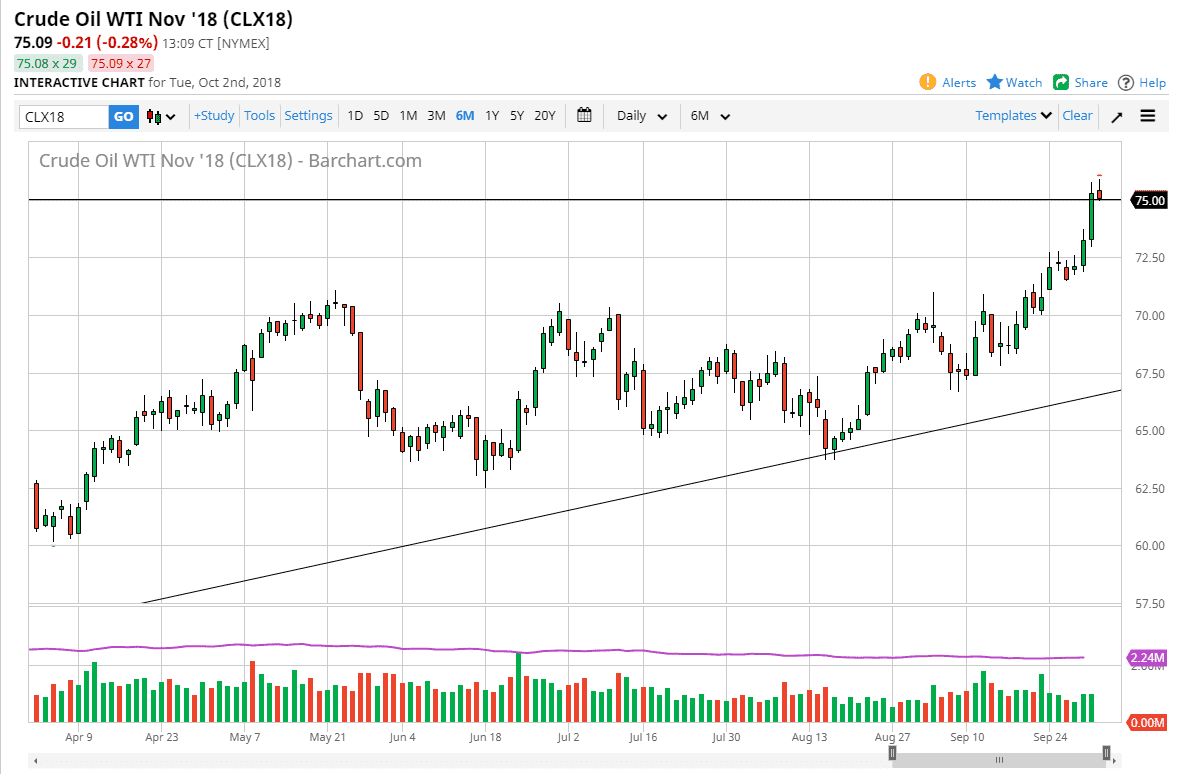

WTI Crude Oil

The WTI Crude Oil market initially surged higher during the trading session on Tuesday, reaching fresh, new highs. However, the market pulled back to form a shooting star by the time we closed, sitting just above the $75 level. Because of this, it’s likely that we could see some type of pullback to pick up momentum again. We are clearly a bit overbought, and I think there is plenty of support down to at least the $72.50 level. The alternate scenario is that we break above the top of the shooting star, which would be an extraordinarily strong sign as well. At this point, I have no interest in trying to short this market, and I believe it is only a matter of time before the value hunters come back to pick up crude oil as it has been so bullish.

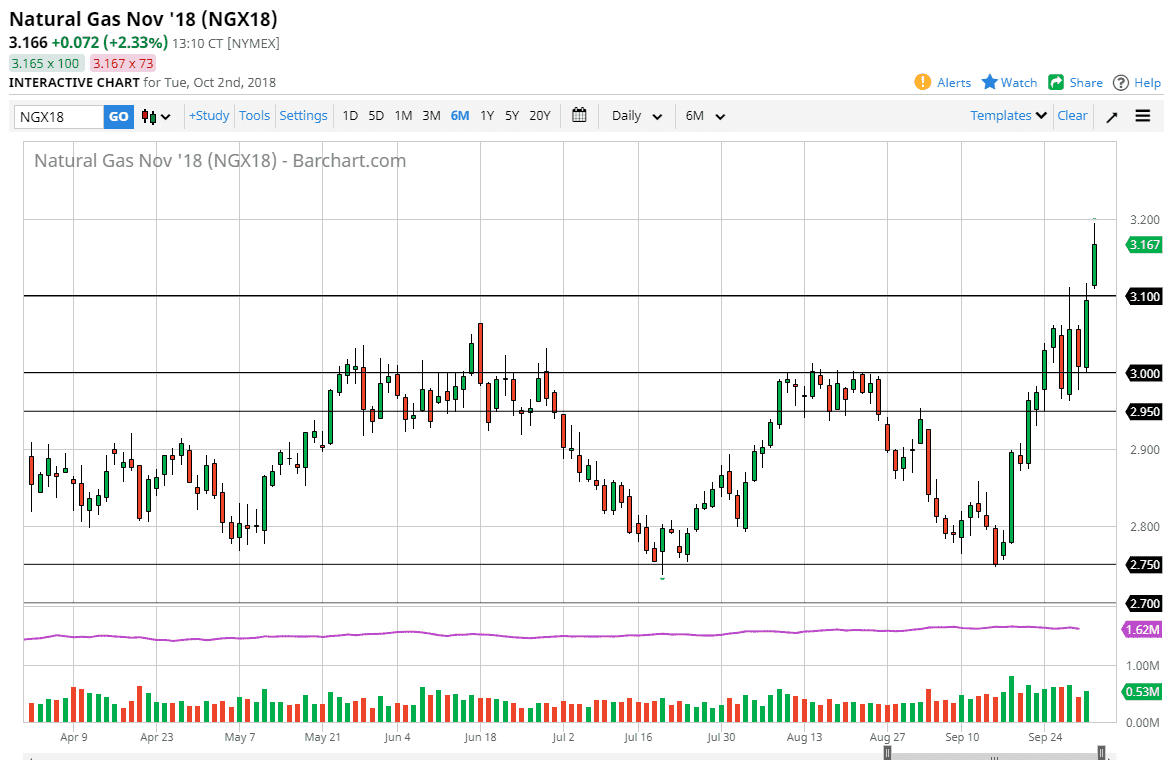

Natural Gas

Natural gas markets gapped higher to kick off Tuesday and exploded much higher to reach the $3.20 level in north American trading. Market participants continue to buy natural gas, but we are getting a bit extended at this point, I think it is only a matter time before we get a pullback but I also anticipate that the $3.10 level underneath should be supportive, as it was resistance in the past. Ultimately, if we were to break above the $3.20 level, then you should start looking towards the $3.25 level next as it seems that every time we gain or lose a nickel, buyers and sellers return. We are certainly in the bullish time of year, so it makes sense that the buyers continue to return. I think at this point you have to look at this as a “buy on the dips” situation.