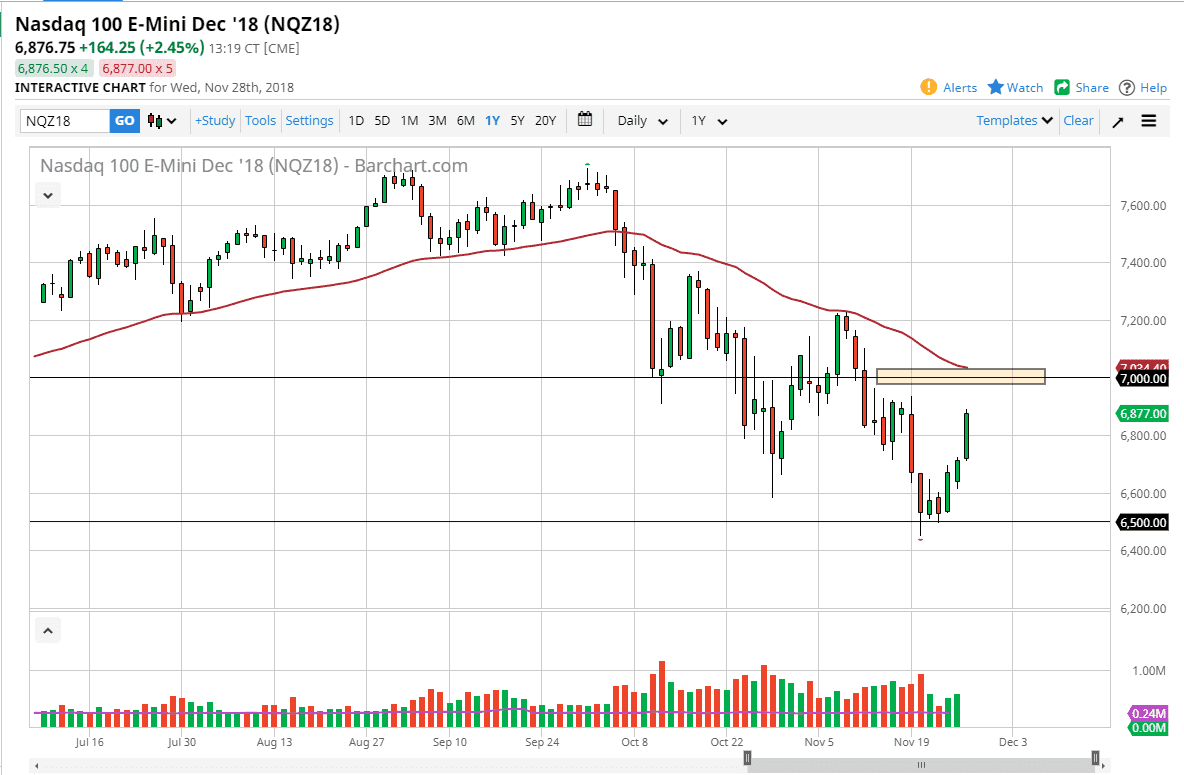

S&P 500

The S&P 500 rallied significantly during the trading session after Jerome Powell reaffirmed that the Federal Reserve isn’t set in its plans going forward, or at least not on autopilot. That seem to be something that the market wanted to see, but I also see the 2750 level above as significant resistance, and now we have the G 20 meeting coming up which of course will have an effect on the markets as well. I think at this point, if you are not long of the S&P 500 already, now is not the time to do it. A daily close above the 50 day EMA is going to be the signal I wait for it to continue to go higher. In the short term, I believe that the market will continue to be focusing on trade wars.

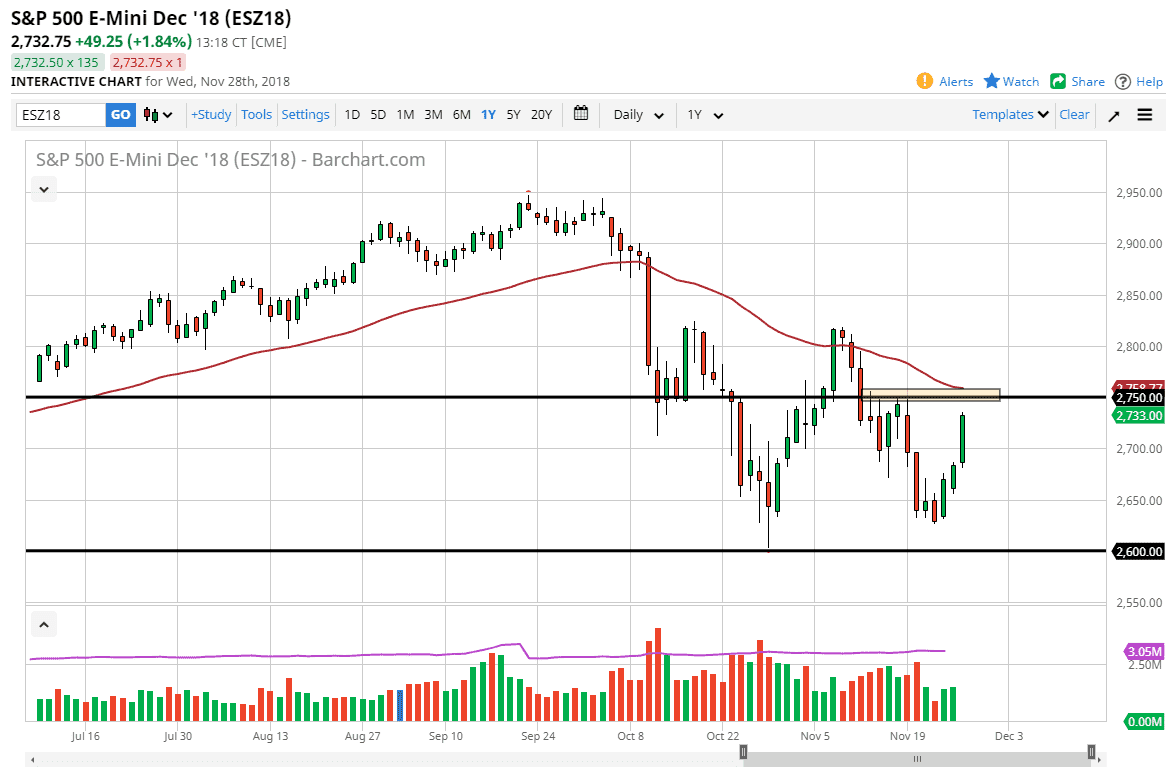

NASDAQ 100

The NASDAQ 100 also rallied, reaching towards the 6900 level. You can see that I have the 7000 level highlighted, which is coinciding nicely with the 50 day EMA. Ultimately, I think that there will be a lot of resistance there, especially if we don’t get some type of positive news out of Argentina. That meeting between the Americans and the Chinese will of course be scrutinized, but I think the market is ahead of itself if it thinks that just because the Federal Reserve is starting to become a little bit more conscious of the markets, it’s smooth sailing. I think there is still a lot of drama to be had between the Americans and the Chinese, and that will cause problems. The 50 day EMA above is going to be resistive, and it’s not until we break above there that I feel comfortable buying this market either.