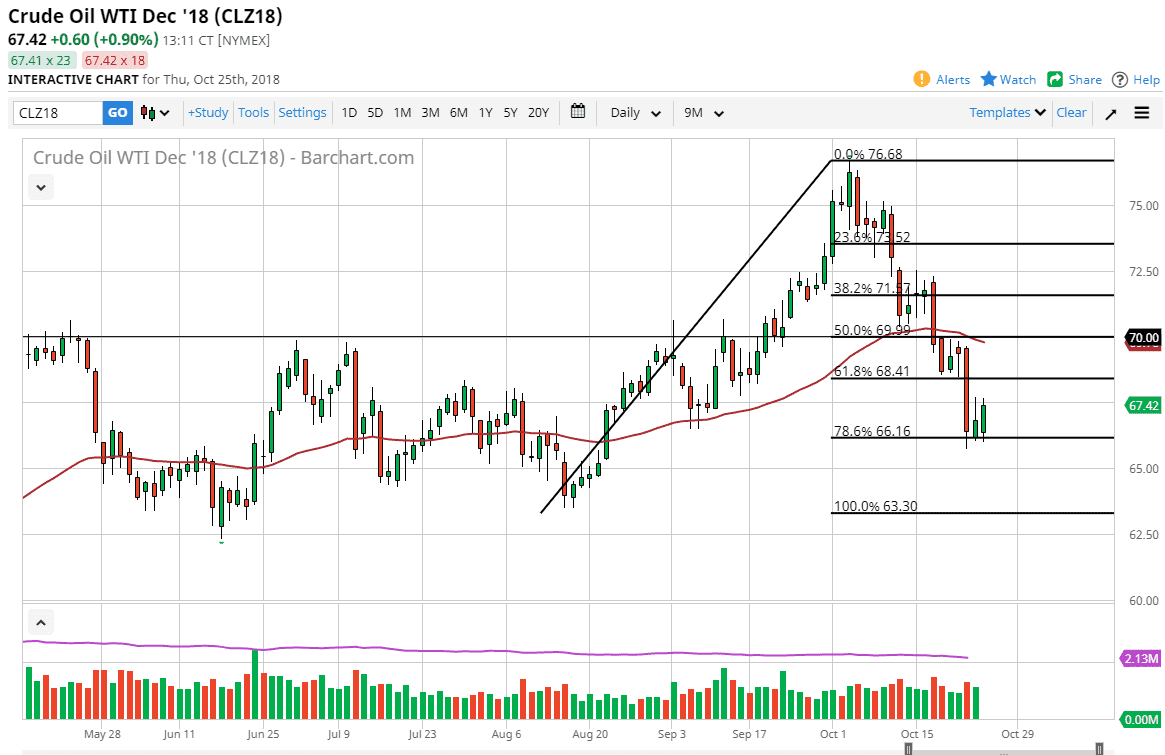

WTI Crude Oil

The WTI Crude Oil market had a solid day on Thursday, reaching towards the $67.50 level. This is a bullish move, and the previous session could end up being an “inverted hammer.” That would be a bullish sign we break above that but I think there is still plenty of selling pressure above as the 50 day EMA is starting to rollover, and of course we have the psychologically significant $70 level above, so I think it’s only a matter time before the sellers come back. The overall attitude of traders has been very bearish, and I think that with the Saudi Arabia and government pledging to pump as much oil as possible, I think we will continue to struggle to find follow-through on these rallies. This is probably the market getting a bounce after selling off as drastically as it had.

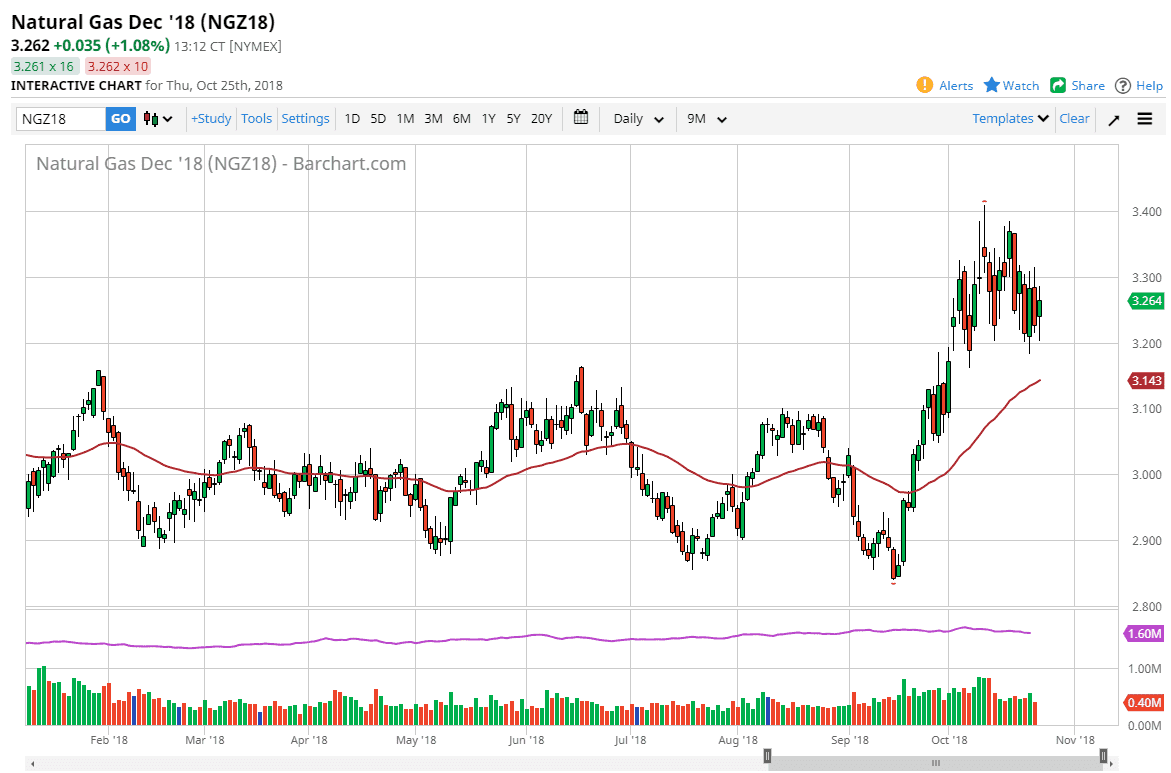

Natural Gas

Natural gas markets were back and forth during most of the session on Thursday, testing the $3.20 level. Overall, this is a market that I think continues to be very noisy, and more importantly, sideways. That sideways action should continue to be what we can expect, as we have a lot of bullish pressure underneath due to the seasonality, but beyond that we have a lot of oversupply. At this point, I think the $3.40 level is very likely the “ceiling” of the market. I also see that the $3.10 level is support, and that being the case I believe that buying dips should continue to work out. At this point in time, I believe that picking up little bits and pieces and short-term bullish trading will probably continue to produce profits as we are in the December contract now.