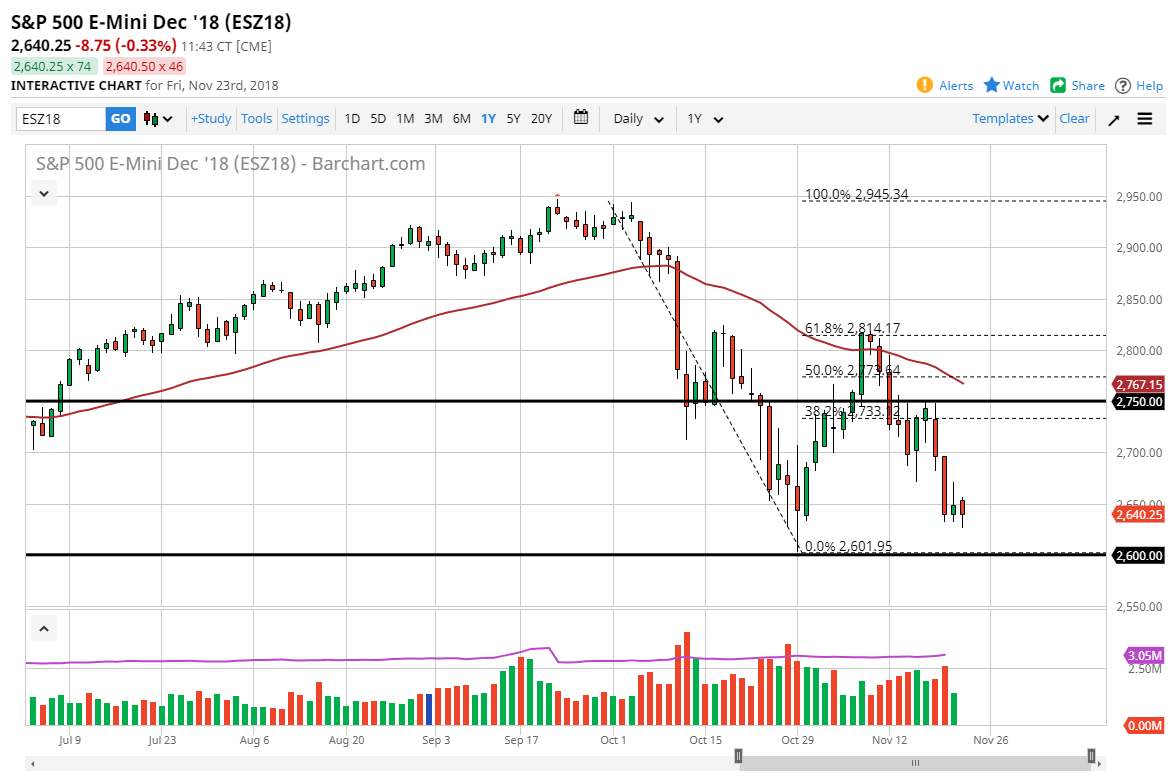

S&P 500

The S&P 500 initially fell during Friday and what would have been a shortened trading session, but we bounced enough to show signs of life towards the end. Ultimately though, we are still very soft and I think that it is only a matter of time before the sellers would reenter on a rally. It does look likely that we are trying to form some type of double bottom, perhaps just above the 2600 level. That double bottom is a tentative rally cry, but it’s not until we break above the 50 day EMA that I’m comfortable for a longer move. I suspect we will get a short-term bounce, followed by selling again near the 2700 level. If we were to break down below the 2600 level, then the market probably goes down to 2500 is next. There are far too many global growth issues out there to think that the S&P 500 is out of the woods.

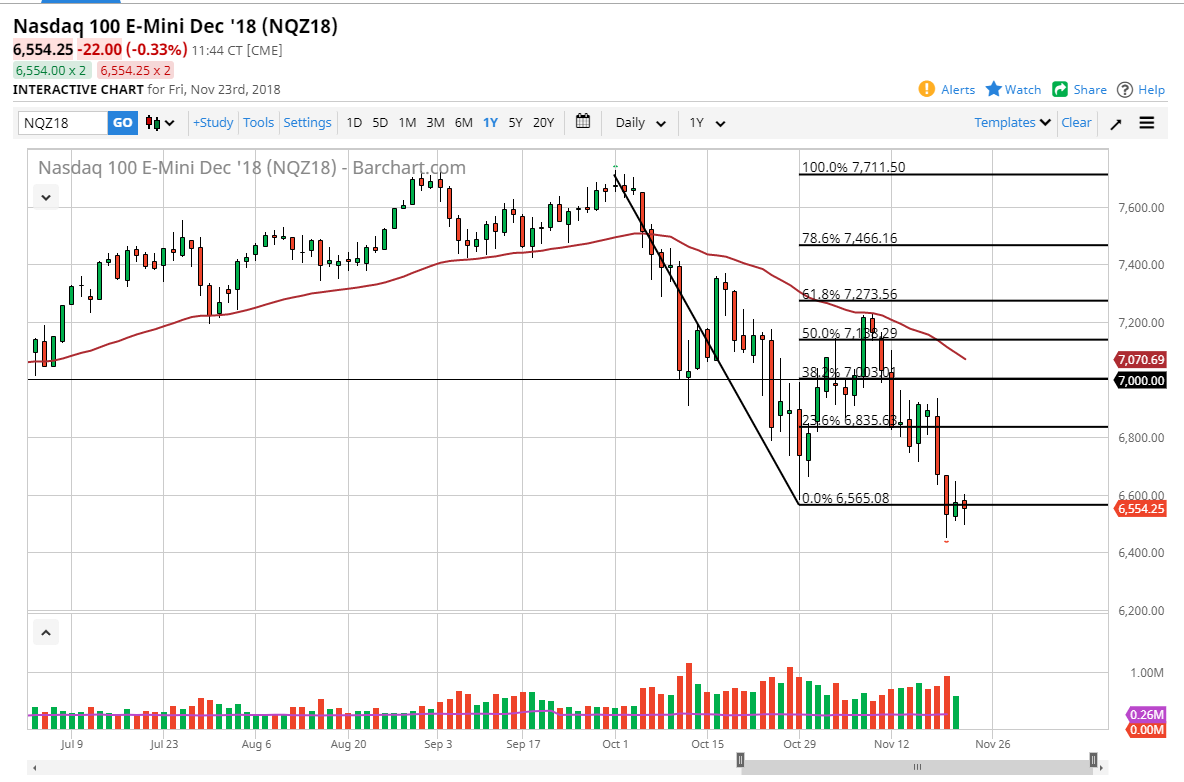

NASDAQ 100

The NASDAQ 100 has fallen a bit during the trading session on Friday as well, as the 6600 level has offered resistance. I think that the market has found a bit of psychological support near the 6500 level, but I think it’s only a matter of time before we break down. I like the idea of selling rallies, because it gives you an opportunity to get short “on the cheap.” The 50 day EMA is decidedly sloped lower, and we have broken down to a fresh, new low recently, and I think we are going to continue to drop. The US/China trade problems continue to weigh upon technology companies, so I think the NASDAQ 100 is going to continue to underperform other stock indices in America.