The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 25th November 2018

In my previous piece last week, I forecasted that the best trades would be long of the NZD/USD and AUD/USD currency pairs. Unfortunately, these were both losing trades. NZD/USD fell by 1.44%, and AUD/USD fell by 1.36%, giving an averaged loss of 1.40%.

Last week saw a rise in the relative value of the Swiss, and a fall in the relative value of the Australian Dollar.

Last week’s Forex market was very quiet and choppy, with no major news really moving prices at all.

This week is likely to be dominated by crucial U.S. GDP data and the FOMC Meeting Minutes release.

Fundamental Analysis & Market Sentiment

Fundamental analysis still tends to support the U.S. Dollar, as American economic fundamentals continue to look strong, although there are increasing fears that further rate hikes will have a more strongly negative impact. Sentiment seems to be still in favor of the U.S. Dollar as despite quite strong recent selloffs in the stock market, the economic fundamentals are still widely seen as good, although there is now an increasing belief that the Federal Reserve should hold off on rate hikes to over over-cooling the economy: some economists are now arguing that U.S. growth is cooling off already. Fundamentals remain bearish on the Japanese Yen, but this currency can still benefit from safe-haven “risk off” money flow.

Brexit remains an unknown, as the British Parliament prepares to vote on the draft Brexit deal next month. It currently looks as though the Government will not be able to secure approval of the deal.

The week ahead in the market is likely to be dominated by the U.S. Dollar. Generally, it is a poor market for traders.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows that after last week’s bearish candlestick, this week printed a bullish engulfing candlestick. The price remains within a multi-week consolidation between support and resistance and I have no strong confidence as to short-term direction, although the edge is still technically in line with the long-term bullish trend, which remains intact. It is now looking a little more likely that the bullish trend will continue.

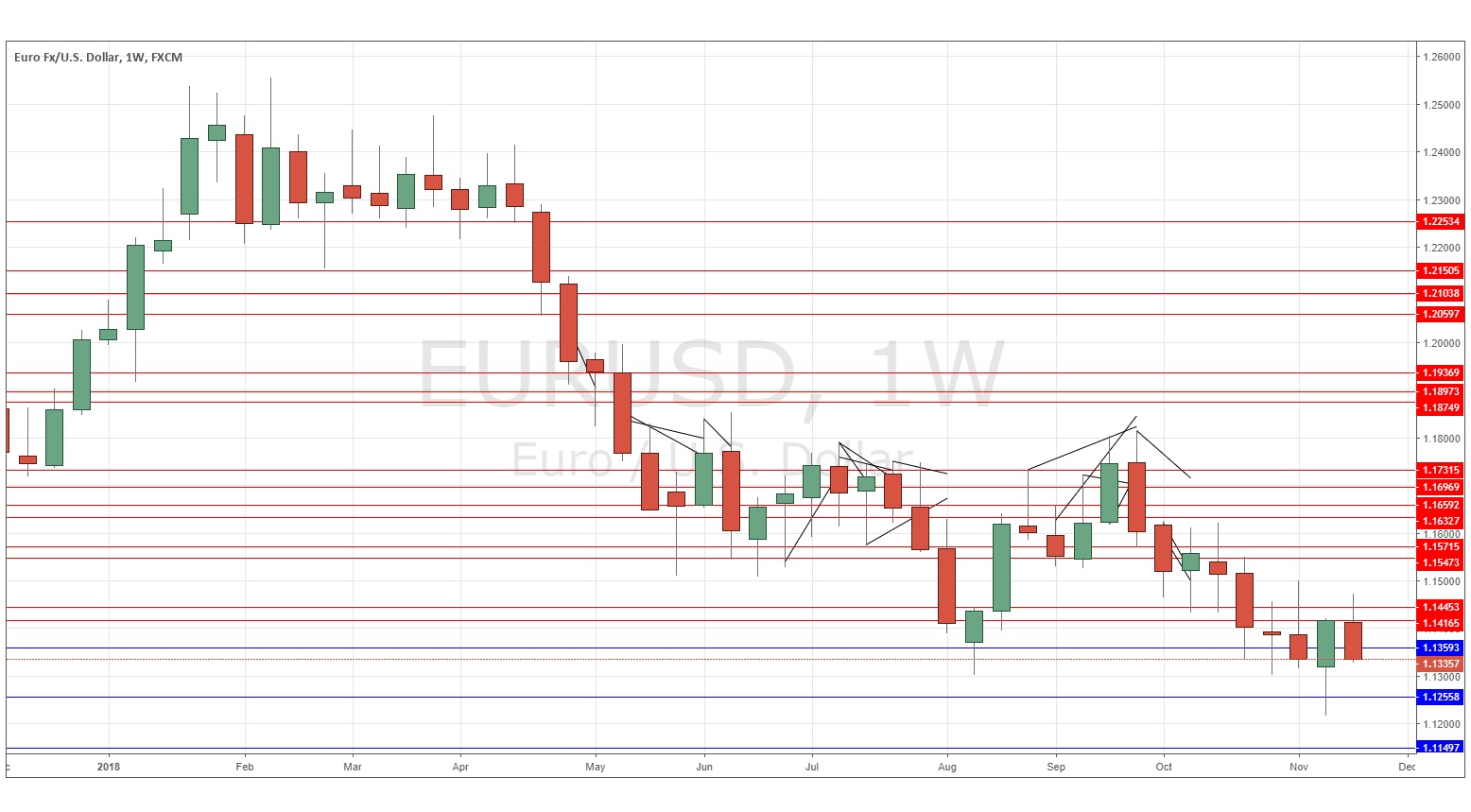

EUR/USD

The weekly chart below shows last week produced a quite solid bullish candlestick which closed right by the bottom of its range. This is a continuation of the general long-term bearish downwards trend which has slowed but seems to still be intact. However, bears should watch out for potentially strong support at or close to the psychological level of 1.1250.

Conclusion

Bearish on the EUR/USD currency pair.