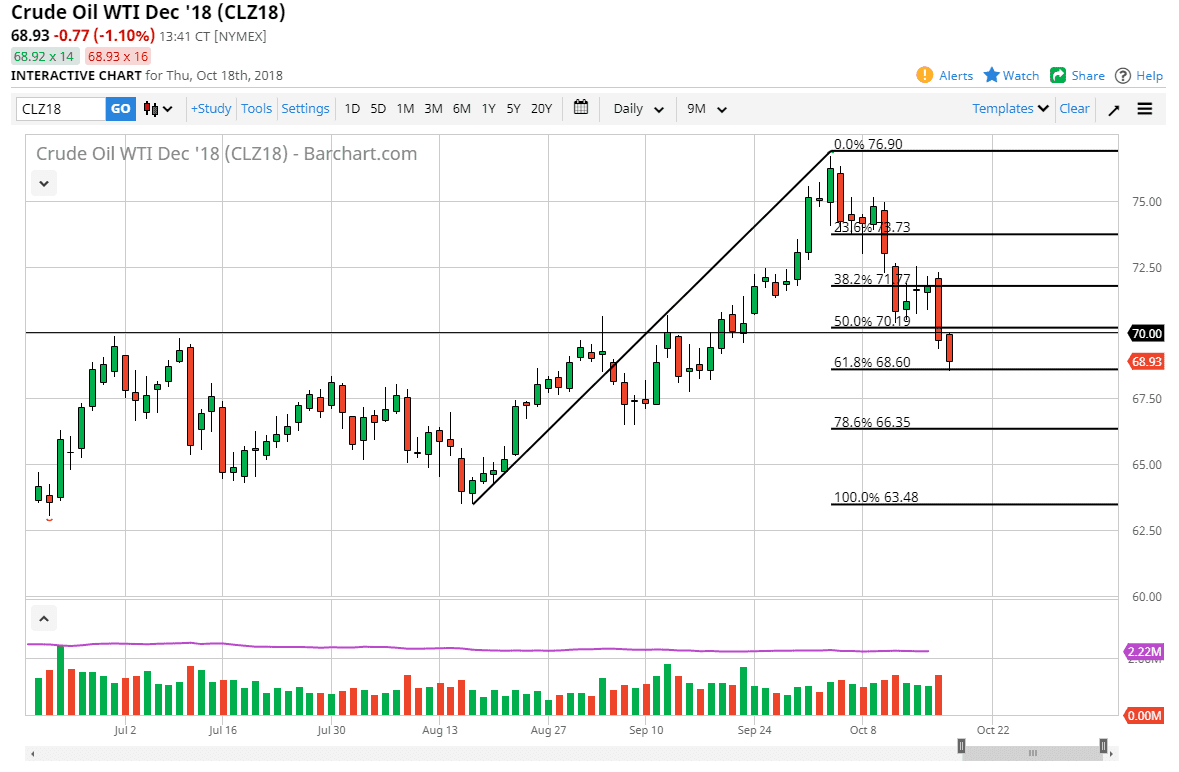

WTI Crude Oil

The WTI Crude Oil market fell during the trading session on Thursday, reaching down towards the 61.8% Fibonacci retracement level. This is an area where I think there could be some interest, but quite frankly the market looks as if it is going to close towards the very bottom of the range, and that normally means that you will get some follow-through. The $70 level above is resistance, and if we were to break above there it would be an extraordinarily positive sign. At this point though, it certainly looks as if oil is in a bit of trouble, and that will be exacerbated by a stronger US dollar if that becomes an issue as well. Ultimately, I am bullish of crude oil but I think we are starting to burn off some of the froth that had been in the market.

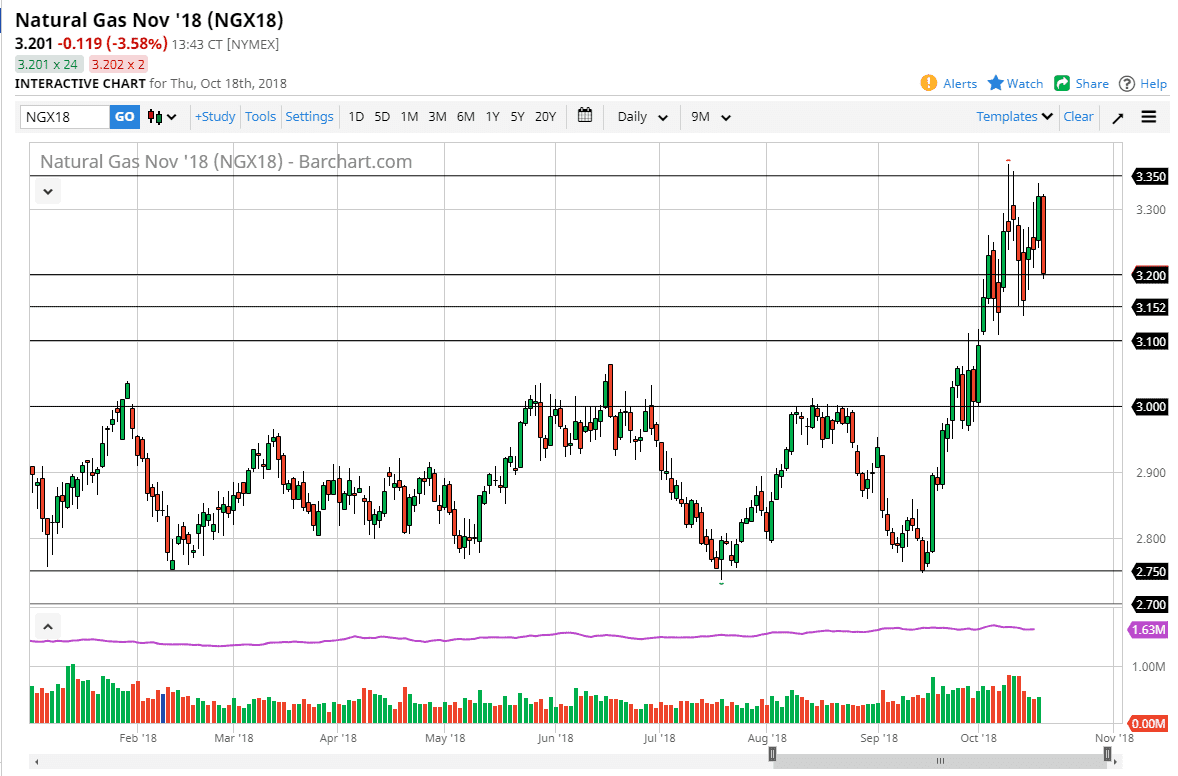

Natural Gas

Natural gas markets broke down rather significantly during the trading session on Thursday, reaching down to the $3.20 level, losing 3.64% by the time I sat down. That’s an extraordinarily negative move, but at this point I think what we are doing is trying to decide whether or not we can go any higher. I don’t think we do in the short term, but I also don’t have any interest in shorting this market. We are in a seasonally bullish time of year, and I think is much smarter to wait for pullbacks offer bits of value that you can take advantage of. After all, you can see that we have been gradually grinding higher but there seems to be a massive barrier at the $3.35 level that the market isn’t quite ready to break above. I believe the “floor” in the market is at the $3.00 level. I find the $3.15 level particularly interesting for a short-term bounce.