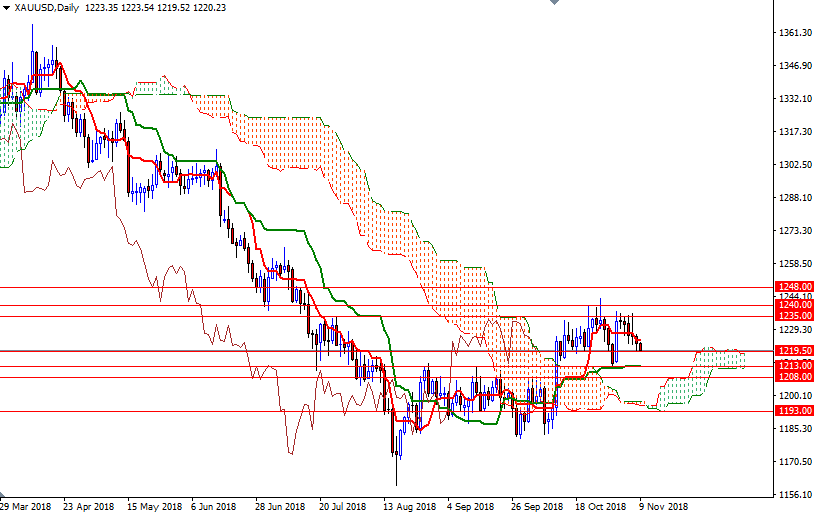

Gold prices fell for a fifth straight session on Thursday as the dollar edged higher after the Federal Reserve indicated that it plans to continue raising interest rates at a gradual pace. “The Committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective over the medium term,” the Fed said in its statement. XAU/USD pulled back to the $1220.50-$1219.50 area as expected after the market dropped below the $1224 level.

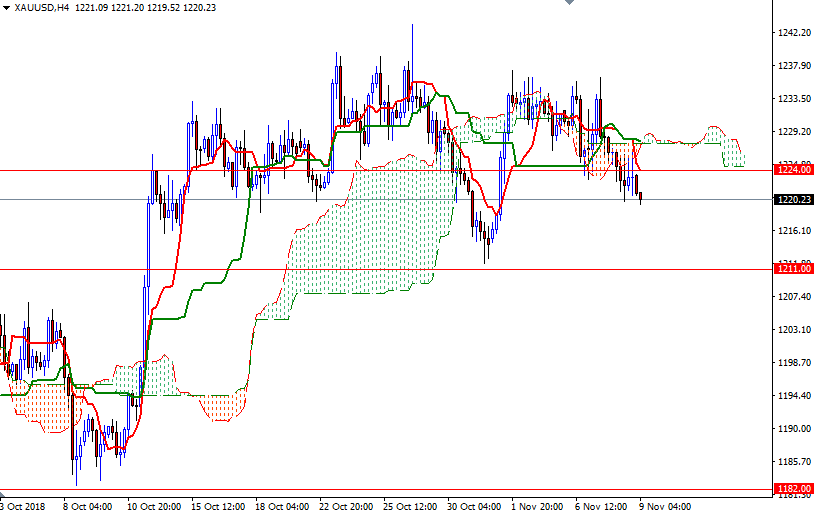

Prices are below the 4-hourly and the hourly Ichimoku clouds. The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned. The Chikou-span (closing price plotted 26 periods behind, brown line) is below prices on the H4 chart.

If prices dive below the support at around the 1219.50 level, we will probably continue grinding lower towards 1216.50-1215. Below that, there is a strategic support in the 1213/1 zone. The bulls, on the other hand, have to lift prices above the 1224 level to retest the resistance at 1227. If XAU/USD penetrates this barrier, the market may head higher and challenge 1230-1229.50. A break above 1230 implies that the market is aiming for 1232.50-1232.