S&P 500

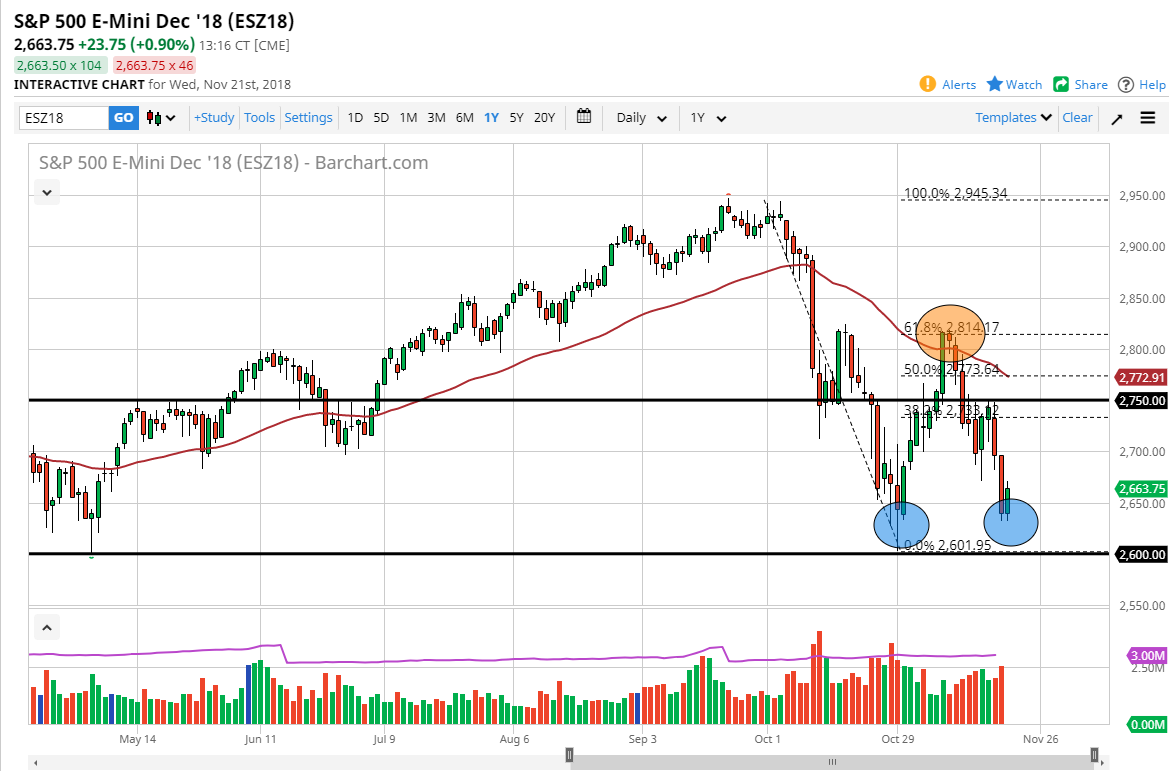

For those of you outside of the United States, you should be aware that it is Thanksgiving Day in America. That being said, there will be no underlying asset moving. CFD markets and electronic futures will be trading later in the day, so while you are trading, a lot of this is going to be speculation as to where we go over the next couple of days. Ultimately, I think the three most important points on the chart are shown in blue and orange, with the blue area being support between 2650 and 2600 on the E-mini S&P 500 futures. The orange area is where we met the 61.8% Fibonacci retracement level, formed a hanging man, and then of course ran into the 50 day EMA. I think what were about to see is a short-term bounce, but don’t get sucked into buying it. I believe that short-term bounce will eventually find sellers but it may take a couple of days.

NASDAQ 100

The NASDAQ 100 as part of the reason I think the S&P 500 will take off for the longer-term. I believe that the NASDAQ 100 making a fresh, new low suggests that we still have downward pressure to deal with. I believe rallies will be sold, with the 6800 level offering a lot of resistance. Beyond that, I have no interest in buying this market until we break above the 50 day EMA on a daily close, something that clearly isn’t going to happen in the short term. Keep in mind that some of the positivity in the market was probably due to short covering going into the Thanksgiving Day holiday, so I wouldn't read too much into this bounce.