTI Crude Oil

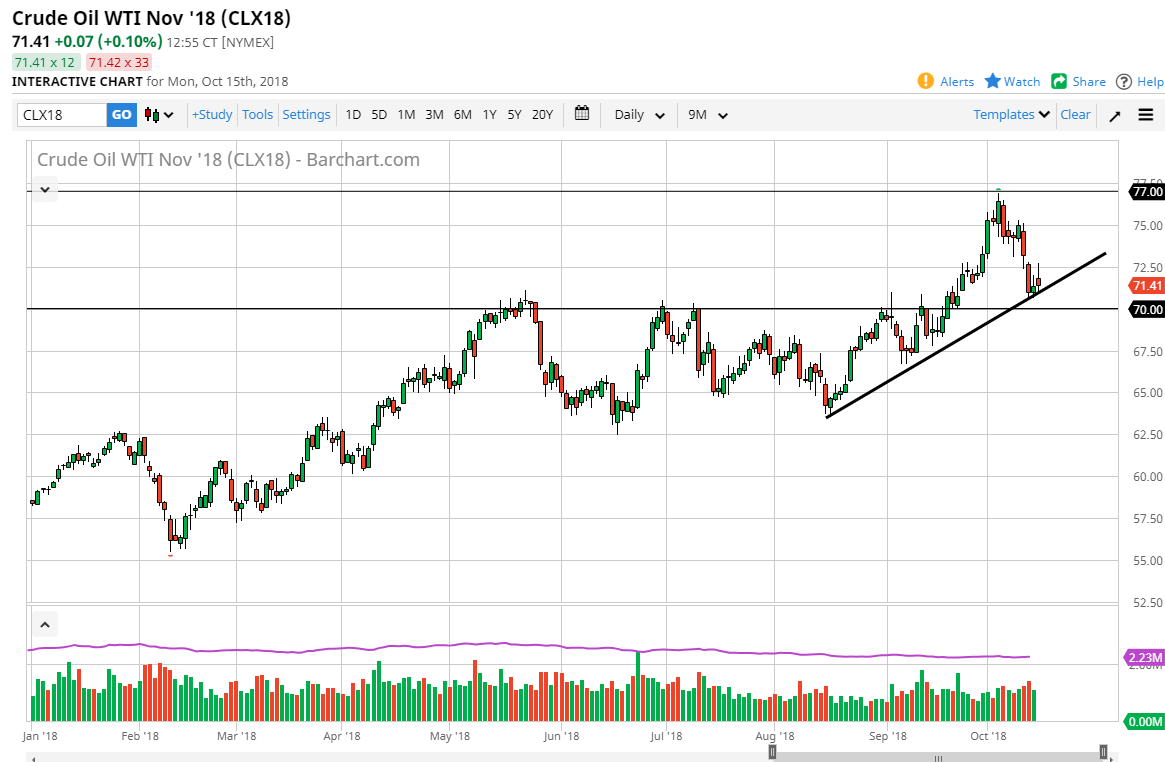

Monday was a wild session for crude oil, simply because as we started out the trading session, energy markets gapped higher as tensions between the United States and Saudi Arabia picked up. This has people thinking that perhaps the Saudi Arabia government would not increase output to help with pricing pressures, and we broke above the $72.50 level in the WTI grade. However, by the time the Americans came back on board, which of course is the most liquid part of the day, we turned around and sold off. We ended up roughly flat, but the daily candle stick is going to end up looking very much like a shooting star. That shooting star was preceded by another one which could also be called an inverted hammer. We are walking along the uptrend line that I have marked on the chart, and I think a break down from here could seriously challenge the $70 level. If we break down below $70, then we could go lower. I do think there’s a lot of support underneath though, so more than likely we will have value hunters. I believe that the crude oil market is going to be massively volatile to say the least. I favor the upside still, but I am much less confident that I was just a few sessions ago.

Natural Gas

Natural gas markets went back and forth on Monday, essentially undecided as to where it wants to go next. It looks like the $3.30 level is going to offer support, and we found buyers near the $3.15 level. The neutral candle suggests that we are trying to figure out where to go next, but it should be pointed out that we’ve had a couple of very negative candles in the last several days, and of course we are very overbought at this point, so a pullback would not be much of a surprise. I think that the $3.10 level is going to be massive support, just as the $3.00 level will be. I believe in looking for value underneath, but short-term traders may try to sell.