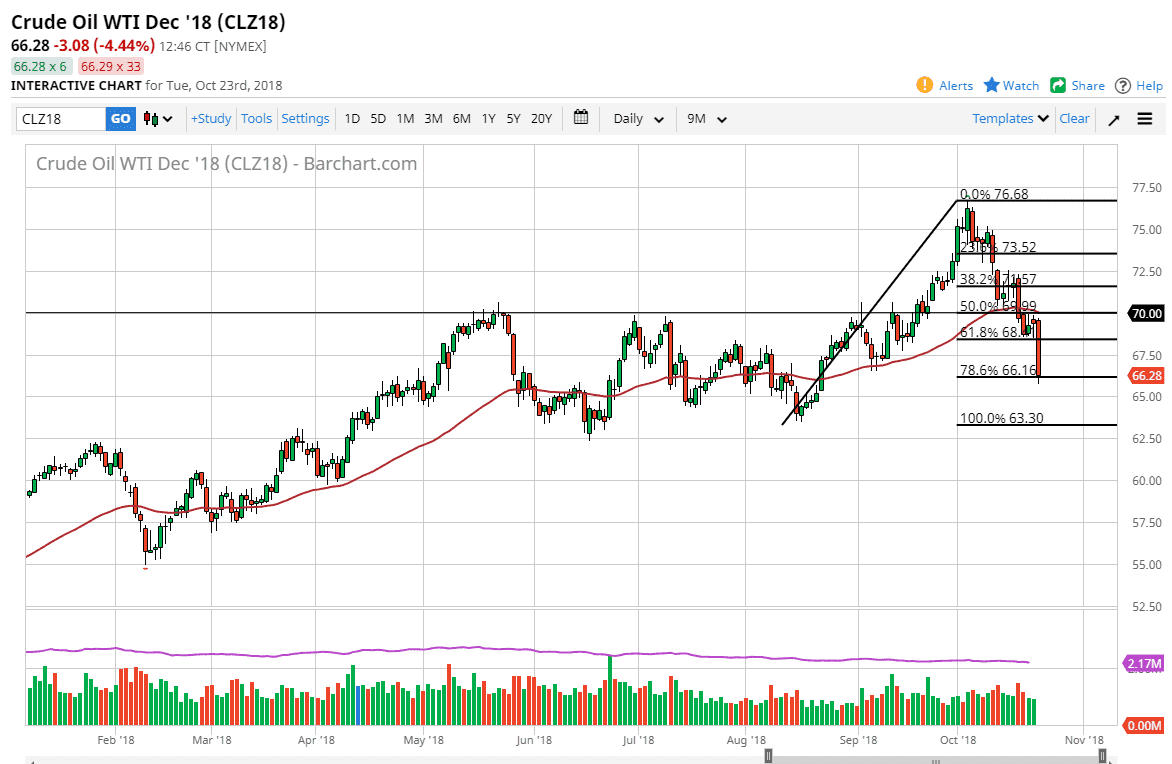

WTI Crude Oil

The WTI Crude Oil market broke down significantly during the trading session on Tuesday as the Saudis have agreed to maximize output, putting some downward pressure on the market itself. Now that we have sliced through the 61.8% Fibonacci retracement level, I find that it is quite typical for the market to reach down to the 100% Fibonacci retracement level, and we certainly looks very negative at this point. I think short-term rallies will be selling opportunities at the 50 EMA has started to turn lower as well. I think signs of exhaustion on short-term charts will be nice selling opportunities as clearly the oil market has been slammed. This is a market that has been ruthlessly sold off, and the action on Tuesday only confirmed all of the negativity around it. It’s not until we get a daily close above the $70 level that I would think about buying this market right now.

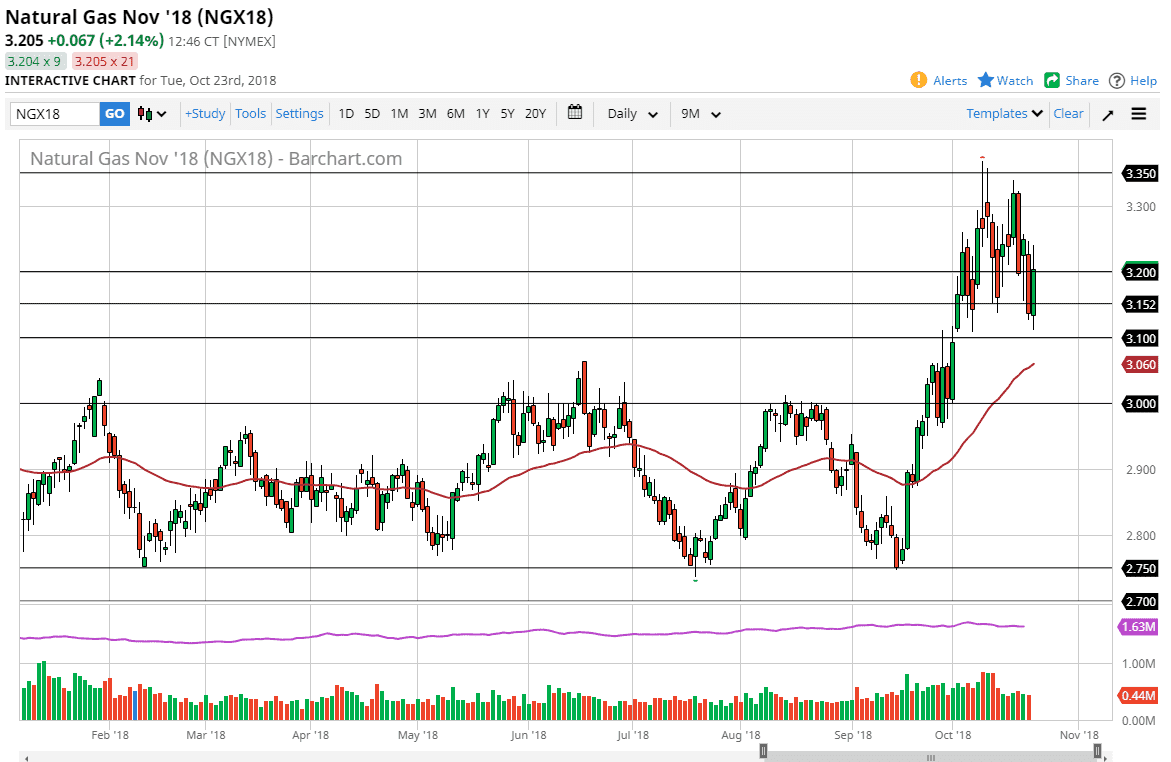

Natural Gas

Natural gas markets initially dipped during the day but found enough support at the $3.10 level to turn around and reach above the $3.20 level, an area that of course has been important more than once. We sold off above there though, and I think what we are looking at here is going to be a continuation of the overall consolidation, because we have the seasonality picking natural gas markets up. The 50 day EMA is at $3.06 right now, and I think it will reach towards the $3.10 level. I think the absolute “floor” is somewhere closer to the $3.00 level. In general, I am bullish of natural gas in the short term, but I recognize that we will get the occasional pullback, but I will look at those as buying opportunities.