Gold prices rose for a fifth consecutive session on Monday as the dollar extended losses. The greenback was weighed by weak housing data and growing notion that the Federal Reserve will raise rates two times next year instead of the three. Global stock markets were mostly lower yesterday. U.S. stocks tumbled as investors sold off internet and other technology shares on concerns over slowing global economic momentum.

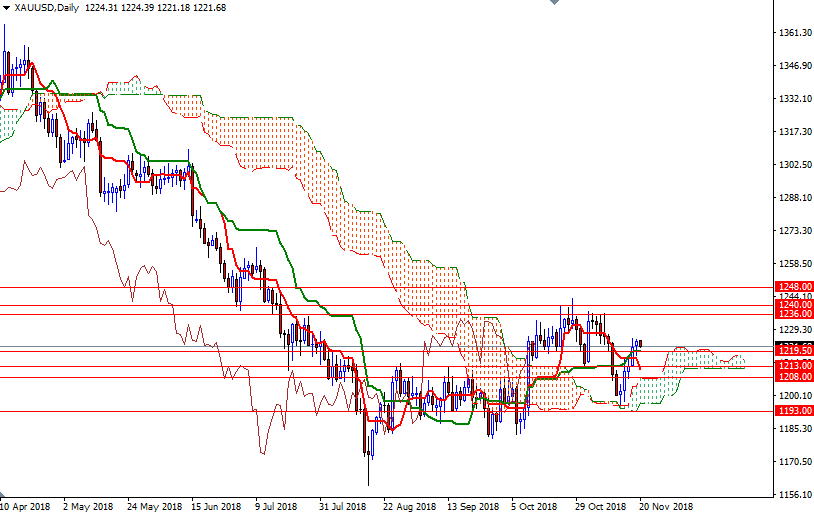

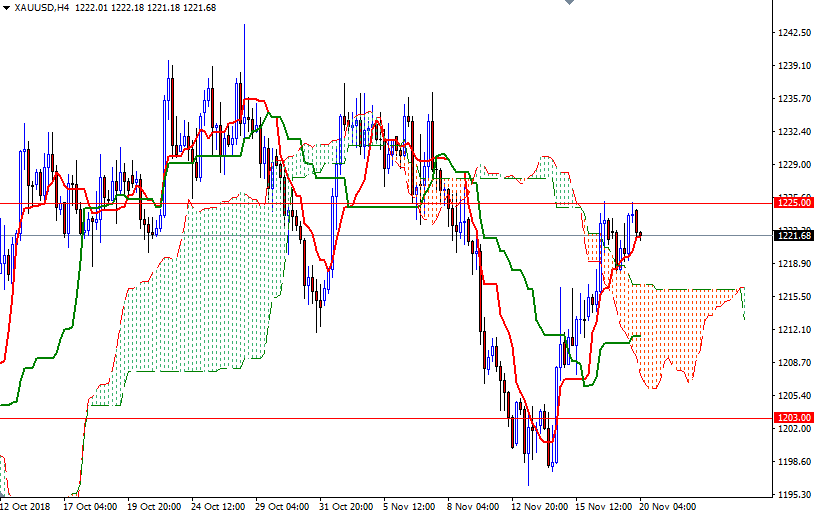

The market is trading above the Ichimoku clouds on the daily and the 4-hourly chart, suggesting that the bulls have the near-term technical advantage. However, keep in mind that prices are still below the weekly cloud. XAU/USD headed higher after the 4-hourly Ichimoku cloud acted as support, but wasn’t able to break the anticipated resistance at around the 1225 level.

If this area holds as resistance today, we may head back to test 1219.50-1219 and 1216.50. A successful break below 1216.50 cloud lead to a test of 1213. The bears have to produce a daily close below 1213 to make an assault on 1208. The bulls, on the other hand, need to pass through the aforementioned barrier in the 1227/5 area to challenge 1232/0. If XAU/USD gets back above 1232, then the next stop will be 1236. A break through there brings in 1240.