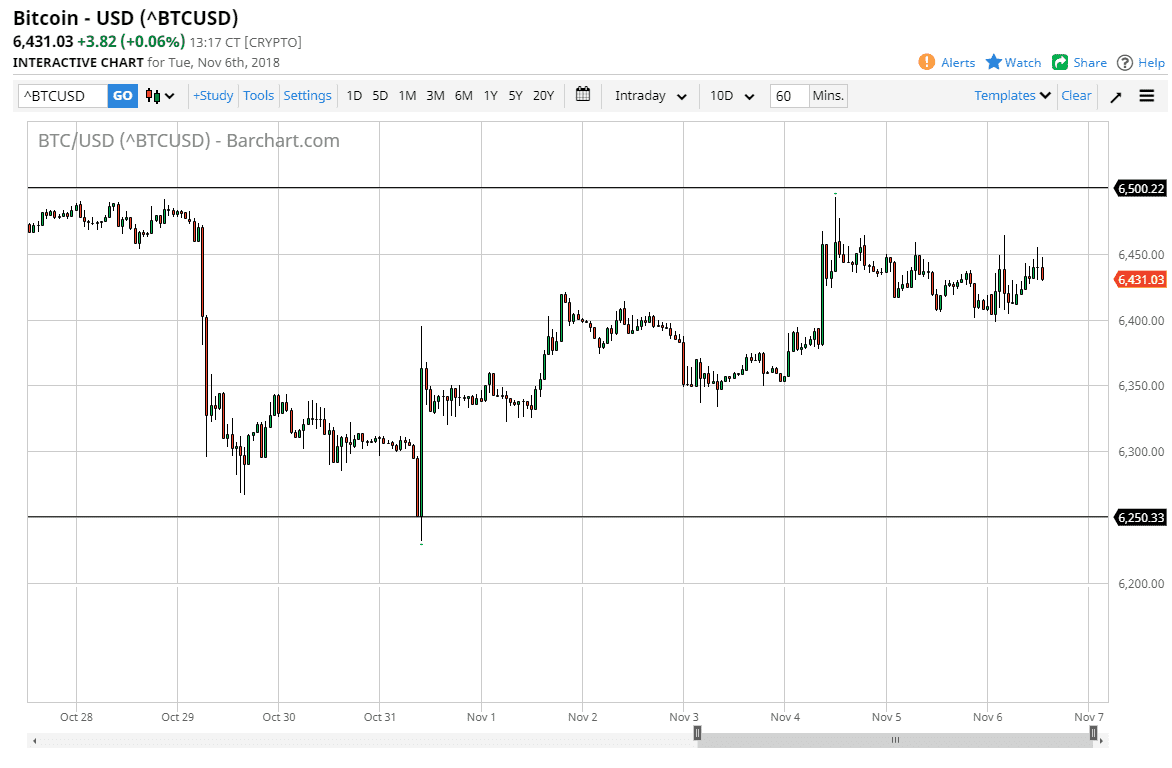

BTC/USD

Bitcoin markets rallied slightly during the trading session on Tuesday, reaching towards the $6450 level. This area has offered a bit of resistance as of late, extending to the $6500 level. That’s an area that has been important a couple of times, and at this point I think that the sellers will jump into this market rather quickly. At this point, I suspect that we are probably going to continue to stay within this overall range, extending down to the $6250 level. In fact, when I look at the bitcoin market, it is becoming increasingly obvious that every $50 or so we have both support and resistance.

At this point, I think that short-term scalping is about as good as bitcoin gets, and I think it’s going to be difficult for traders to build up any type of momentum in one direction or the other as there is no catalyst for bitcoin to move significantly. When you look at the daily chart, it becomes increasingly obvious just how much volatility has been socked right out of the market. However, longer-term that might be a good sign as it shows stability for investors, and perhaps most of the speculators are either gone or so far underwater that they can’t be bothered.

That being said, there are going to be a lot of retail investors willing to sell once the market gets relatively close to their entry price, which for some people unfortunately is closer to $20,000. That is going to continue to put bearish pressure on bitcoin and slow the ascent of the market regardless. That might be what this market has always needed though, a slow, steady, and gentle grind higher more than anything else. If we do break down below the bottom of this consolidation area, I would anticipate a lot of support near the $6000 level again.