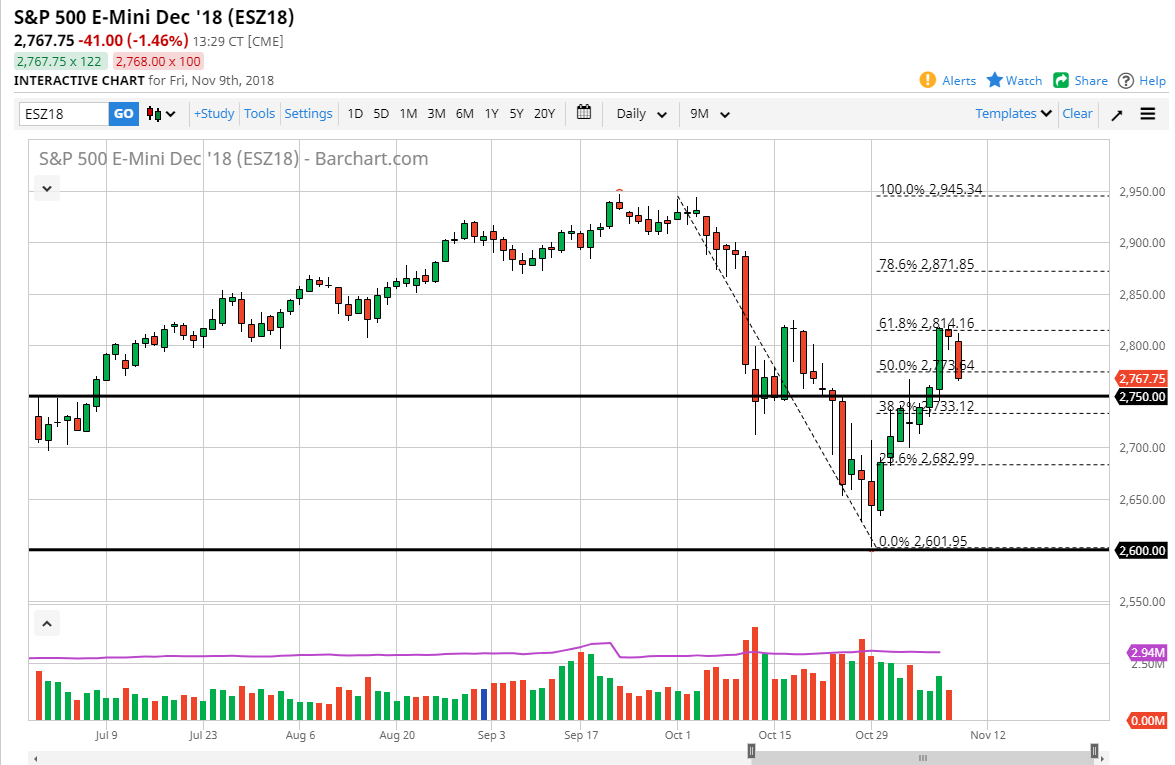

S&P 500

The S&P 500 has fallen during the trading session on Friday, breaking down below the bottom of the candle stick from Thursday, making it a “hanging man.” At this point, it’s likely that we will continue to drop, based upon the fact that we had formed that “hanging man,” and pulled back from the 61.8% Fibonacci retracement level. If we break down below the 2750 handle, the market continues to go lower at that point, perhaps testing the 2700 level next. The alternate scenario of course is that we break above the highs from the last couple of days and continue to go towards the 2900 level. Ultimately, this is a market that continues to be very erratic, and driven by a Sino-American relations, higher interest rates, and concerns about global growth.

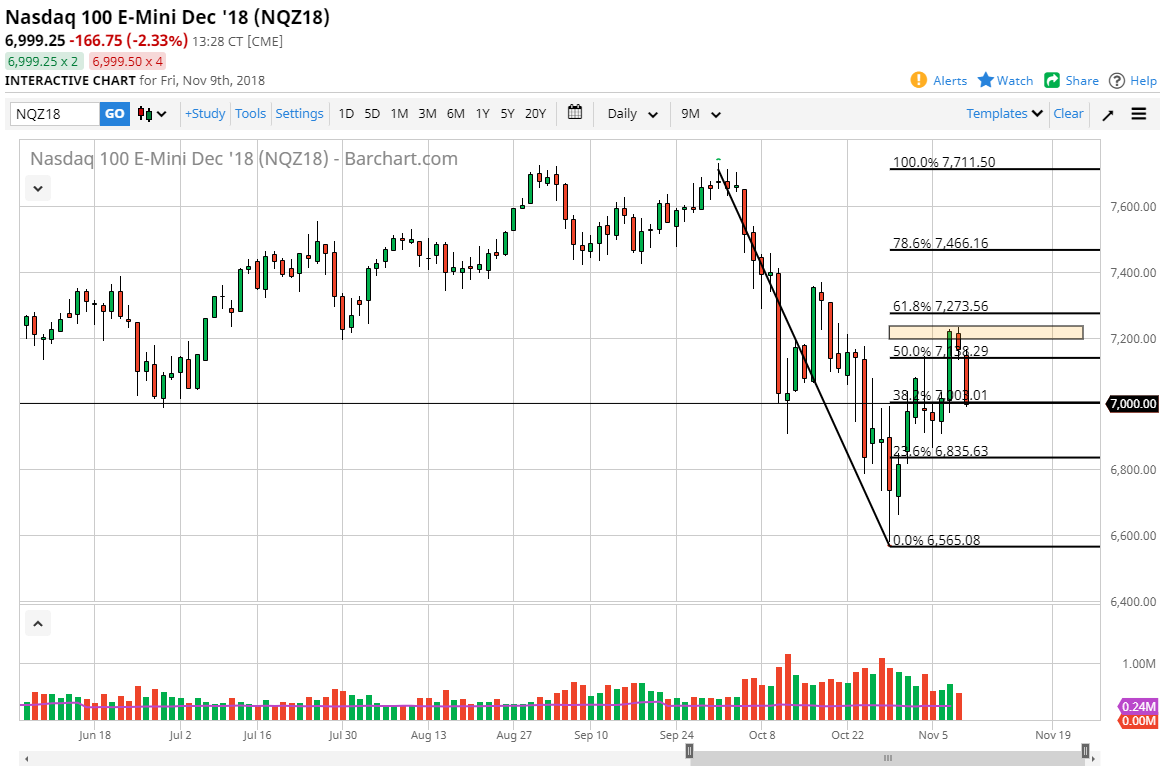

NASDAQ 100

The NASDAQ 100 fell hard during the trading session on Friday, reaching down to the 7000 level. This is an area that should have a lot of support attached to it though, so the next 24 hours should be very difficult. I think you’re probably best leaving this one alone, or at least you should trade in small positions. I suspect a bounce is likely, but not necessarily certain. I certainly wouldn’t put any of my trading capital into a position like that, because quite frankly I don’t like the odds based upon the fact that we have completely given back the postelection rally. I suspect it’s easier to short the S&P 500 than it is to start trying to fight the downward trajectory and the support in the NASDAQ 100. I believe that there is still a lot of concern out there when it comes to global growth.