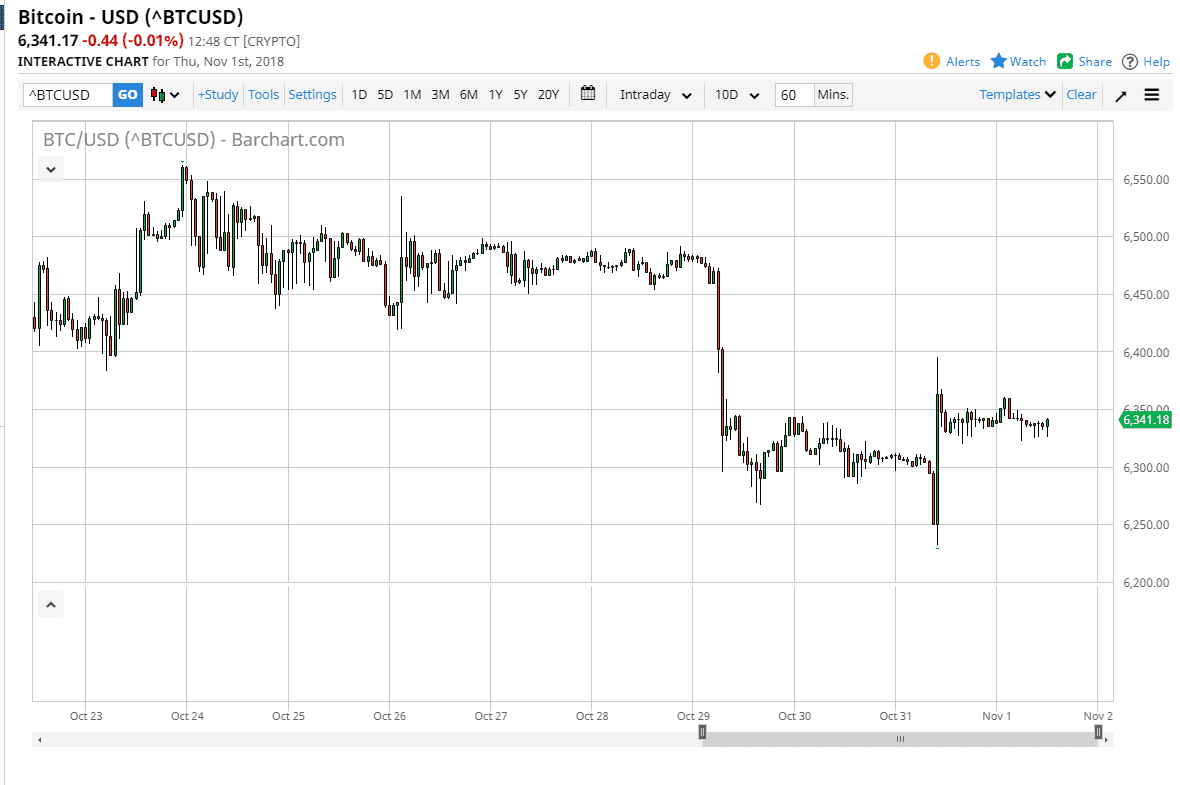

Bitcoin did nothing during the day on Thursday, as we continue to see a severe lack of momentum in either direction. At this point, it looks as if you will have to scout this market more than anything else. One thing that is good about this type of market is that we have stopped falling, so it’s likely that a lack of volatility could eventually entice institutional money back into the market. After all, most people who work in institutional firms do not like 10% swings per day, because while the gains are great, losses are horrific.

Bitcoin traders are essentially falling asleep at this point, but investors on the other hand like the idea of the market essentially sitting here. The $5800 level is the bottom of a big support zone that starts at the $5000 level, so if we break down below that level, then the market could go as low as $5000 rather quickly. This is a market that breaking down on below that level would be a horrifically negative sign as it is an area that has been so stringently reliable. However, we also have the alternate scenario as well.

In that scenario, we could break above the $7000 level, reaching towards the $7500 level, and then eventually the $8250 level. That would take some type of catalyst, and I think that we are hurting for that right now. Scalping back and forth is probably going to be as good as this gets. I think the $6400 level is potentially resistive, just as the $6500 level is. The $6200 level looks to be rather supportive. Beyond that range, it’s going to be difficult to put a lot of money to work now.