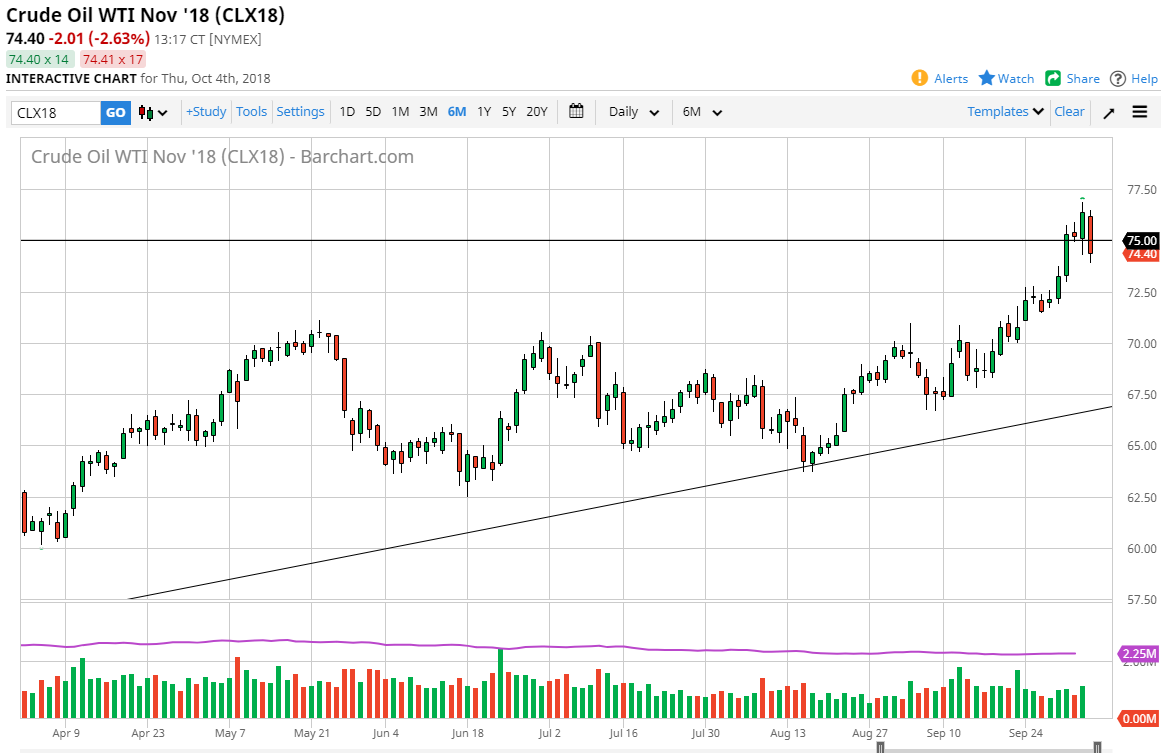

WTI Crude Oil

The WTI Crude Oil market broke down a bit during the day on Thursday, slicing through the $75 level to show bearishness. We broke down below the lows of the session on Wednesday, showing signs of negativity, but we did see a bit of buying towards the end of the day. I think at this point it’s obvious that the market favors the upside longer-term, but we had gotten a bit overbought, so it makes sense that we need to find a bit of value. Ultimately, I think that we will find buyers, and I would like to see a pullback to the $72.50 level. Otherwise, we could get a turnaround during the session but that would focus more on short-term charts than anything else. Either way, I don’t have any interest in shorting crude oil, it will simply wait for signs of a bounce.

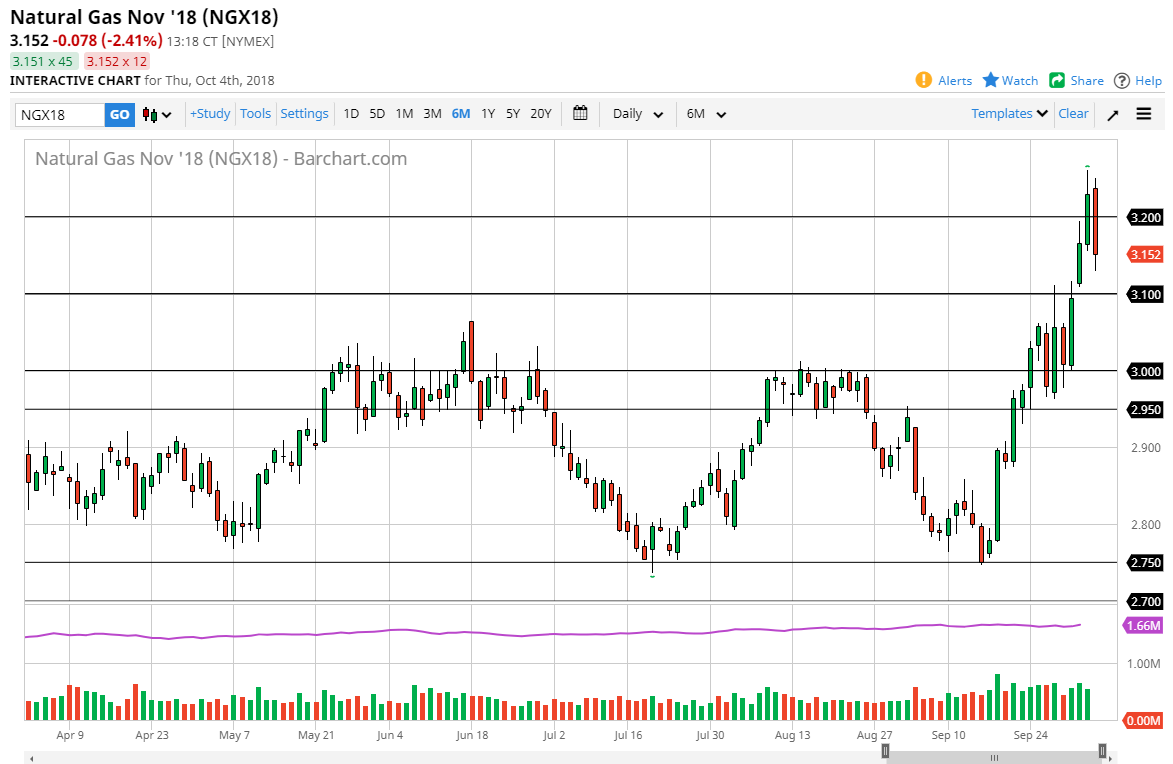

Natural Gas

Natural gas markets were extraordinarily volatile during trading on Thursday, as the inventory number is a bit more bearish than anticipated. Beyond that, it’s likely that we will continue to see bullish pressure longer-term, but we most certainly need to pull back further to offer value that’s worth putting money to work on. I believe the $3.10 level should offer support, just as the three dollars level will. Otherwise, you are probably better off sitting on the sidelines and waiting for a better price. We are at high levels, although we are starting to trade in the seasonally bullish time of year for natural gas. I believe that there is a bit of a “floor” at the three dollars level currently. It’s not until we break down below there that I would consider selling.