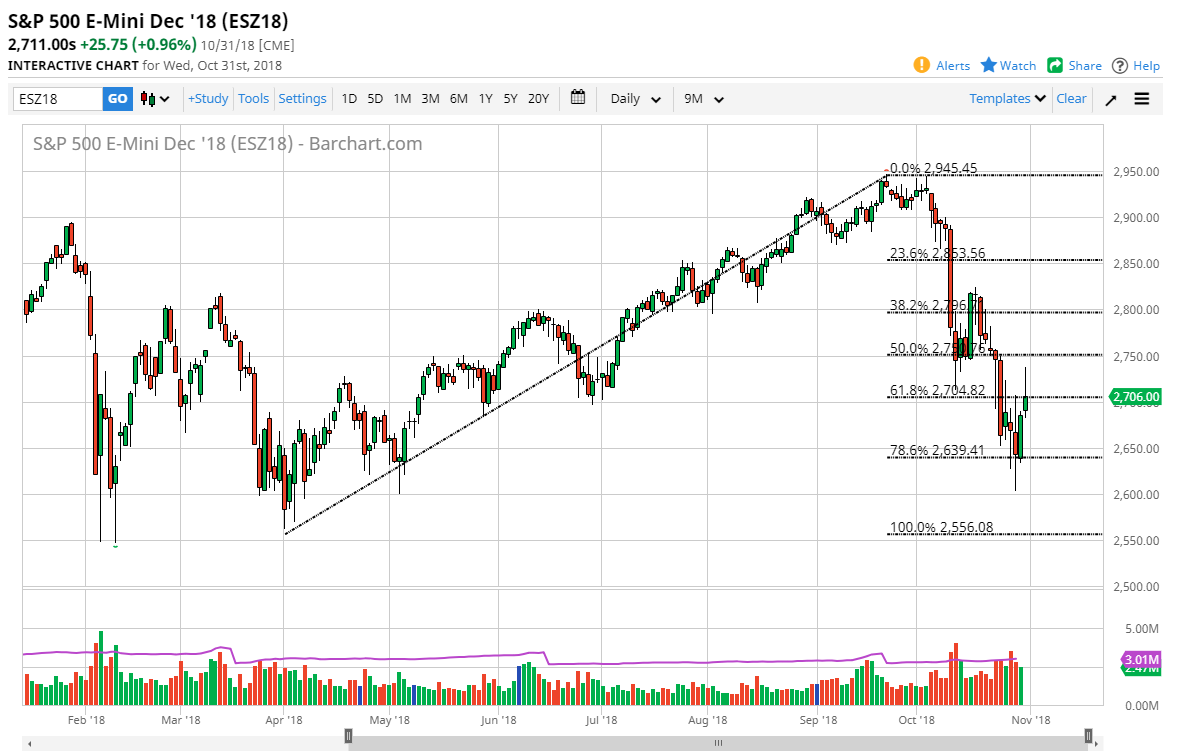

S&P 500

The S&P 500 rocketed to the upside after gapping higher to kick off the trading session on Tuesday. However, the 2750 level has offered enough resistance to turn things around of form a massive shooting star. This gives me pause for concern, and I think that the selling isn’t quite done. If we break above the top of the shooting star and perhaps even the 2750 handle, then I might be impressed, but the daily candle stick does suggest that there is a bit of hesitation to go higher, and therefore I think that people will be looking to dump off stocks that have been losses. Beyond that, I think that the last hour of trading on Wall Street was horrific, and that leads me to believe that we would probably see a lot of selling coming rather soon.

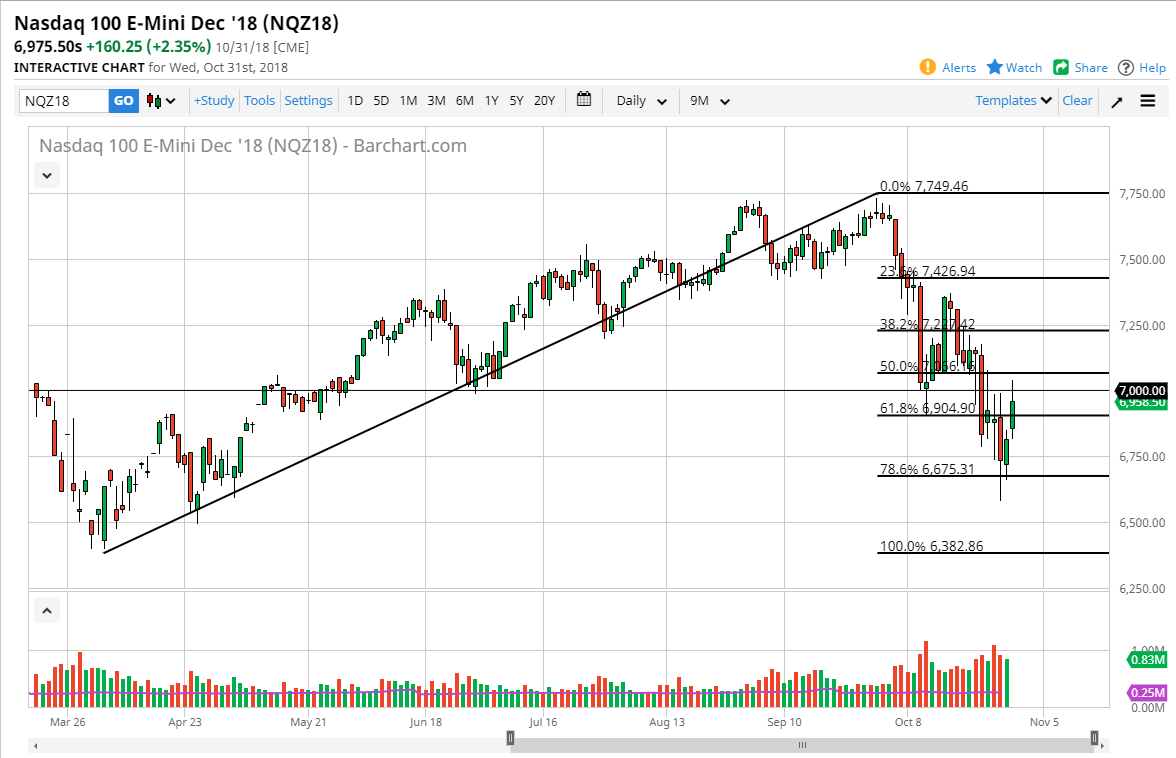

NASDAQ 100

The NASDAQ 100 rallied as well but failed at the 7000 level again. This candlestick is much more interesting and bullish than the S&P 500 candlestick, but it still faces a lot of noise just above, and I think it’s only a matter of time before the sellers come back in. I think there is far too much technical damage done to the market for it to continue to go higher in this manner, so I think a pullback is probably about to happen. The 6750 level underneath will be a target, and the fact that we could hold 7000 tells me that there is still a lot of fear out there. Beyond that, there’s a lot of put buying out there, which is a way to protect an upward move, meaning that people are still concerned. I think a pullback comes soon.