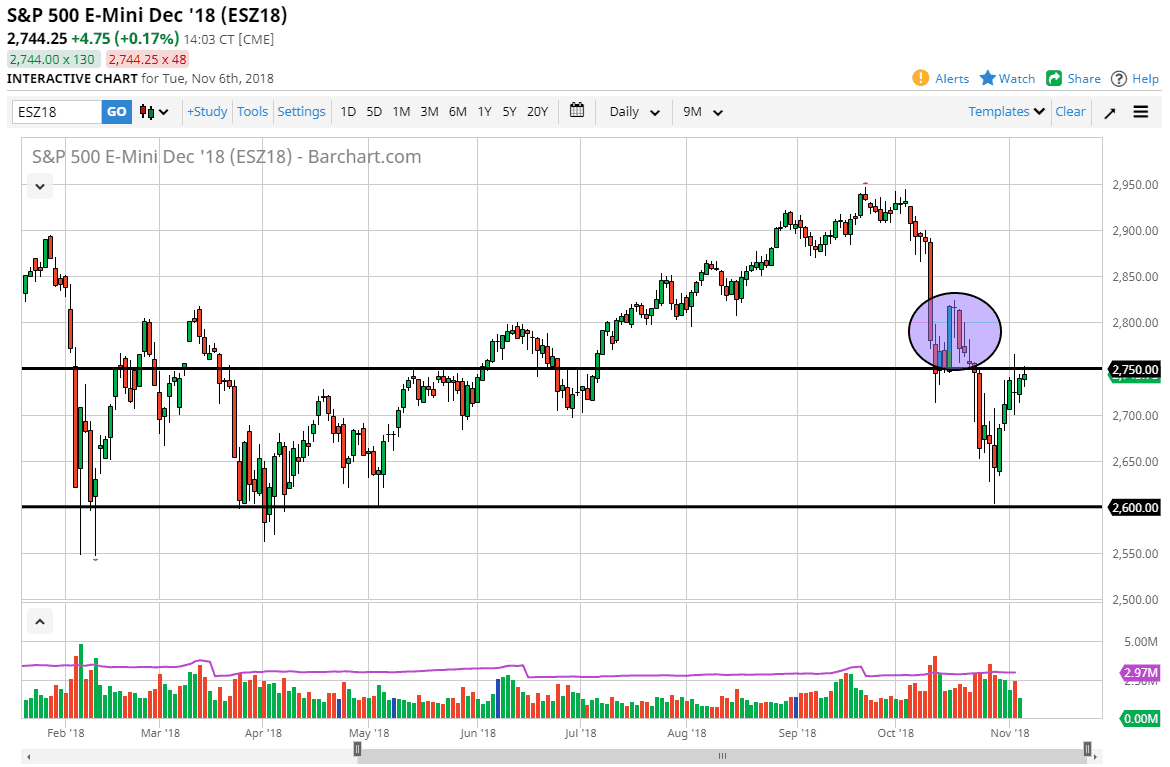

S&P 500

The S&P 500 went back and forth during the trading session on Tuesday as we await the results of the US midterm elections. Because of this, it’s likely that the market is going to react somewhat erratically, but I also have noticed that there has been a lot of noise right around the 2750 level, as it has been both support and resistance. I think at this point, it’s probably a bit difficult to put any money to work, but if we can break above the 2800 level, then the market should go higher, perhaps reaching towards the 2900 level. I suspect that if we get a bit of exhaustion here, which would make structural sense, the market could break down to the 2700 level initially, perhaps even lower than that.

NASDAQ 100

The NASDAQ 100 has gone back and forth during the trading session on Tuesday but continues to struggle just above the 7000 handle. At this point though, I think there is significant resistance near the 7100 level that would have to be cleared to start buying. If we roll over, I think there is a lot of support just below as well. If you are going to trade futures markets or CFD’s based upon the US stock markets, you will probably be better served waiting at least 24 hours before you put money to work. This is because nobody really knows when it’s “baked into the market.” At first blush, I suspect that the Republicans hang on to both the House of Representatives and the Senate, then it will probably be bullish. However, keep in mind that trading robots will be placing orders based upon every headline that crosses the wires, so it’s going to be extraordinarily erratic.