WTI Crude Oil

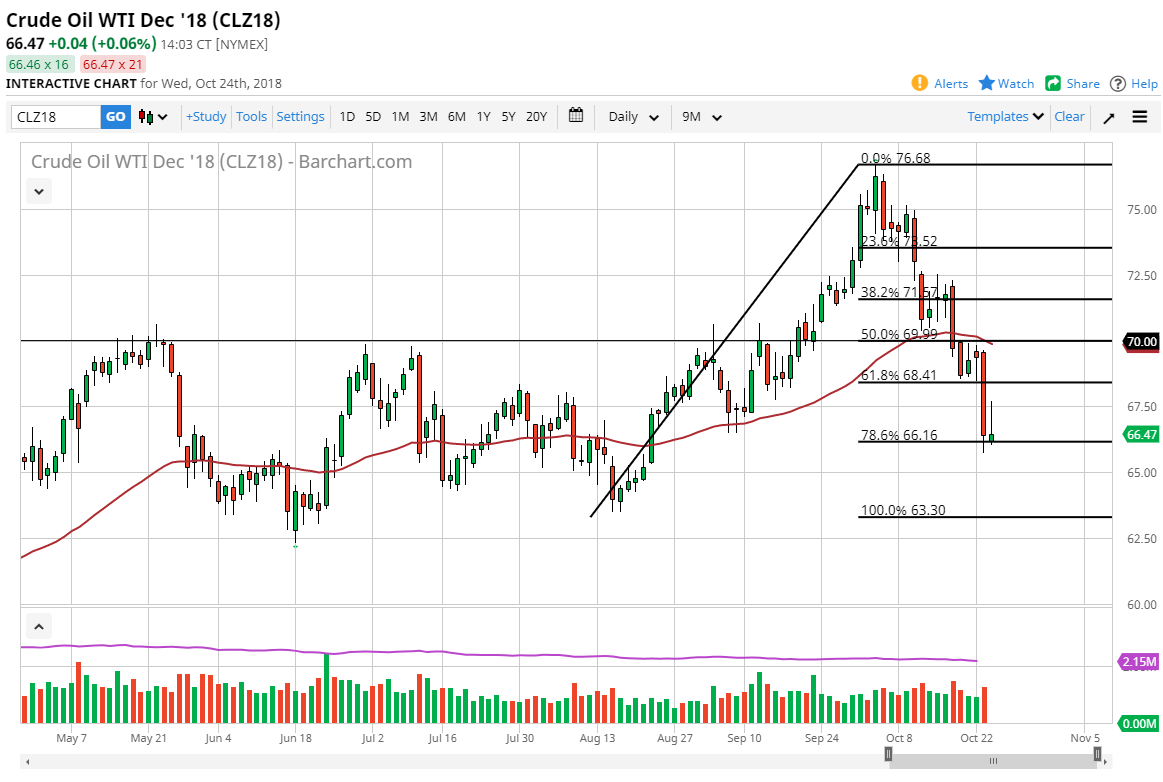

The WTI Crude Oil market rallied rather significantly during the trading session, perhaps in a bit of a “dead cat bounce” on Wednesday after being sold off so brutally on Tuesday. However, you can see that we gave up most of the gains and ended up forming something akin to a shooting star the shooting star could be a sign of continuation to the downside, and essentially become a “inverted hammer”, which a break below the bottom of would be bearish. Either way, no matter what you call it, the pattern shows that buyers simply cannot hang on to gains. At this point, I think we are very likely to see this market continue to go lower. In the short term, I believe that shorting rallies that show signs of weakness will continue to be the best way to trade this market.

Natural Gas

Natural Gas traders had a rough day as we went back and forth on Wednesday, hovering above the $3.20 level in the December contract. It looks as if the market will continue to bounce around in this general vicinity, and I think although we are in a seasonably bullish time of year, the reality is that there is the possibility of a “El Niño winter” in the United States, which would keep the temperatures in America little higher than expected. Pay attention to that, and if you hear the phrase “El Niño”, that is a bad thing for natural gas.

Beyond that, there is a ton of supply out there so it’s going to be difficult to break out to the upside and continue to go higher. Once we get past the winter months as far as trading is concerned, quite often natural gas markets or rollover. However, we have at least a couple of months ahead that could be somewhat elevated.