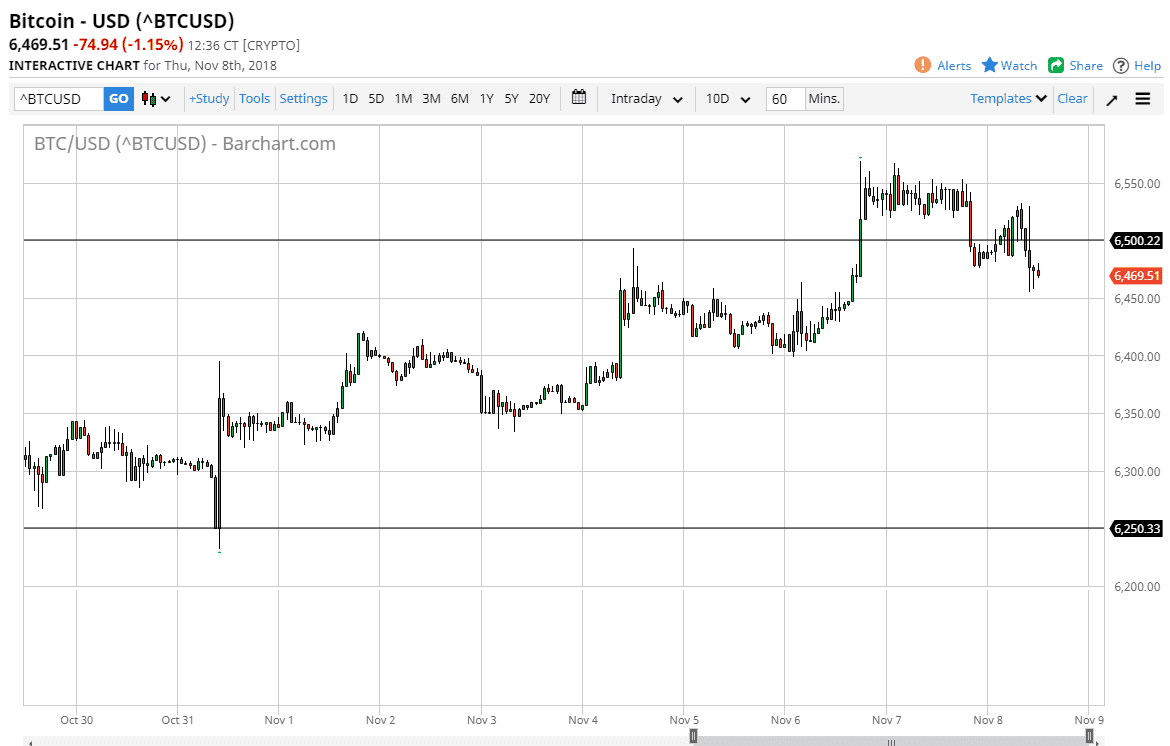

BTC/USD

Bitcoin markets drifted a bit lower during trading on Thursday, as the crypto currency markets continue to be very choppy and sideways from a longer-term standpoint. The $6500 level has brought in some selling, but at this point we are still technically in a short-term uptrend. I think that this market is one that you continue to scalp and can’t put serious money into unless you are willing to “buy-and-hold.” Looking at this market, it’s obvious that we had gotten a little bit overextended, but I think that buyers underneath will continue to pick this market up. I am very interested in the $6400 level, and I think that a buying opportunity may present itself if we drop back down there.

If we do get a bounce from the $6400 level it’s likely that we could go to the $6500 level next. I believe that the best way to play the bitcoin market is to use a CFD as opposed to the actual crypto currency itself. But if you need to scalp this market, and I think that’s the only way you can play, you need to use the CFD markets as they avoid all of the hassles of going into crypto currency exchanges.

This is a market that I think is trying to build up the momentum, but there’s so much in the way of negativity when it comes to bitcoin that it’s going to be very difficult to make major moves. If you are a longer-term investor though, then these dips could be opportunities to pick up little bits of the coin. As far as selling is concerned, I’m not overly interested in doing so, at least not until we break down below the $6400 level.