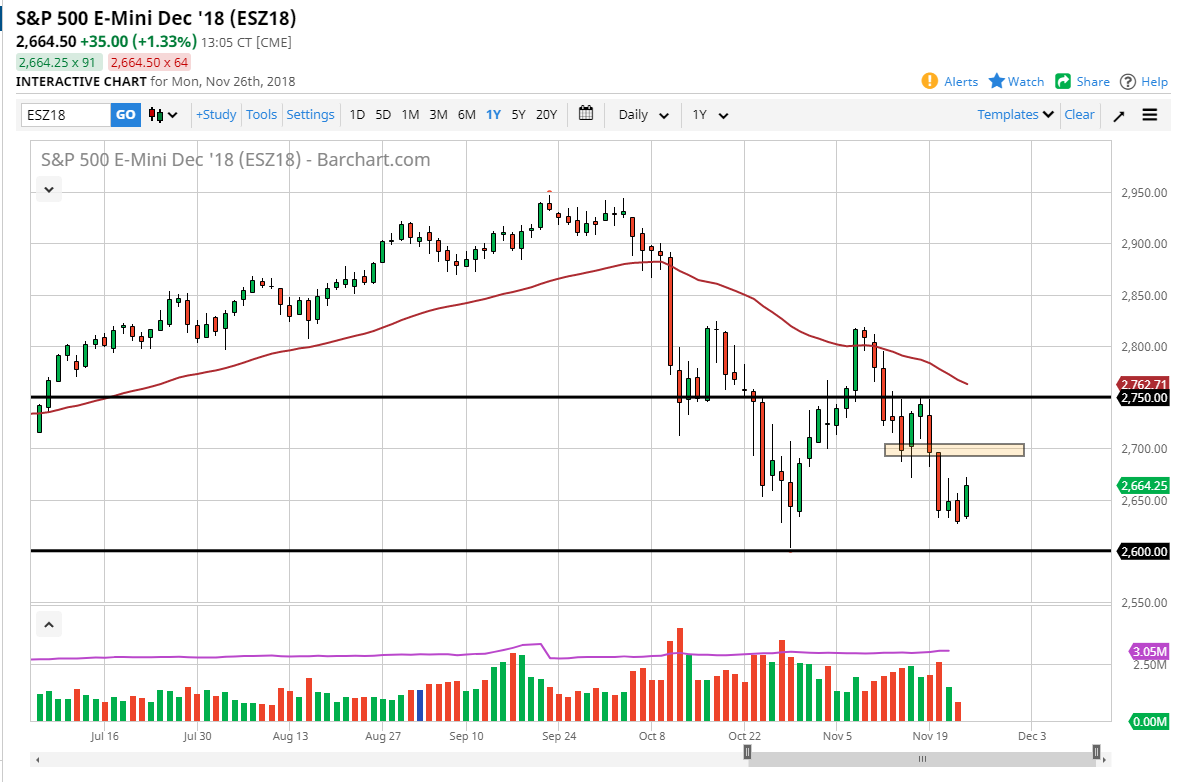

S&P 500

The S&P 500 broke higher during the session on Monday as traders came back from the weekend. It does show a proclivity to try to go higher, and I think perhaps we may be getting a bounce that has been needed for a while. The 2700 level above is the first major barrier to overcome, so if we reach that area I suspect that the sellers will come back into this market, and that the first signs of exhaustion that I anticipate selling. However, if we break above the 2700 level, then the market could go looking towards the 2750 level. Ultimately, I believe that it will take very little to shake this market up, as we await to see what the reaction to the meeting between the Americans and Chinese procures, or doesn’t procure in Argentina. I suspect that disappointment will probably send this market lower eventually.

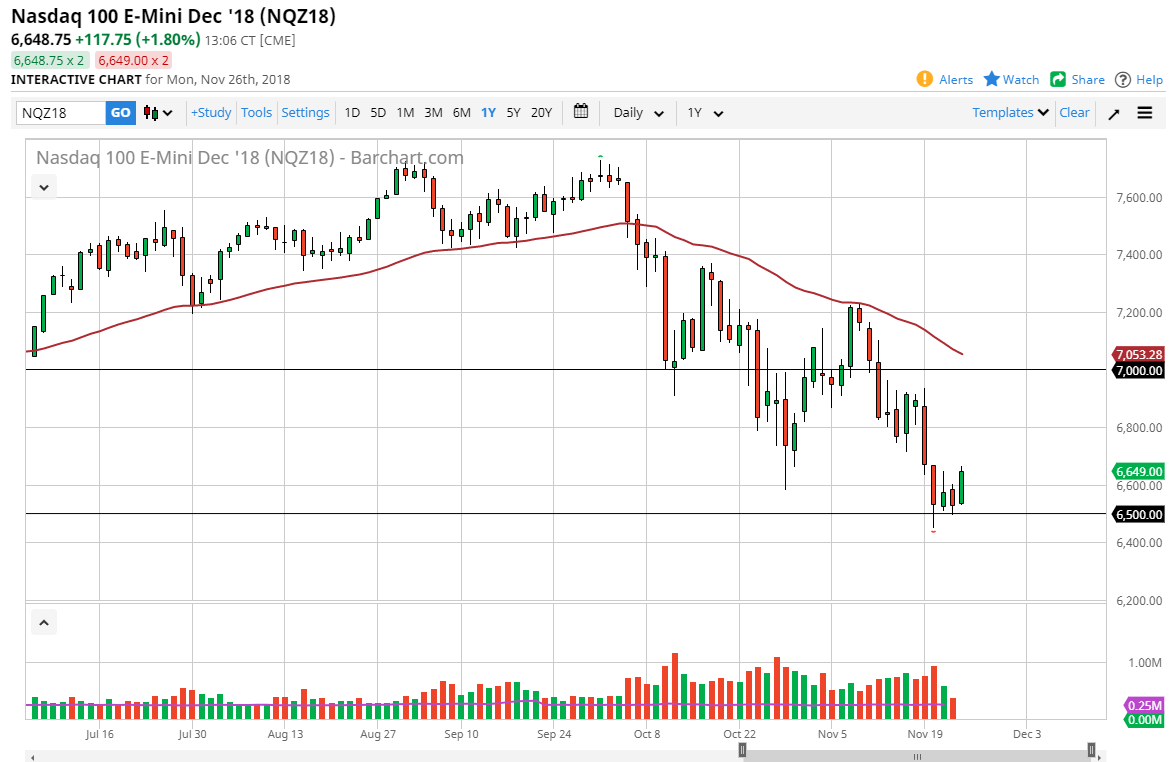

NASDAQ 100

The NASDAQ 100 broke higher during the session on Monday, breaking above the top of the shooting star candlestick from Thursday. If we can break above the top of the range during the trading session on Monday, then I think we continue to go towards the 6800 level. However, we have seen such destruction in this market that I think that every bad headline has the ability to turn this market right back around. This market will be especially sensitive to US/China relations, as so much in the way of technology value is found traveling between these two countries. I am not interested in buying this market, at least not in the short term. I’m looking for signs of exhaustion to start selling. At that point, I think we would test the 6500 level again, and if the Americans and Chinese can come to gather in Argentina, that could send this market relaying again.