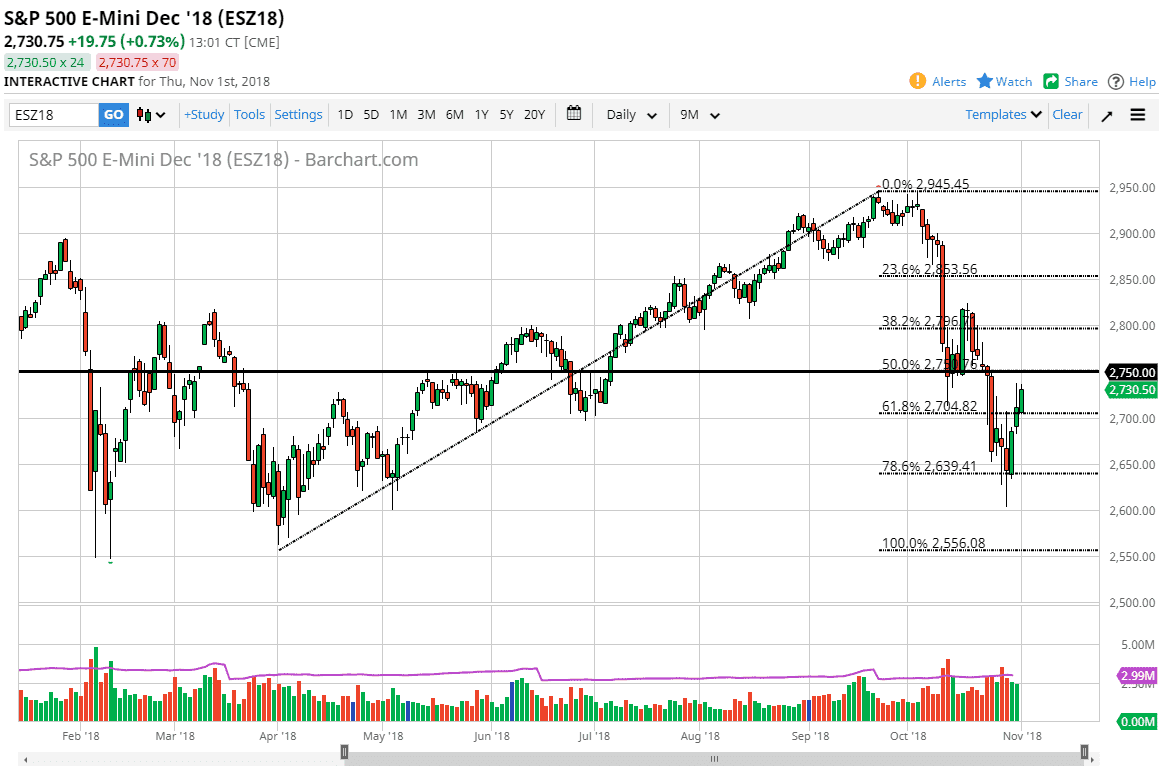

S&P 500

The S&P 500 rallied significantly during the trading session on Thursday, as we continue to see a strong rally after the last couple of days. The 2750 level was previous support that sent the market much lower, so I think that is going to be an area that is somewhat resistive. At this point, I think that if the market rallies above the 2750 level, then perhaps we could have something going. Obviously though, with the jobs number coming out today it’s going to come down to that. I suspect that you are probably better off staying out of the market for the next 24 hours in letting the Friday candle close on the daily chart before putting any serious money to work.

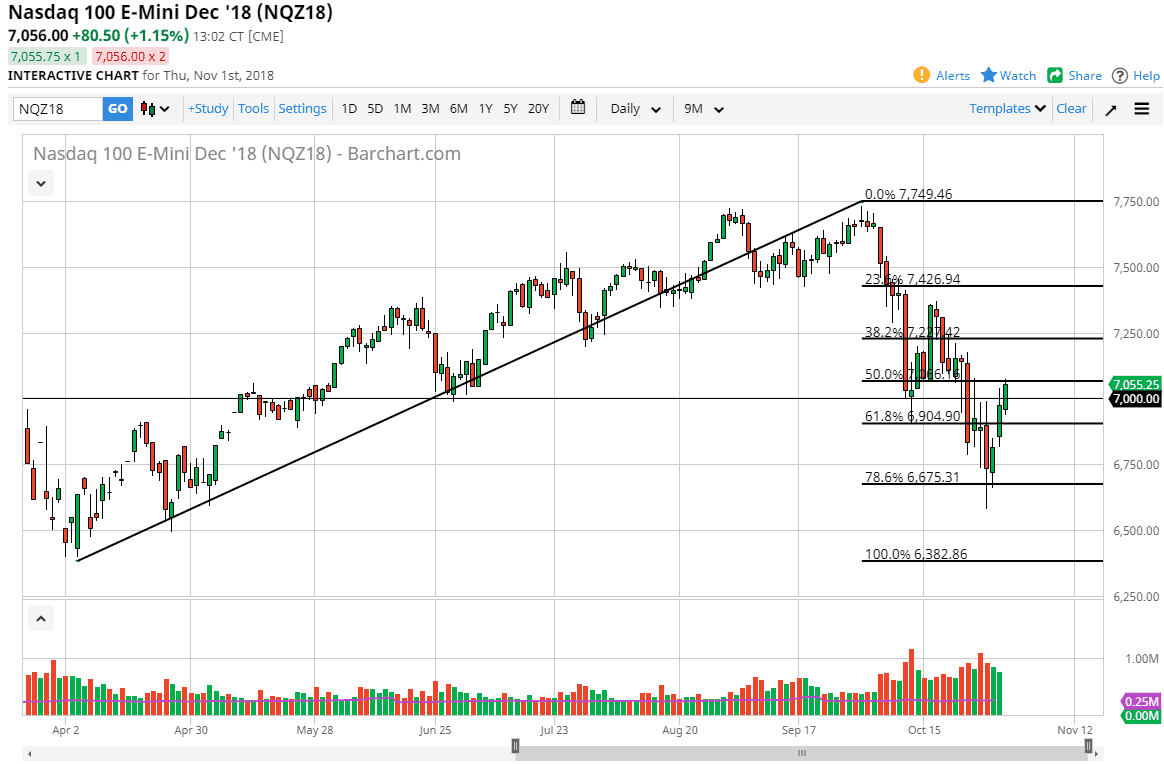

NASDAQ 100

The NASDAQ 100 also rallied during the session, showing signs of life again. However, we are facing a significant amount of resistance just above current levels, and with the jobs number coming out today, it’s very likely that we are going to see a lot of resistance. If we can break above the 7100 level, we could then go higher. Overall, if we see signs of exhaustion, I think that the market will probably continue to go a bit lower. That could be the balance that the sellers are looking for, and I think given enough time the jobs number will send this market in one direction or the other. I do favor the downside at this level, but if the daily candle closes above the massive red one that we are approaching, then I think we could see a shift in overall attitude. The next 24 hours are going to be crucial.