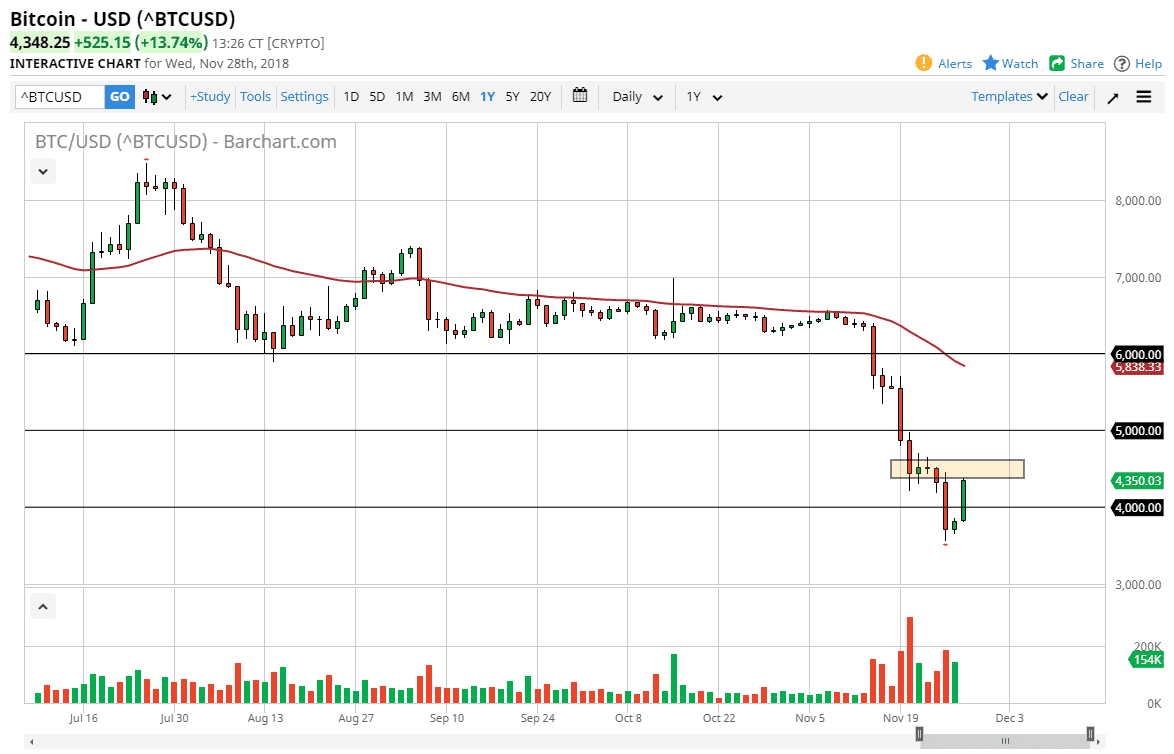

BTC/USD

The bitcoin market rallied rather significantly during the Wednesday session, as the US dollar got hammered. By breaking above the $4000 level, the market has shown some light finally. However, I think that the $4500 level will continue to offer a bit of resistance, and it would not surprise me at all to see this market roll over from here. However, if we break above this level then it opens the door to the $5000 handle. There is the 50 day EMA above that will also offer technical resistance, so I think that even if we do get a rally from here, we have broken down so much that the technical damage will continue to cause major problems. Bitcoin has been brutalized as of the last couple of weeks, so it’s obvious that the market has been a bit oversold.

I think at this point, it’s likely that we will see sellers come back in and push this market lower, and that at various resistance levels there are tons of traders coming in to short the market, or perhaps even take a smaller loss than they may have had to just a couple of hours ago. Overall, I think that the market continues to go lower, and that rallies should be thought of as opportunities to take advantage of what has been a very strong downtrend, and the market of course is aware of this. It would be very difficult to imagine a scenario where the markets will turn around longer term. Bitcoin is broken, and I think that until we break above the 50 day EMA on a daily close, it’s going to be very difficult to buy this market. Currently, the 50 day EMA is near the $5825 level.