Gold prices rose $2.42 an ounce on Thursday, extending gains to a third straight session. A lower U.S. dollar and new concerns surrounding the Prime Minister Theresa Mayís plans to exit the European Union were supportive daily elements for the precious metal. In economic news, the Commerce Department reported retail sales increased 0.8% last month. The New York Fedís manufacturing index came in at 23.3, up from the previous monthís 21.1. The Federal Reserve Bank of Philadelphia said its index of regional manufacturing activity dropped to 12.9 from 22.2 the prior month.

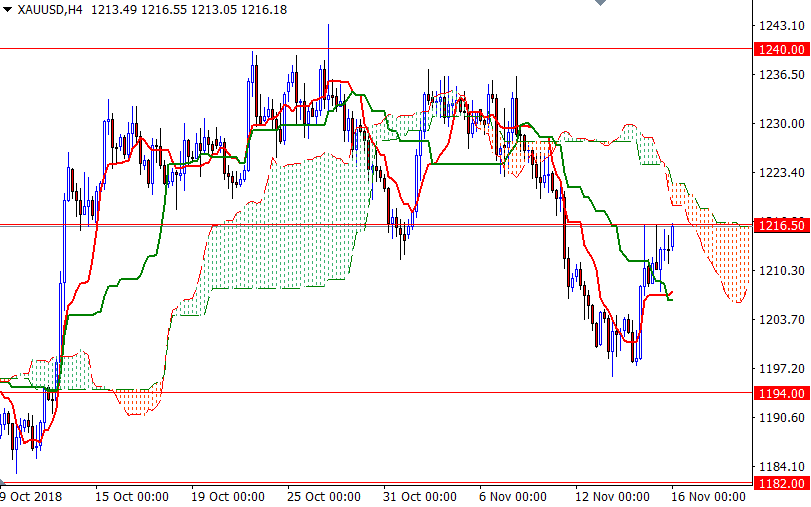

XAU/USD is trading above the Ichimoku clouds on the H1 and M30 charts; plus, the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are positively aligned. However, prices are still below the 4-hourly cloud.

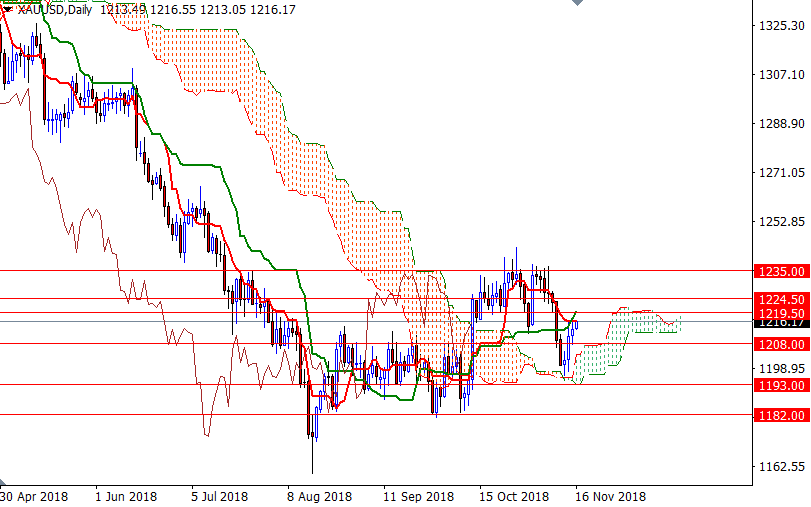

The bulls have to pass through 1216.50 to reach the 4-hourly cloud, occupying the are area between 1219.50 and 1222. If the bulls can capture this strategic camp, they will be targeting 1227/5. A daily close above 1227 is essential for a continuation towards 1232/0. To the downside, the initial support sits at 1208. The bears have to push prices below there to make an assault on the next support at 1205. If this support is broken, then 1201.64-1200 and 1198 will be the next targets.