Gold prices ended Wednesday’s session up $4.16 an ounce as the dollar was pressured by weak U.S. economic data. The Commerce Department reported that orders for durable goods dropped 4.4% last month. The University of Michigan’s consumer sentiment index came in at 97.5 for November, down from the 98.3 recorded in October.

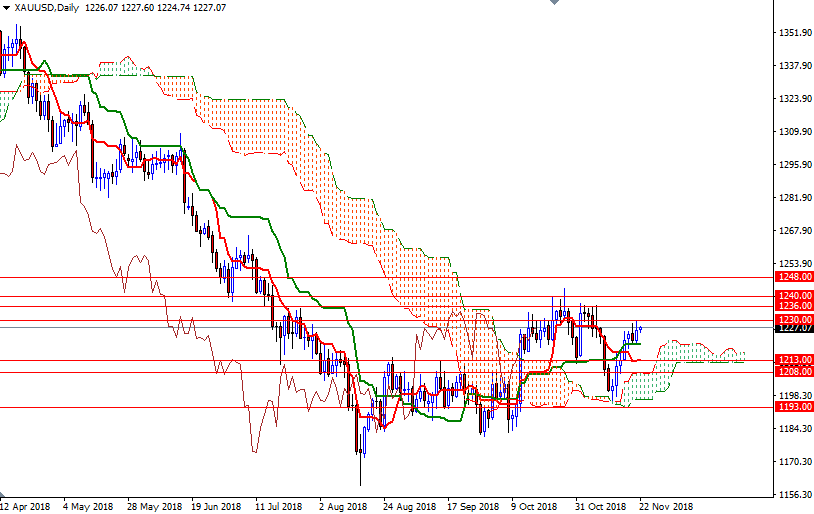

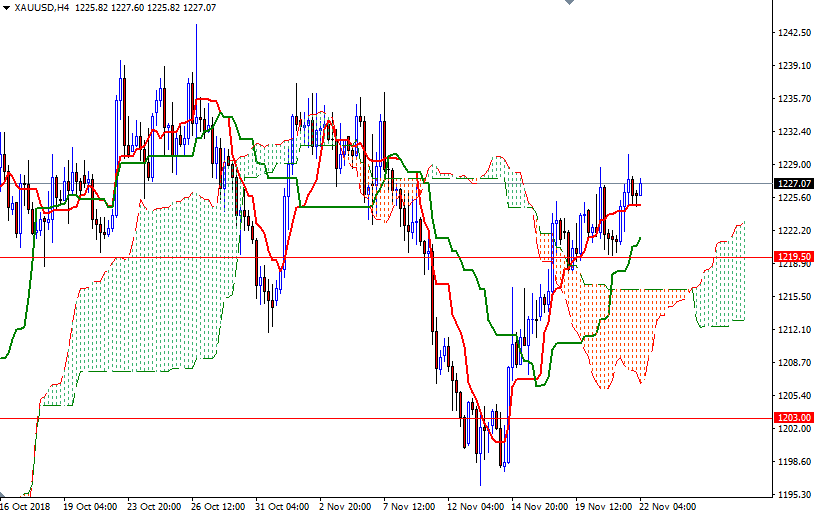

The market is trading above the daily and the 4-hourly Ichimoku clouds, suggesting that the bulls have the near-term technical advantage. XAU/USD reached the 1230 level after prices got back above 1227, but the market is struggling to remain above this strategic barrier. The bulls have to pass through 1230 to challenge 1232. If this resistance is broken, the market will be targeting 1236.

To the downside, the initial support is located in the 1224.80-1224.70 zone. A break below 1224.70 implies that we may head back to 1222. If this support gives way, then 1219.50-1219 will be the next stop. The bears need to drag prices below 1219 to tackle 1216.50-1216, the top of the 4-hourly cloud.