WTI Crude Oil

The WTI Crude Oil market initially tried to pull back a bit during the trading session on Wednesday, but then shot straight through the air even though we had a very negative inventory number, as people continue to worry about the Iranian sanctions taking oil off-line. At this point, it’s a bit of a stretch to come to that conclusion, but I think that the overall bias is pretty simple: we are going higher. Now that the $75 level has been broken significantly, that should become your short-term floor, and pullbacks should be buying opportunities. If the US dollar starts to lose a bit of strength, that should also help the crude oil market gain as well. I believe in buying on the dips and have no interest in shorting this market as it has gotten extraordinarily bullish.

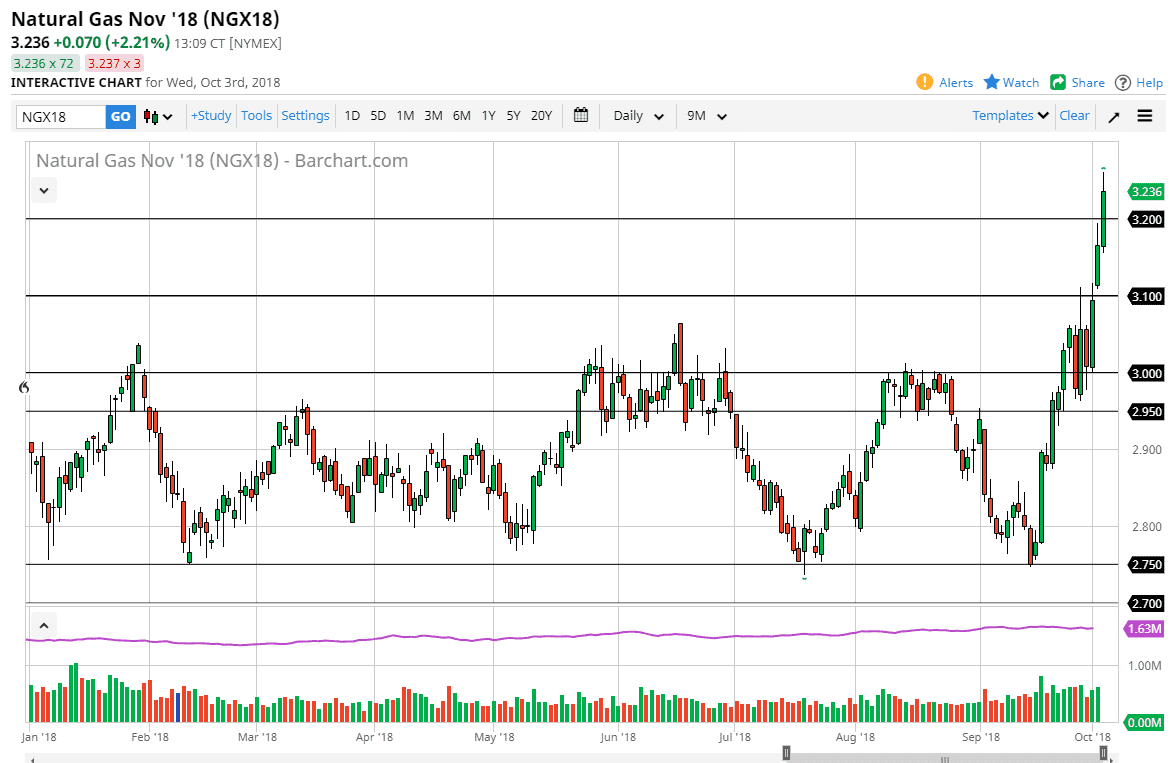

Natural Gas

Natural gas markets exploded to the upside again during the day on Wednesday, as we continue to go parabolic to the upside. I don’t have any interest in trying to short this market right now, as we have shown so much in the way of buying. I think at this point it’s foolish to start buying natural gas, but I certainly wouldn’t want to step in front of this freight train by trying to sell it. I think what you are waiting for is some type of pullback that you can take advantage of, because while I thought it was parabolic yesterday, it’s even worse now. At this point, I think that the $3.00 level will be the “floor” in the market and should continue to be respected by longer-term traders. If it does get broken, that will be very interesting to say the least. Seasonality is working in favor of natural gas pricing though.