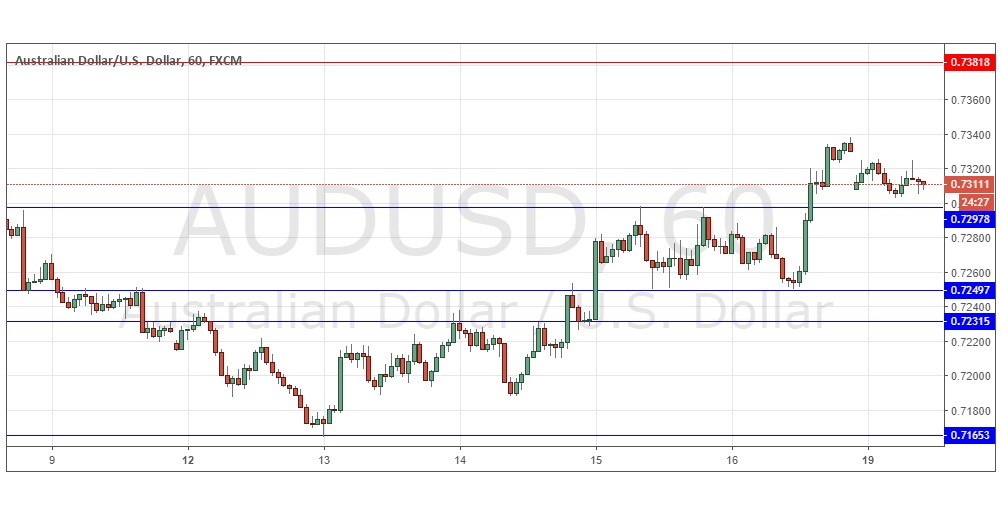

Last Thursday’s signals produced a nicely profitable long trade from the hourly pin candlestick which rejected the support level identified at 0.7250.

Today’s AUD/USD Signals

Risk 0.75%.

Trades may only be taken from 8am New York time to 5pm Tokyo time, during the next 24-hour period.

Long Trades

Go long following some bullish price action on the H1 time frame immediately upon the next touch of 0.7298, 0.7250, or 0.7232.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade

Go short following some bearish price action on the H1 time frame immediately upon the next touch of 0.7382.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote yesterday that an unlikely break above 0.7268 would be a very bullish sign. This happened and is a surprise, as the price managed to break quickly above three resistance levels, and it is still holding up above them a few hours later. The AUD is also rising by more than the NZD over the day, which is another bullish sign. The main cause seems to be stronger than expected Australian employment data.

The outlook now much be more bullish, yet we need to see still higher prices to remain confident in a further bullish movement. If the nearest support at 0.7266 holds with a firm bullish bounce I will take a bullish bias, or alternatively if the price makes new highs and stays there for at least an hour.

There is nothing important due today concerning the AUD. Regarding the USD, there will be a release of Retail Sales data at 1:30pm London time, and the Chair of the Federal Reserve will be giving a minor speech at 4:30pm.