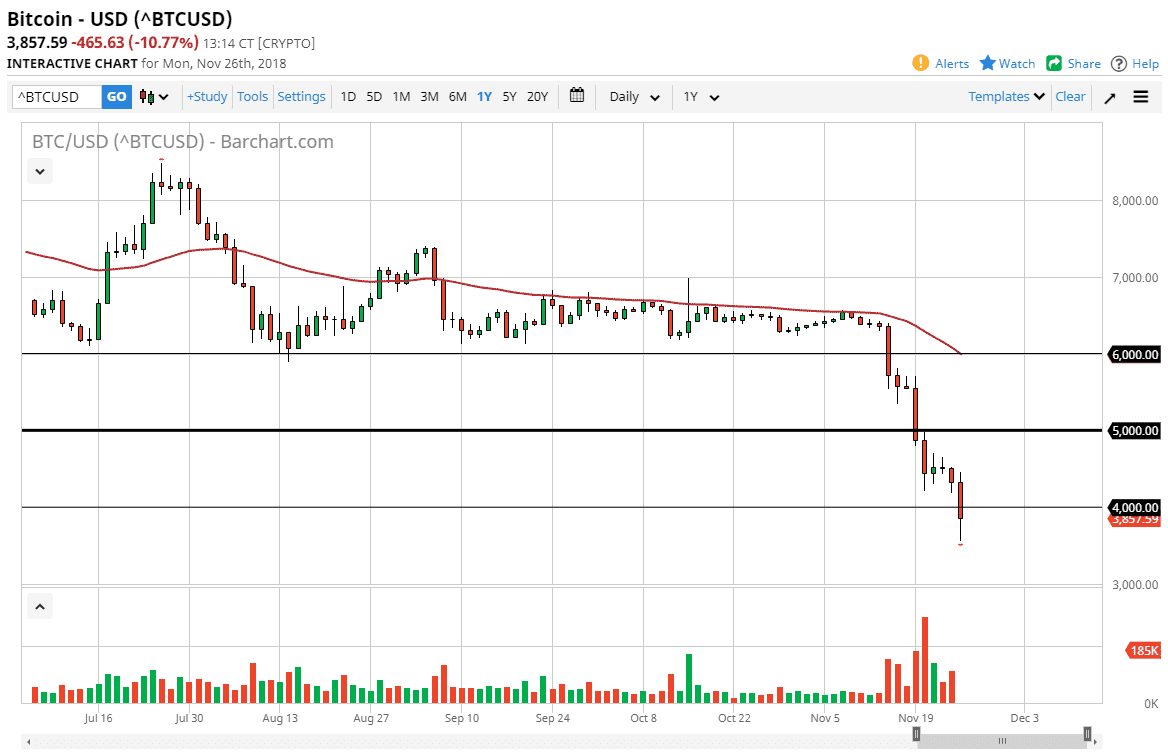

BTC/USD

Bitcoin broke down significantly during the trading session on Monday, slicing through the $4000 level. This market has come undone rather significantly as of late, but we did get a nice bounce towards the end of the day. I think this is essentially a bit of a “dead cat bounce” though, and we will see sellers jump into this market at the first signs of trouble. I believe that the $4000 level will of course have a lot of influence on what happens next, but even if we do break above there I can see several resistance levels above.

I think at this point, the $4500 level is the first major resistance barrier above the $4000 handle, and then we will find plenty of sellers near the $5000 level. At the first signs of an exhaustive candle on a short-term chart, perhaps even on the hourly chart, you will see traders dumping Bitcoin rather quickly. This is a market that has broken down drastically, and the fact that we have pierced below the $4000 level shows just how dire things have become.

People are starting to question whether or not bitcoin will ever fully be adopted, and quite frankly I don’t think it’s going to considering how much we have seen in a drop-off of transactions over the last several months. This has been one of those markets that there is always a reason to believe later, but those reasons continue to fail, or perhaps simply just don’t present themselves in reality. At this point, I have no interest in buying bitcoin at all, but if we did break above the $6000 level, one would have to stand up and take notice. That’s a 50% gain from here though, so it’s very difficult to imagine that.