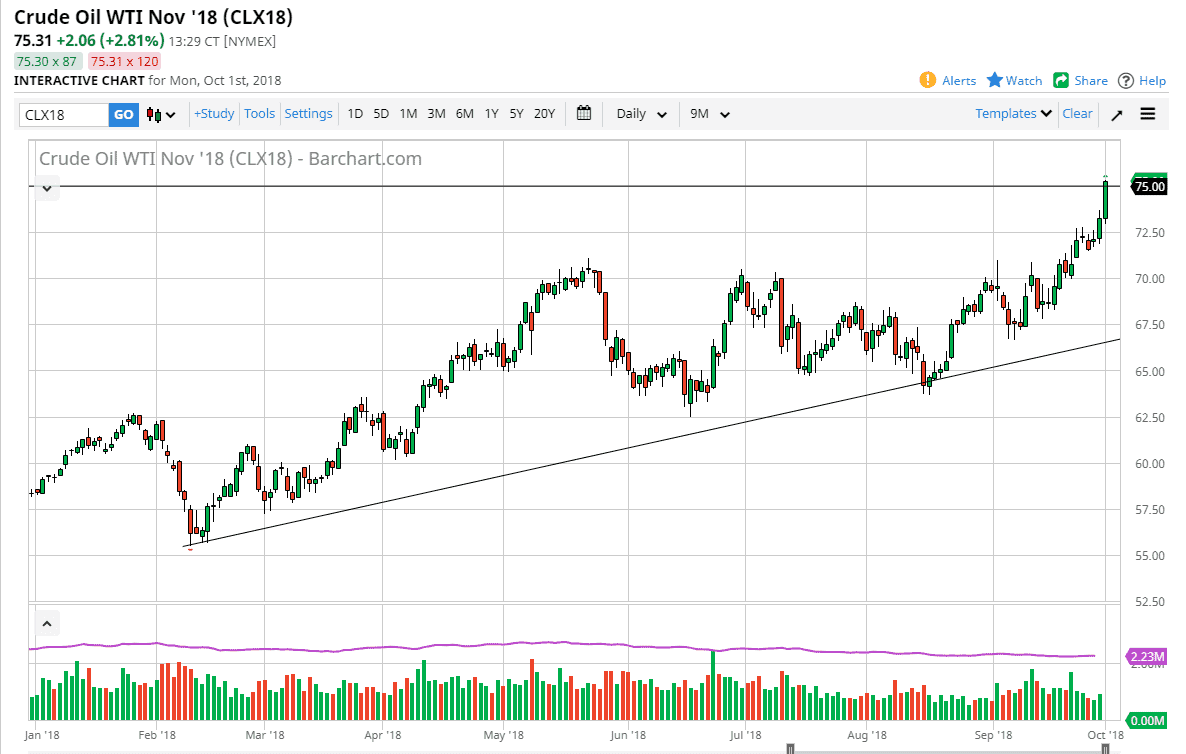

WTI Crude Oil

The WTI Crude Oil market exploded to the upside, slicing through the $75 level, a very psychologically important level. The fact that we broke above there so drastically during the day suggests that we are in fact ready to go much higher. Because of this, I think it’s clear that you can’t sell this market, and you need to wait for pullbacks in order to get involved. At this point, I think that the $72.50 level underneath should be supportive, as it was resistance in the past. If we break above the top of the daily candle stick for the session on Monday, even though it is technically a bullish sign, I don’t think you can buy at that high level as there is a significant concern of being overbought and therefore a continuation of the move higher. I have no interest in selling this market.

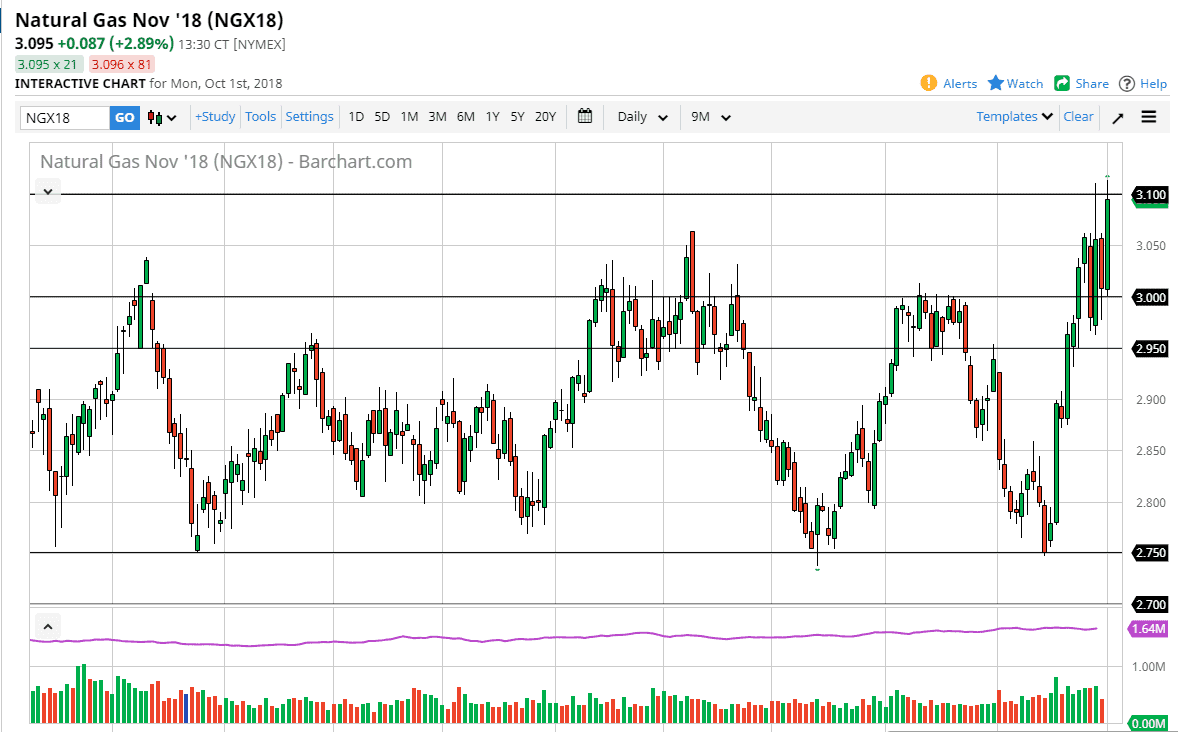

Natural Gas

Natural gas markets rallied significantly during the trading session to make a brief appearance above the highs from a couple of days ago, so at this point it looks as if the buyers will continue to be attracted to this market, and I think that it’s only a matter time before the buyers will look at this market with value in mind, with the $3.00 offering a bit of a “short-term floor.” I think that the $2.95 level is the bottom of the overall support level and the floor, so if we were to break down below that level, the market will drop to the $2.75 rather drastically. Alternately, if we can break above the $3.10 level on a daily close, the market will almost undoubtedly explode to the upside start looking towards the $3.20 level.