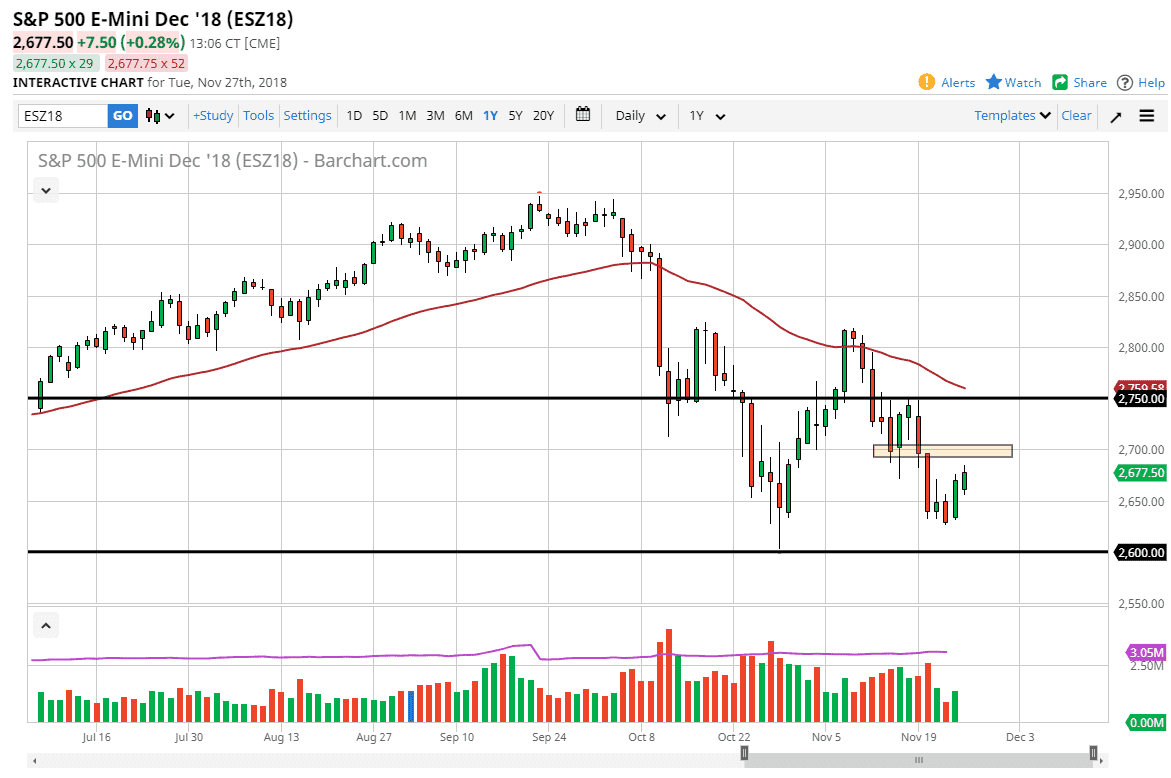

S&P 500

The S&P 500 rallied a bit during the day on Tuesday, but still has a lot of resistance above at the 2700 level. That’s an area that I have a rectangle drawn, as I believe it is previous resistance and of course support. At this point, I think that signs of exhaustion in that general vicinity should be nice selling opportunities. Yes, there have been headlines about Donald Trump suggesting that the Americans and Chinese could strike a deal, but we’ve heard this before. I think that the rally will be faded, but once we break above the 2750 level or the 50 day EMA, that would of course change everything. Until then, I look at rallies with a bit of suspicion, but I also recognize that you should be flexible in your trading approach. Obviously, there is significant support above the 2600 level underneath, so I think the one thing you can count on is a lot of choppiness.

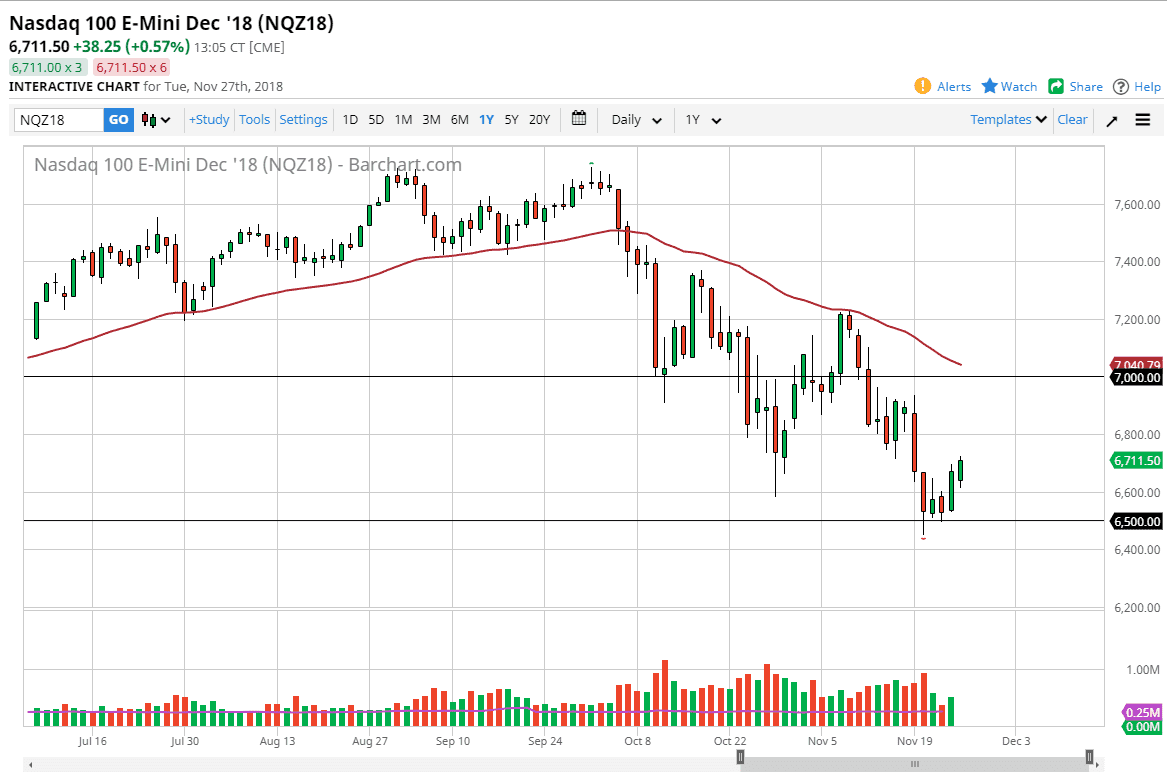

NASDAQ 100

NASDAQ 100 traders initially sold, but then ended up turning things around and rallying quite nicely. I believe this is based upon hope that the Americans and the Chinese will come to some type of agreement or at least that perhaps the trade tariffs may be postponed while they try to work things out. I suspect they are setting themselves up for disappointment, so I'm going to step away and look for an exhaustive candle to start selling, with a particular interest at the 6850 region.

Beyond that, there is the 50 day EMA on the chart that is hovering around the 7000 handle, and I would expect to see a lot of selling pressure in that area as well. Overall, I think this bounce is necessary but it doesn't really change much.