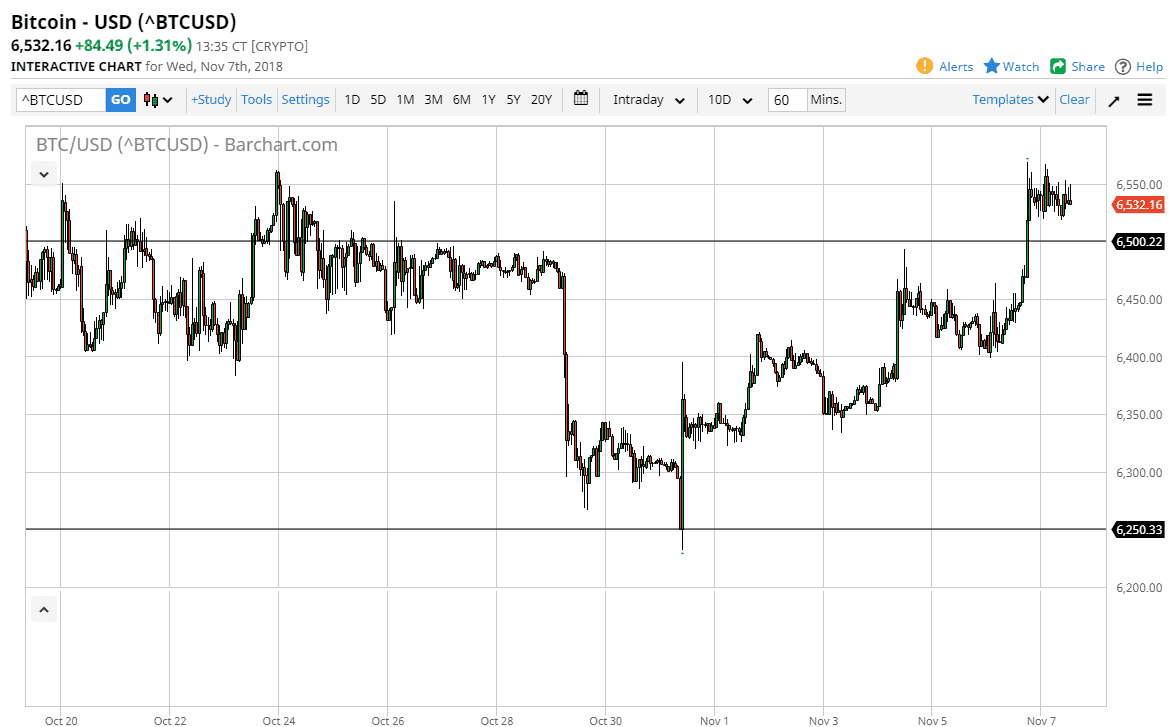

Bitcoin markets did rally a bit overnight, but most of the session on Wednesday was rather quiet although above the $6500 level. That’s an area that was previous resistance, so it should now be supported based upon market memory. I believe that the market finding buyers in that area makes a bit of sense, and we could continue to grind higher. The keyword of course would be grind. If we break down below the $6500 level, then we are likely to go down to the $6450 level, possibly the $6400 level after that.

This continues to be a short-term market, and therefore I think that the best thing you can do a scalp this market based upon support and resistance every $50 or so. It’s a very technically driven market right now, but it’s going to come down whether or not you have the ability to trade with those types of conditions. Ultimately, this market is going to be difficult for longer-term traders, but longer-term investors may be starting to build up a position. If we do get a break to the upside, the $7000 level will of course be crucial, as it is a large come around, psychologically significant figure.

Ultimately, I believe that the $6000 level underneath continues to be massive support, and I think the longer-term traders continue to defend that area. If we were to break down below there, then I think the market could go much lower, but right now it looks as if that isn’t a threat and it’s likely to be a market that you can buy the dips, but I would expect much per trade. If you have the ability to trade short-term, it does offer a nice opportunity with the $6500 level right now being significant support for scalpers.