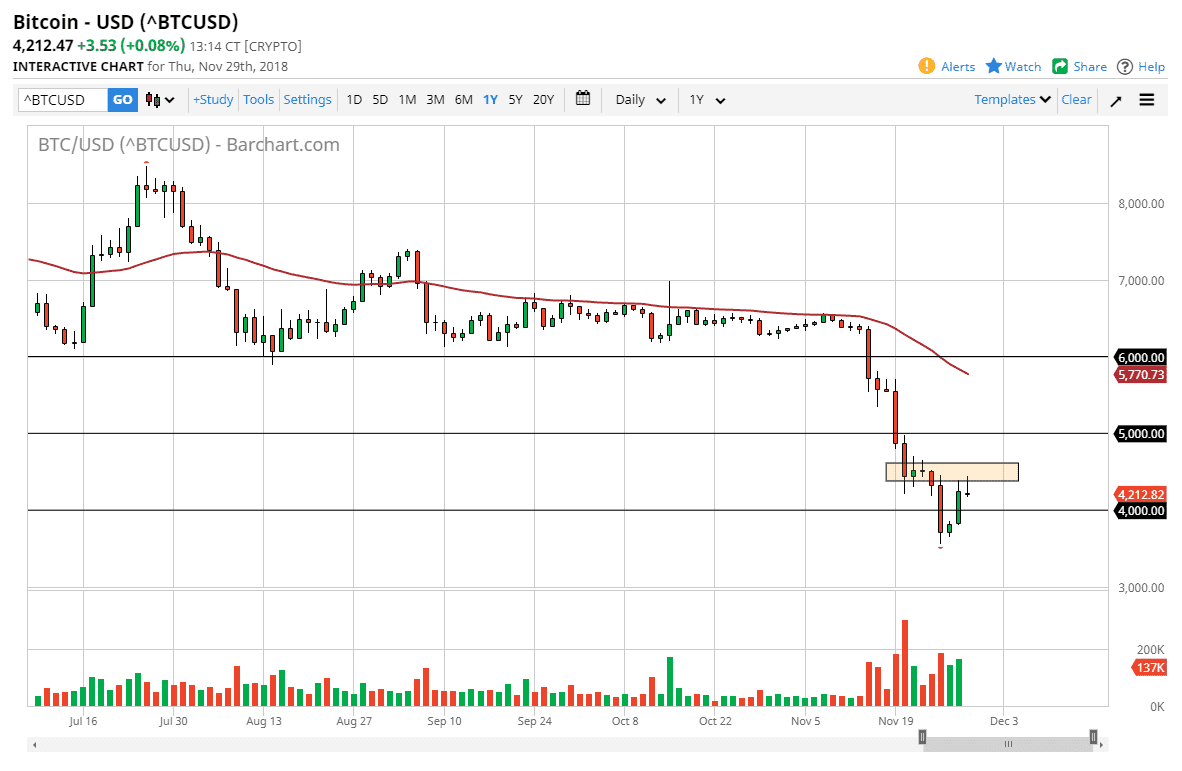

Bitcoin markets tried to rally initially during the trading session on Thursday, but as you can see the area that I have marked on the chart has offered resistance at roughly $4500, and as we have rolled over we have formed a bit of a shooting star. The shooting star of course is a very negative sign, and we are in a downtrend. At this point, I think that we are going to go lower, as we still have plenty of concern around the world when it comes to crypto. Quite frankly, there’s no use for Bitcoin quite yet, as it is simply a speculative instrument. All speculation eventually builds a bubble given enough time, as the fundamentals don’t support the pricing. At this point, Bitcoin doesn’t serve much of a purpose, so it certainly can’t be worth $10,000 a coin or anything like that.

With this action, I suspect that we are going to continue to go lower, perhaps reaching towards the $3500 level, possibly even $3000 after that. If we do break above the $4500 level, then I think we could go to the $5000 level after that. That’s an area that of course will cause a significant amount of resistance based upon the large come around, psychologically significant figure, which is an area where we see a lot of interest I believe. Even if we break above there we still have the 50 day EMA above causing technical resistance.

I see no reason for this market to rally in the short term, so I think that we continue to fade rallies going forward. Beyond that, it would not surprise me that when things to stabilize they look a lot like the last several months before the break down, simply going sideways overall.