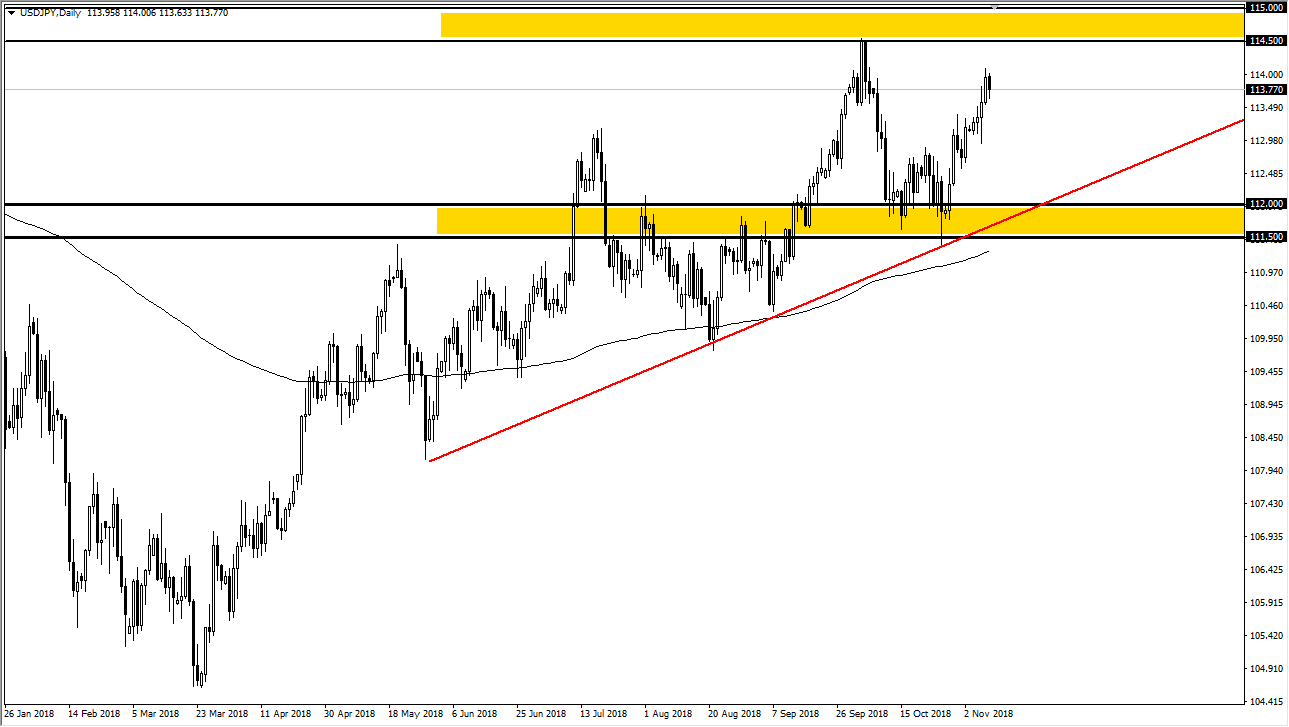

USD/JPY

The US dollar fell a bit against the Japanese yen during the trading session on Friday as traders started to take profit going into the weekend. There is a significant amount of supply just above, and of course a massive resistance barrier at the ¥114.50 level that extends to the ¥115 level. In other words, it makes sense that we would pull back a bit from here. I think there is plenty of support underneath, including the 200 day EMA, the uptrend line, and of course the ¥112 level. I don’t want to short this pair, I simply want to pick up the pair at lower pricing and take advantage of value. If we could break above the ¥115 level, then we could go much higher, perhaps the ¥117.50 level. Lots of volatility is probably the one thing you can expect.

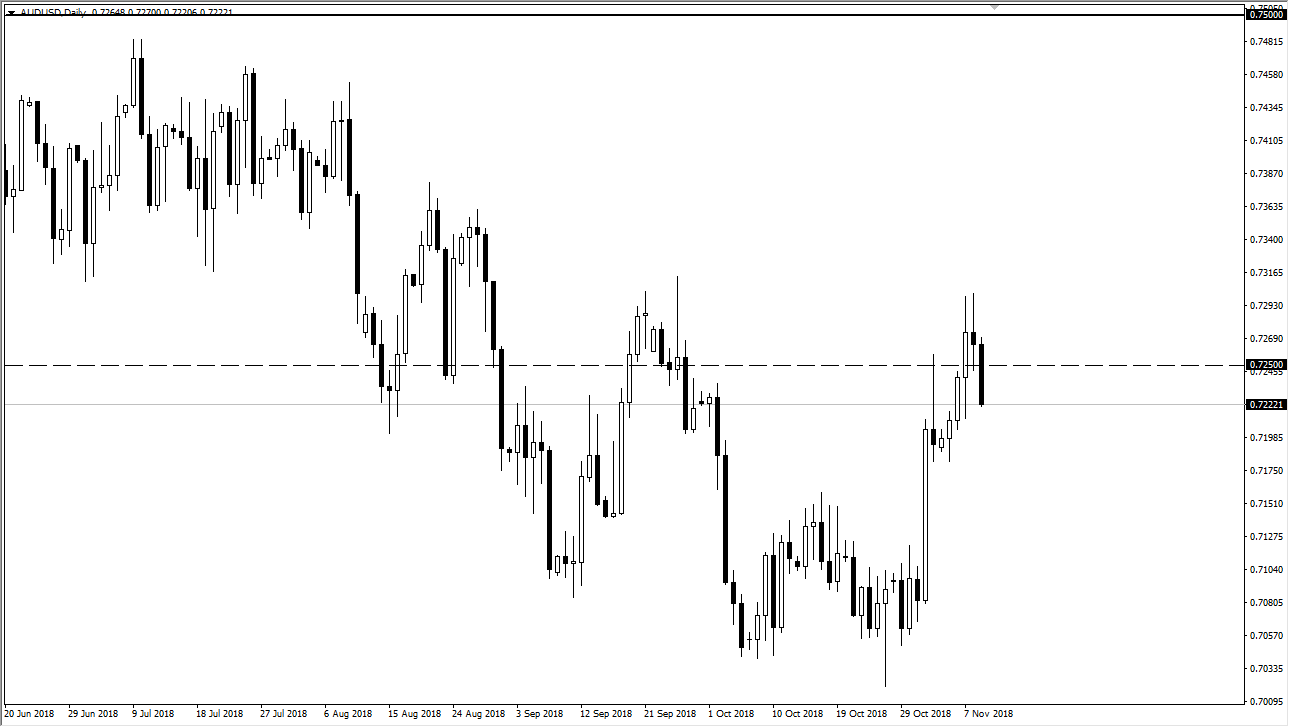

AUD/USD

The Australian dollar has been at the mercy of Sino-American trade relations for some time, and although we have seen a massive rally as of late, it looks like the 0.73 level is going to be a bridge too far as it were for the buyers. By breaking below the Thursday candle, we have set in some bearishness in this pair, and I would expect a little bit of follow-through, perhaps even accelerating if we get bad headlines over the weekend involving either China or the United States. I believe the market has gotten ahead of itself, because quite frankly I don’t expect much out of the meeting between the Americans and the Chinese in Argentina.

If rhetoric starts to heat up, this pair will fall. I also believe that the Democrats taking the house does not weaken the hands of Donald Trump, because this is one of the few areas in which they agree, trade negotiations. In fact, I would not be surprised at all to see this pair revisit the bottom. Doing that would only signify consolidation.