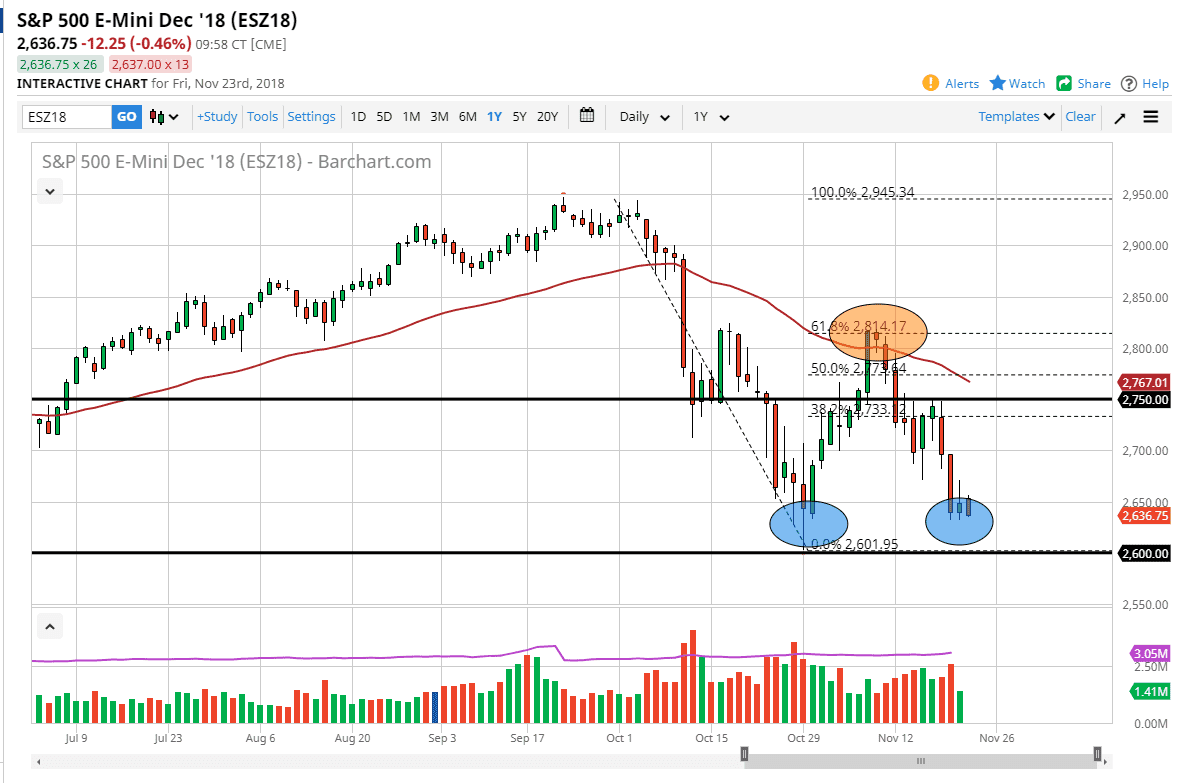

S&P 500

The S&P 500 wasn't trading, but the E-mini S&P 500 contract was available for electronic traders around the world. We got a little bit of a bounce at the open but then rolled over. I think the 2600 level underneath should be supportive, and I think that the market breaking down below there should send this market down to the 2500 level. I think that the market breaking below there could send it into a catastrophic tailwind. However, if we rally from here I think there is plenty of resistance above, starting at the 2700 level, going to the 2750 level after that. Beyond that, the 50 day EMA above should also offer resistance. I think selling rallies will continue to be the best way to deal with this market.

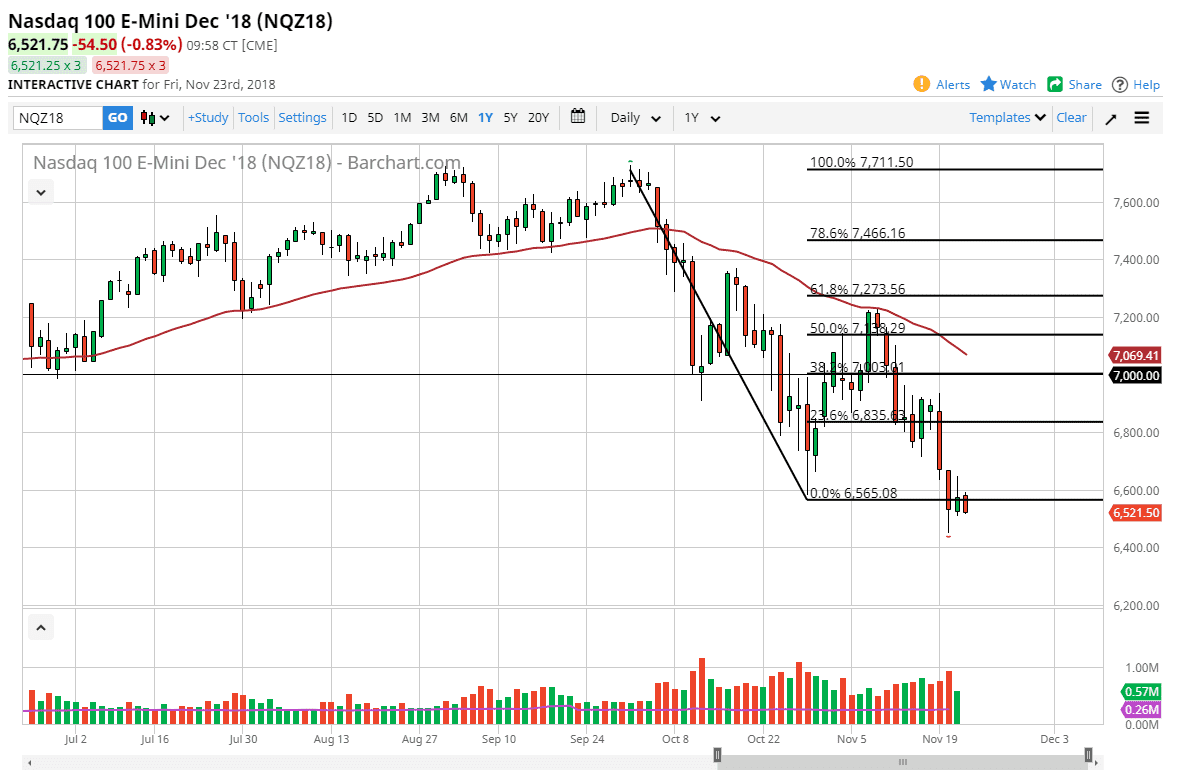

NASDAQ 100

The NASDAQ 100 has shown a proclivity to drift a little bit lower during the day as well, but again it was on very thin volume as Americans were off on Thanksgiving Day, and I think that today will also be a bit thin. Overall, the market will continue to find sellers above, unless of course we can wipe out the negative candle from the Monday session, something that would take quite a bit of momentum. The 50 day EMA is continuing to point lower, so I think at this juncture you are better off waiting for selling opportunities on signs of exhaustion. If we break down below the lows from the Tuesday session, the market could go lower, perhaps down to the 6400 level, followed by the 6200 level. The US/China trade sanctions will continue to hurt tech companies, which of course makes up a bulk of this index.