S&P 500

The S&P 500 tried to rally during trading on Wednesday, but found the 2750 level to be too much, and then broke down below the bottom of the inverted hammer from the trading session on Tuesday, kicking off a fresh bearish signal. As I record this, we are dancing around the 2700 level, and I think now were probably going to go looking towards 2750. Regardless, I think it’s only a matter of time before the sellers get involved on rallies anyway, and I think we will probably go looking towards the 2600 level given enough time. That’s an area that should be rather stringent in its support, but if we were to break down that level, we could open the door to the 2500 level. I have no interest in buying this market until we break above the 50 day EMA on a daily close.

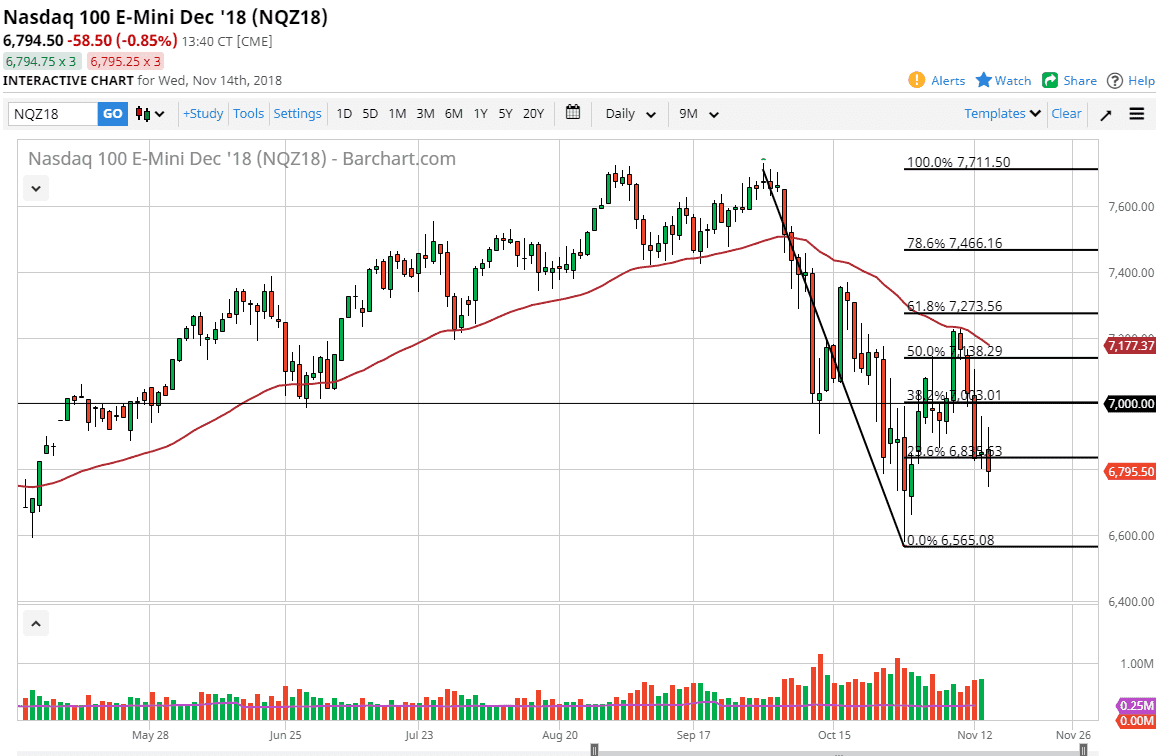

NASDAQ 100

The NASDAQ 100 tried to rally a bit during the trading session as well but then turned around to break down below the bottom of the inverted hammer from the Tuesday session as well. This tells me the market is going to continue to see 7000 as a major barrier, and we will probably go looking towards the lows again near the 6500 level. I think that selling rallies continues to work, at least until we get a major shift in attitude. Right now, I don’t see that happening and I think that the 50 day EMA on the chart shows perfect support and resistance going back several months. It’s turning lower, has been used as resistance a couple of times, and it now looks like fresh lows could be targeted underneath given enough time.