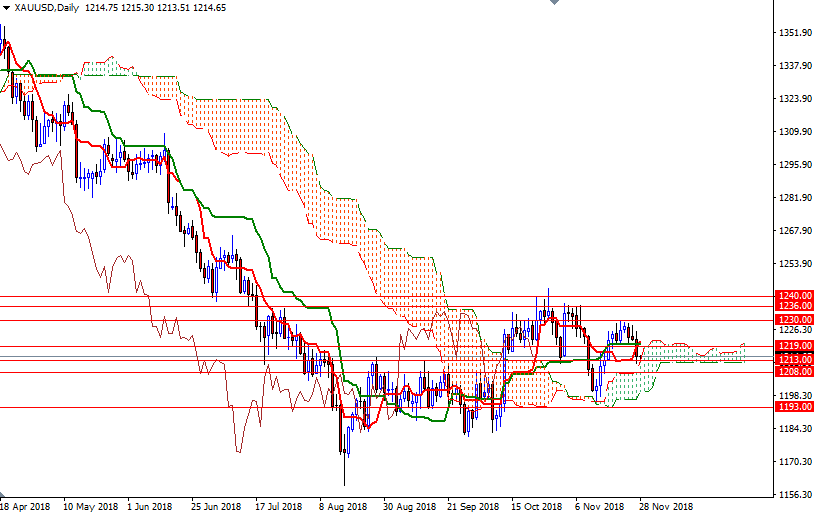

Gold prices fell $7.12 an ounce on Tuesday, hitting their lowest in nearly two weeks, as gains in equities and a stronger dollar dented demand for safe-haven assets. Some chart-based selling was also behind gold’s 0.58% drop yesterday. XAU/USD drifted lower and returned to the $1213 level as expected after the market pierced below the support at around $1219.

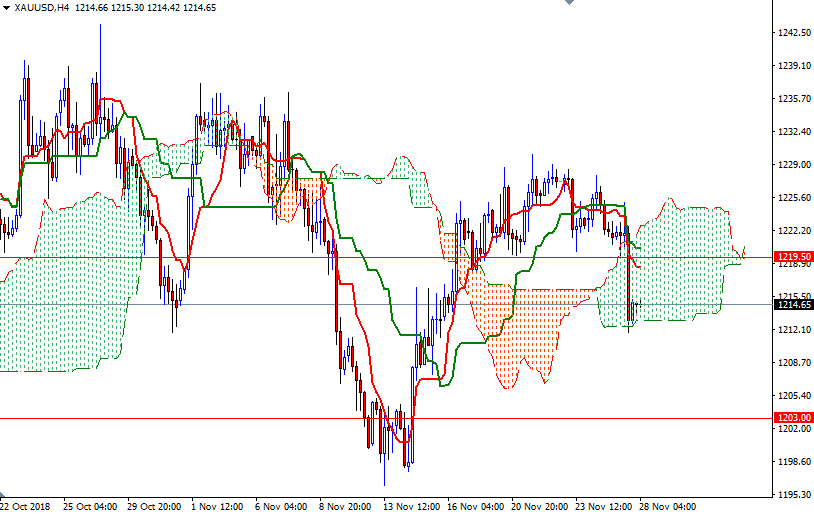

The market is trading below the Ichimoku clouds on the H1 and the M30 charts; plus, we have negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-day moving average, green line) on the 4-hourly and the hourly charts. The bottom of the 4-hourly cloud and the top of the daily cloud converge in the 1213-1211 area. The bears need to capture this strategic support to make an assault on 1208-1206.60. If XAU/USD falls below 1206.60, then the next stop will be 1203.

To the upside, the initial resistance stands in the 1216.50-1215.75 zone. The bulls have to pull prices above this barrier to revisit 1218 and 1220.50-1219.50. Closing above 1220.50 on a daily basis paves the way for a test of 1225.30-1224.80.