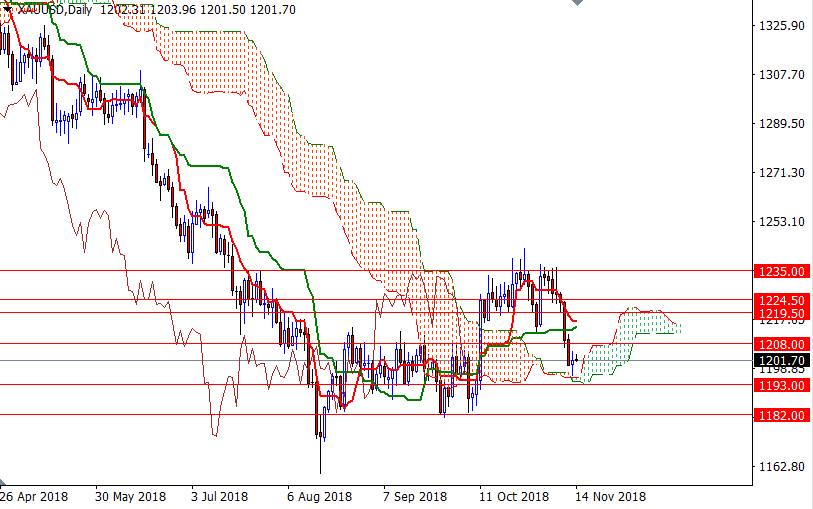

Gold prices rose $1.49 an ounce on Tuesday, snapping a seven-day losing streak, as the dollar took a breather after hitting a 16-month high. XAU/USD moved lower towards to the daily Ichimoku cloud as expected after prices broke below the $1203-$1200 zone. U.S. economic data due for release Wednesday is light and includes the consumer price index.

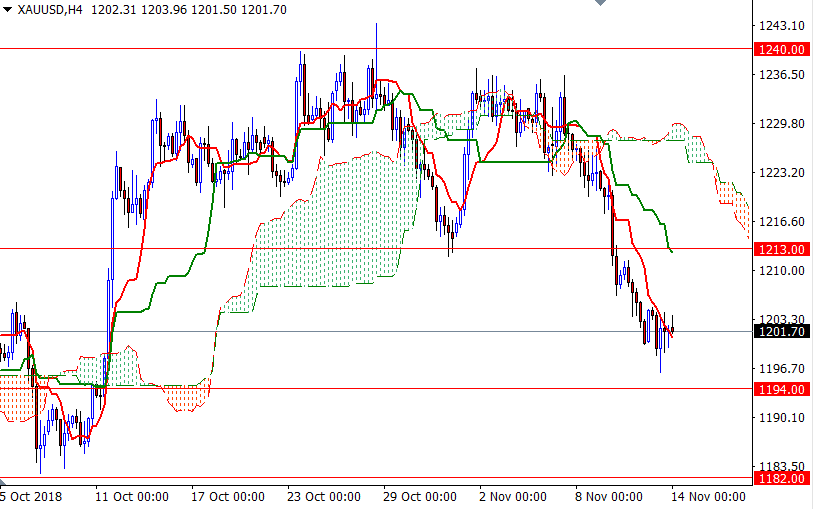

The market is trading below the weekly and the 4-hourly Ichimoku clouds. In addition, the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned on both charts. However, there is a strategic support in the 1195/3 area, occupied by the daily cloud. The bears will need to drag prices below the 1201.64-1200 area to revisit 1198 and 1195/3. A break below 1193 implies that XAU/USD is on its way to 1189-1187.50.

To the upside, the initial resistance is located at 1205, followed by 1208-1207.50. If XAU/USD climbs back above 1208, we may head higher to 1213/1. The bulls have to produce a daily close above 1213 to tackle the next barrier in 1218-1216.50.