S&P 500

The S&P 500 went back and forth during the trading session on Friday as we continue to get headlines pushing the stock markets around. It’s been obvious that the China trade related headlines have been the major focus of the markets, and they are ending the week on a very soft note. I believe that we do have downside here, if we break below the 2700 level which should accelerate down to the 2600 level. I believe that we are starting to see a little bit of value hunting, and that does help. Ultimately, I expect a lot of choppiness and I don’t expect to see this market break down below the 2600 level very easily, as there has been major support underneath there. Expect a lot of erratic in choppy trading, focus on short-term charts, and keep your positions as small as possible.

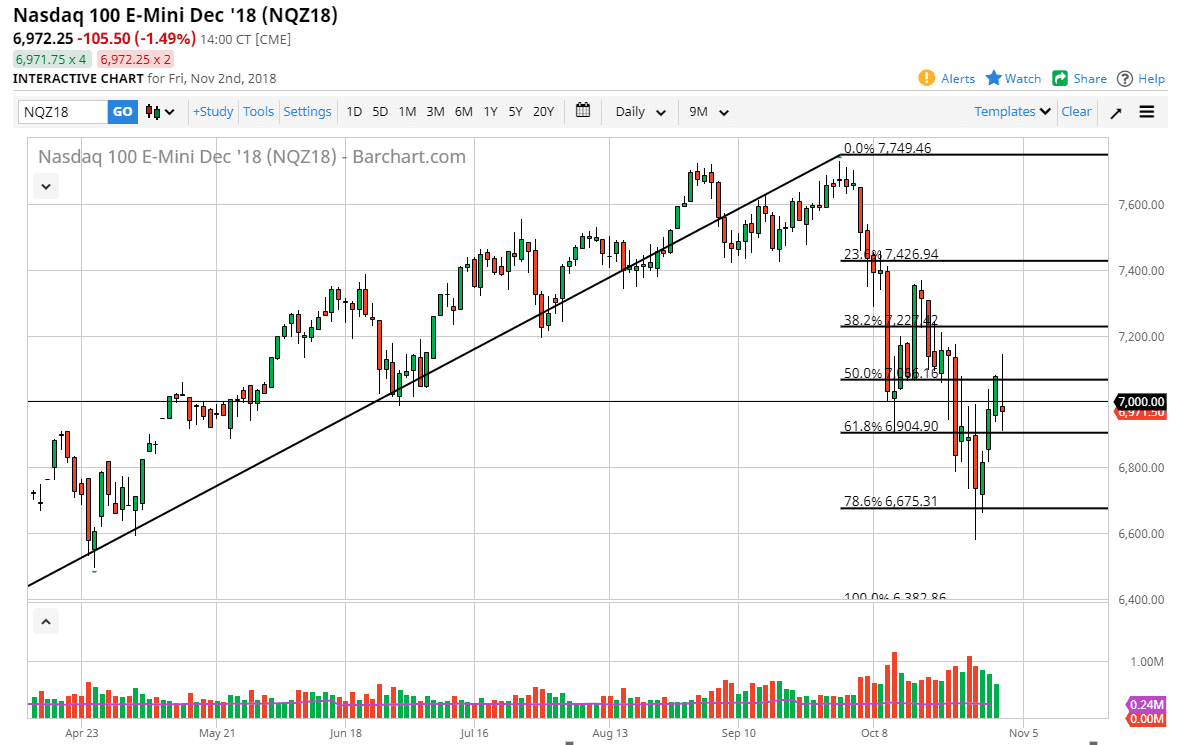

NASDAQ 100

The NASDAQ 100 took the brunt of the hit from the Chinese headlines, breaking well below the 7000 level after hearing that. Even though we have a very strong job market in the United States, this chart is starting to look very technically broken again, and I think if we break down below the 6900 level, we will probably drop back down towards the lows where we had seen such a massive bounce. Otherwise, if we break above the top of the shooting star for the trading session on Friday, that would send this market higher, breaking above the 7200 level. Overall, expect a lot of volatility and in the erratic behavior of the stock markets, I think it’s good to be difficult for people to hang onto positions for any real length of time.