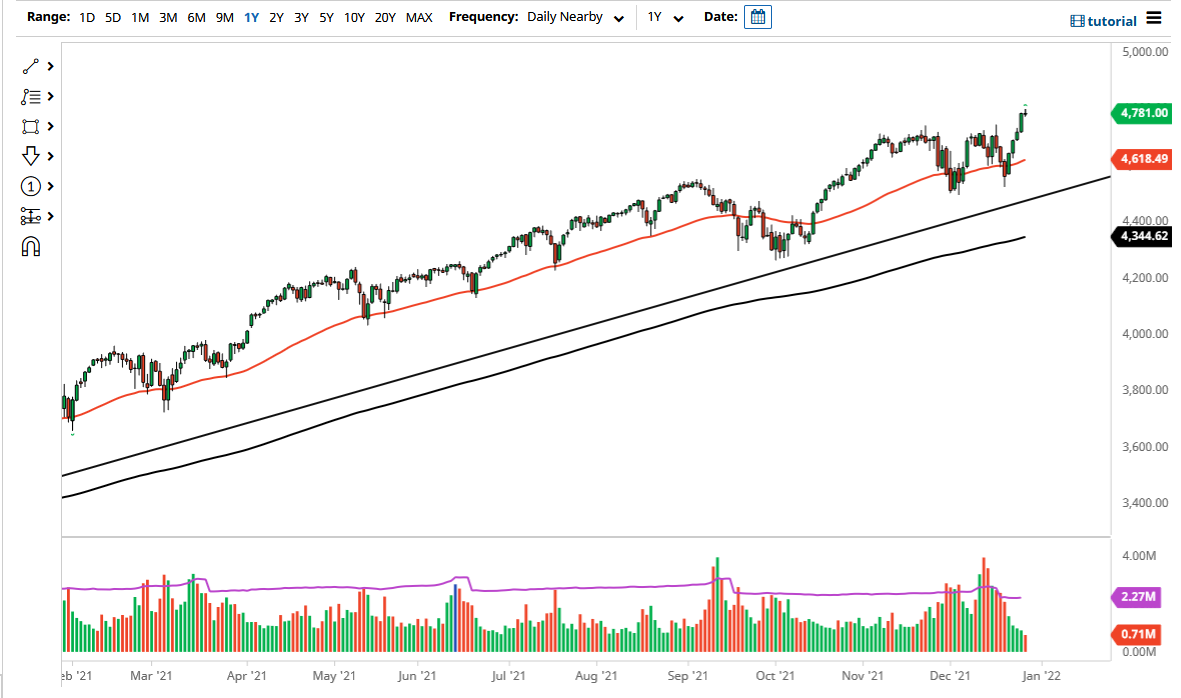

S&P 500

The S&P 500 initially pulled back during the trading session on Friday, and then turned around to form a bit of a hammer. We are sitting underneath the 2750 handle, which is an area that has been resistance. I believe that if we break above there, the market will probably go looking towards the 50 day EMA, and then perhaps the recent highs. I think at this point, if we break down below the bottom of the hammer for the session on Friday, then we go looking towards the 2700 level, the 2650 level, and then eventually the 2600 level after that. There are a lot of concerns out there about global trade and of course interest rates, so I think that the S&P 500 is still susceptible to sudden selloffs.

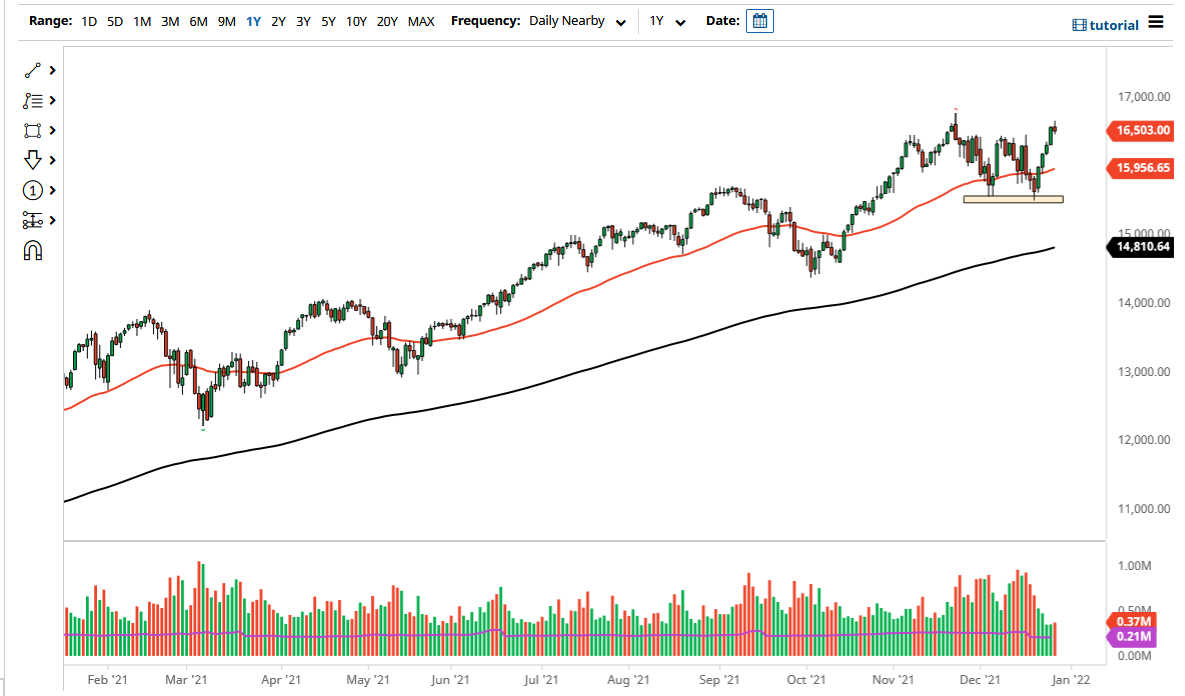

NASDAQ 100

The NASDAQ 100 has also seen a back-and-forth type of session, initially gapping lower and then going down towards the 6800 level, only to turn around of form a bit of a hammer. At this point, I think there is a lot of resistance above at the 7000 handle, an area that has been important more than once. I think the 50 day EMA on the chart shows a lot of exhaustion and negativity in this market, so I think that we won’t be able to break above there anytime soon. The other scenario of course is that we have just formed a bit of a double bottom, but I think that is a bit of speculation at this point at best. The US/China situation continues to weigh upon technology stocks, and we have just seen Nvidia get whacked for 20%. That shows just how soft tech could be.