BTC/USD

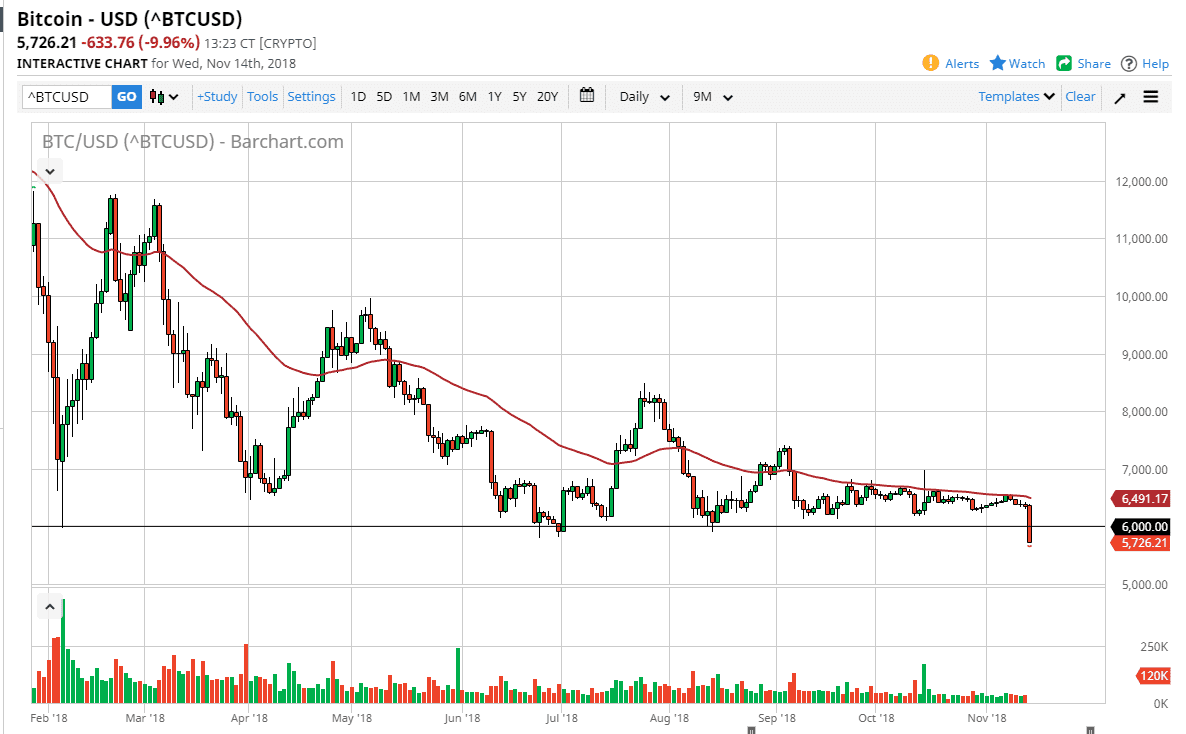

Bitcoin markets broke down during the trading session on Wednesday finally, slicing through the $6000 level, and as I record this has broken below the $5800 level. This was the move that the sellers were hoping for, and it now looks as if we are ready to go lower. I’ve been saying for months now that if we can break through this level, the coin probably goes down to $5000. Obviously, that’s a large, round, psychologically significant number, but this is a market that simply has no reason to go higher.

At this point, I believe in selling rallies, perhaps on short-term charts. Adoption simply isn’t happened in a meaningful way, and I don’t know that it’s ever going to. If you think about it, it’s only a matter of time before crypto currency becomes something that is central bank denominated anyway, so that’s going to be a major issue with bitcoin longer term.

If we can break above the 50 EMA, then we can go higher, but that’s the very minimum of what I’m looking for to start buying. If we can break above the $7000 level, then we could go to the $7500 level, perhaps even the $8000 level. I think it’s more likely that we fall down to the $5000 level and perhaps even break down through that level eventually. At this point, a break down below the $5000 level will probably send this market down to the $4000 level next.

Recently, we been able to go back and forth in a short term consolidation type market, but now we have a clear push to the downside, so now we go back into the previous “fade the rally” type of situation, because not only is bitcoin week, the US dollar is strong.