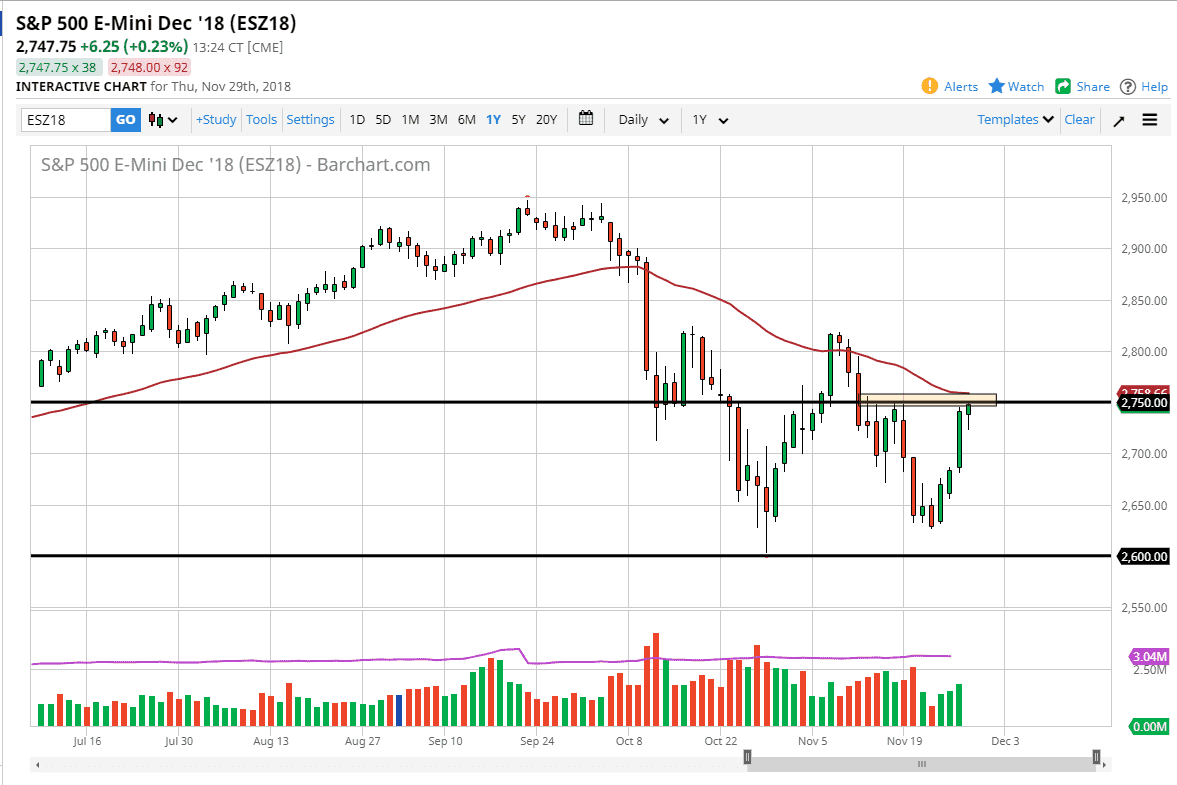

S&P 500

The S&P 500 initially pulled back during the trading session on Thursday but then turned around to slam into the 2750 level. This is an area of significance, as it not only is an area of resistance in the recent past, but it’s also been support. Beyond that, the 50 day EMA is hanging around this figure and after the Meeting Minutes from the FOMC, market participants are starting to get in their head that perhaps the Federal Reserve is starting to leave a door open to be able to keep interest rates low for a while. However, we still have the G 20 meeting over the weekend, and it’s going to be difficult to feel completely safe and secure going long until we get through it. If we can get some type of an agreement between the Americans and the Chinese, that could be the reason we go higher.

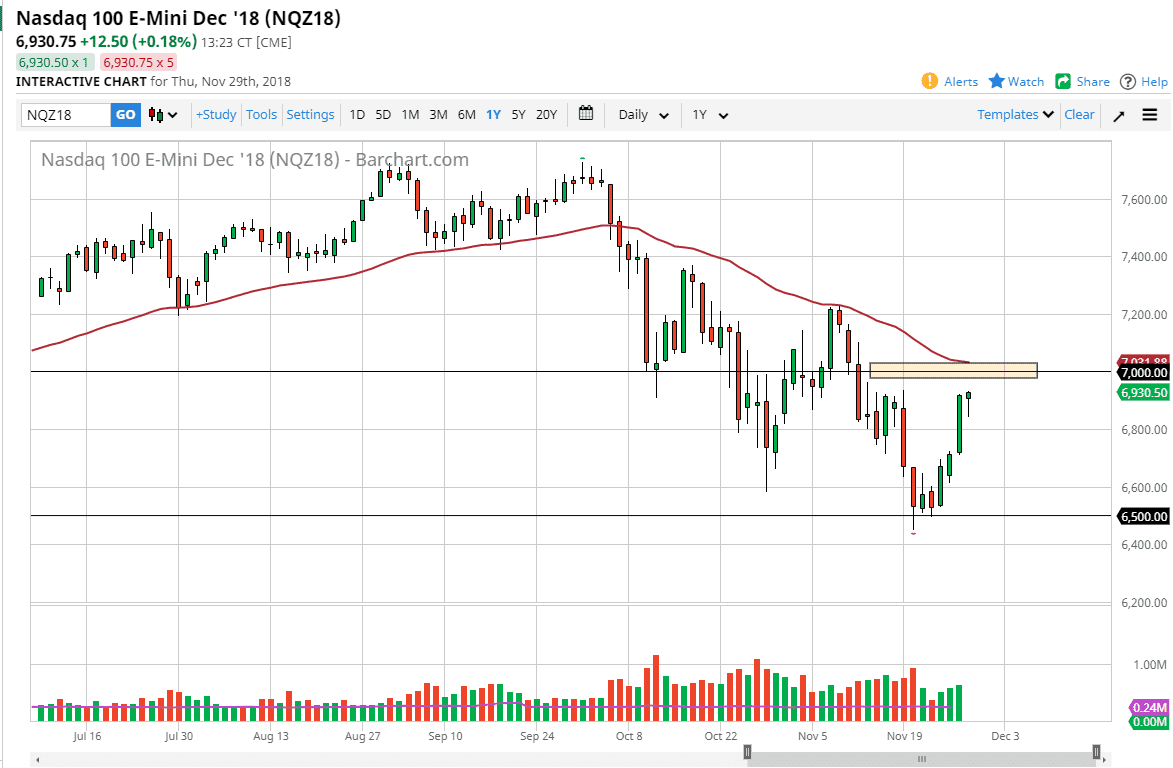

NASDAQ 100

The NASDAQ 100 also initially pulled back during the trading session on Thursday, but then slammed into the resistance that we closed out the trading session on Wednesday with, and it now looks as if we are going to go looking towards the 7000 level above which of course is the 50 day EMA as well as a large, round, psychologically significant figure. The question now is whether or not the US and China can come together and give us some type of good news out of Argentina. If they do, I fully expect that the market will probably rally quite drastically, and the NASDAQ 100 could be a major beneficiary as it is composed of so many international technology companies. If we break the bottom of the candle stick from the Thursday session, that could be a very bad sign.