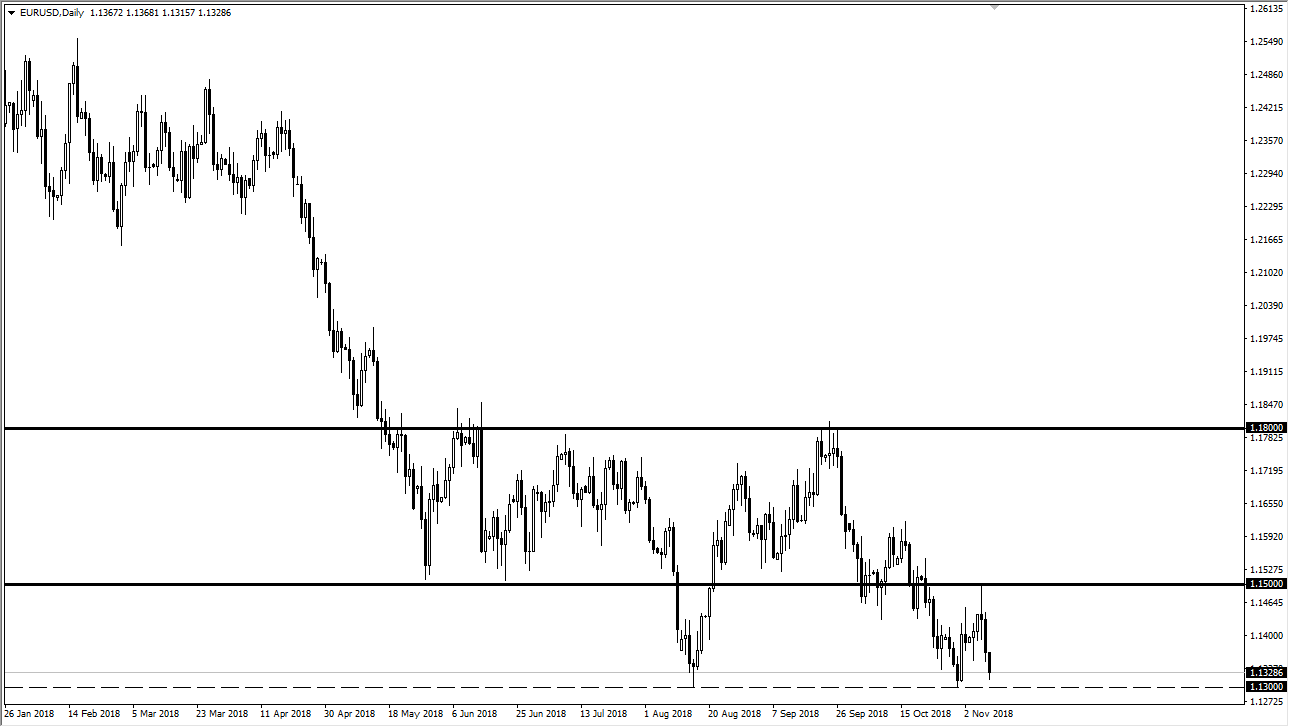

EUR/USD

The Euro fell again on Friday, reaching down towards the 1.13 level and an area that of course has offered support. The fact that we rallied towards the 1.15 level and then rolled over shows a “lower high”, and I think it’s only a matter time before we break below the 1.13 level. Once we do, the market is very likely to go down to the 1.12 level, followed by the 1.11 handle as it is a major support level. I think we are more than likely going to see an attempt at a bounce, but that bounce will probably offer a selling opportunity. In fact, it’s not until we clear the 1.15 level that I’m looking to buy the Euro as we obviously have a lot of weakness. The strengthening US dollar is due to higher interest rates and of course issues with the Italian debt situation in the European Union, and quite frankly fears of global growth continue to be an issue as well. Finishing the week so softly in this pair is an ominous sign.

GBP/USD

The British pound broke down below the 1.30 level during the day on Friday, and as you continue to see a downtrend line offering significant resistance. Ultimately, I think we could drift down towards the 1.27 level underneath which is massive support. If we break down below that level, the market will continue to go even further to the downside. However, I think with concerns about the Brexit and higher interest rates coming out of the United States, it’s likely that we will continue to see a lot of volatility in this pair. I still favor the downside, as quite frankly I think most of the world does at this point.