S&P 500

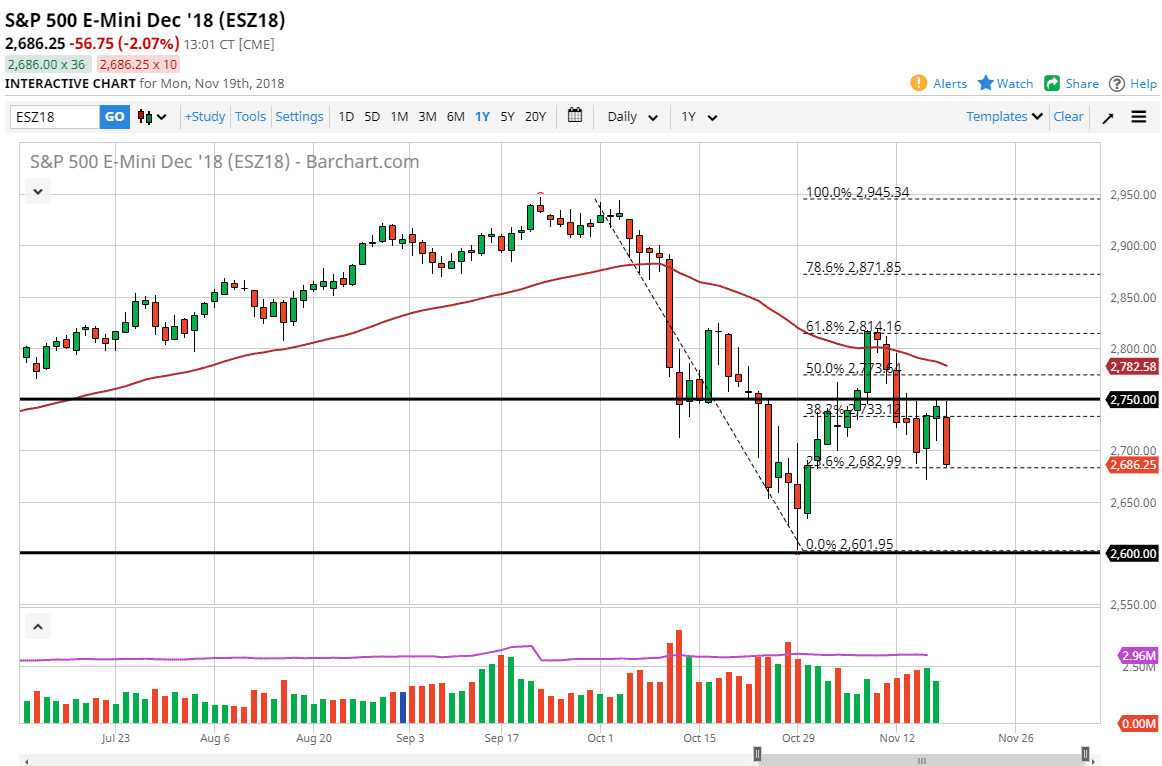

The S&P 500 has broken down rather significantly after initially trying to rally during the day on Monday, as the cartage continues. As traders contemplate the breakdown of American/Chinese trade relations and of course the negativity that we have seen over the weekend, it makes sense that we will continue to struggle to pick up risk appetite. With that being the case, the S&P 500 will continue to struggle overall. Rallies at this point continue to struggle at the 2750 handle, an area that has a lot of resistance recently. If we were to break above that area, then the market will focus on the 50 EMA. If we can break above there on a daily close then I might be convinced to start buying, but obviously this market looks very sick.

NASDAQ 100

If the S&P 500 looks soft, the NASDAQ 100 looks terrific. It looks as if we are going to wipe out the entirety of the recent rally, and I suspect that we are going to go much lower. 6500 would be targeted after that low, and then I think that we could be looking at 6000 given enough time. Overall, I believe that the NASDAQ 100 will continue to get hammered due to the trade sanctions, which of course directly affect a lot of the technology companies in the US. Because of this, I think that the NASDAQ 100 will probably lead the way lower. At this point, the 7000 handle above continues to be massive resistance and I think will be tough to break above. I would not be a buyer until we close above the 50 day exponential moving average on the daily chart. I don’t see that happening anytime soon.