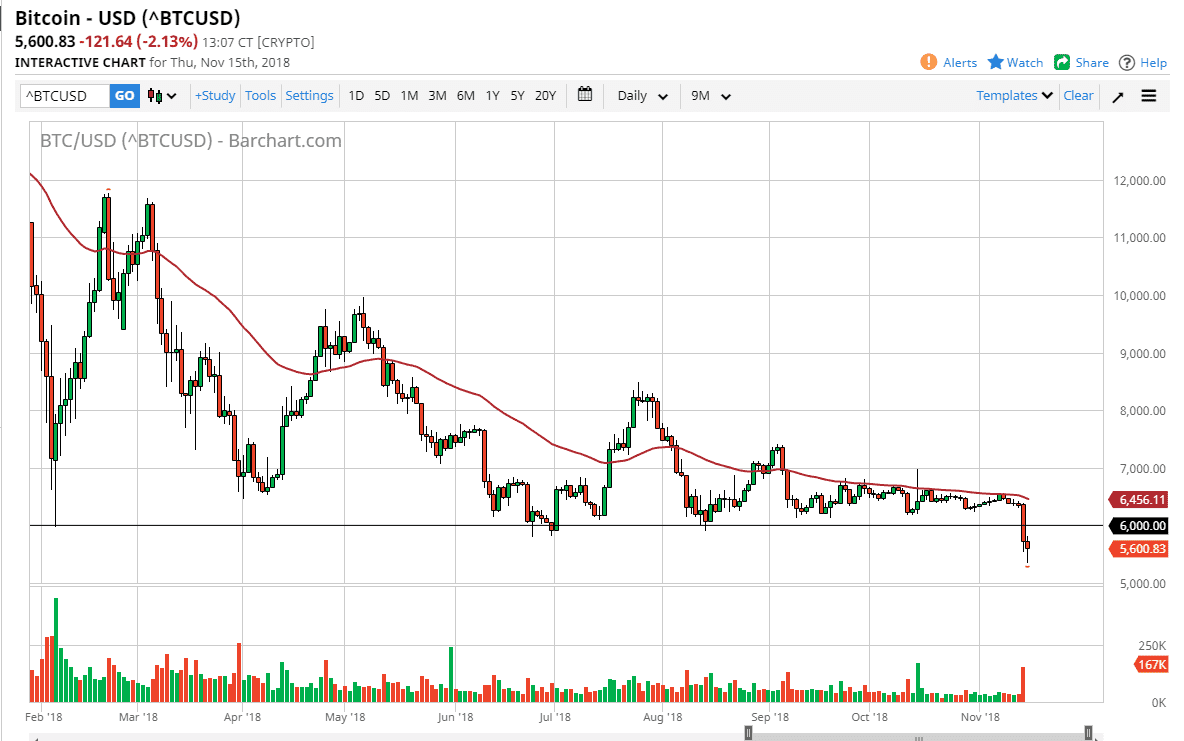

The bitcoin market broke down initially during trading on Thursday but did bounce enough to turn around and form a hammer. That’s a good sign, but at this point we have broken down enough that I would anticipate that the previous support should be resistance. Beyond that, the 50 day EMA is above the candle stick from the break down on Wednesday, so I think it’s only a matter of time before the sellers will come back into this market. I believe that short-term traders will be looking for opportunities to sell on short-term rallies that show signs of exhaustion. I think the $6000 handle makes an excellent area to start looking for those.

The alternate scenario of course is that we break down below the hammer for the day, which should send this market down to $5000. That’s an area that is crucial, not only from a structural standpoint, but also from a large, round, psychological standpoint as well. I think if we break down below there, we would continue to go much lower. I don’t necessarily think we’re going to get a massive melt down from here but I do think that there are plenty of Sellers above looking to get out of this market. There were a lot of short-term traders buying this market just above the $6000 level, and the simile find themselves into a negative position. This has been extraordinarily reliable for months on end, so they will be looking to get out once we get close to breakeven for them.

Again though, if we can break above the 50 day EMA on a daily close, I might be convinced to start buying for a short-term trade. I don’t see that happening now and it looks very likely that we are going to go lower.