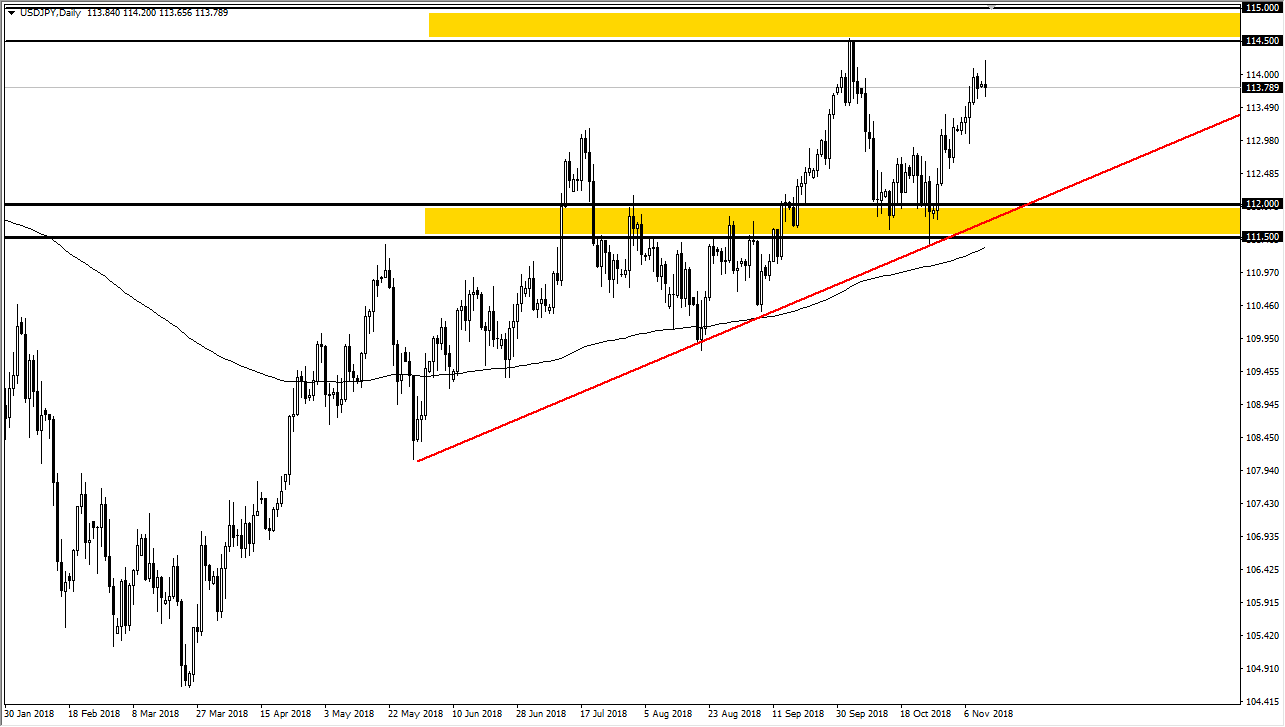

USD/JPY

The US dollar rallied initially during the trading session on Monday but gave back most of the gains. Because of this, we ended up forming a shooting star which of course is a very negative sign. Ultimately, this is a market that is overbought and it makes sense that we need to pullback towards more support. The 200 day EMA is just below the uptrend line, so obviously there is a significant amount of support underneath for the longer-term trader. However, I think that it’s only a matter of time before we get a bounce. Short-term traders are probably looking to either take profits or try to short a market that has gotten ahead of itself. However, I think this is a short-term opportunity, and I would anticipate that most traders will look at it as such, as we are in such a strong uptrend. However, the ¥114.50 level has offered a major resistance, so it makes sense that we pull back to pick up momentum.

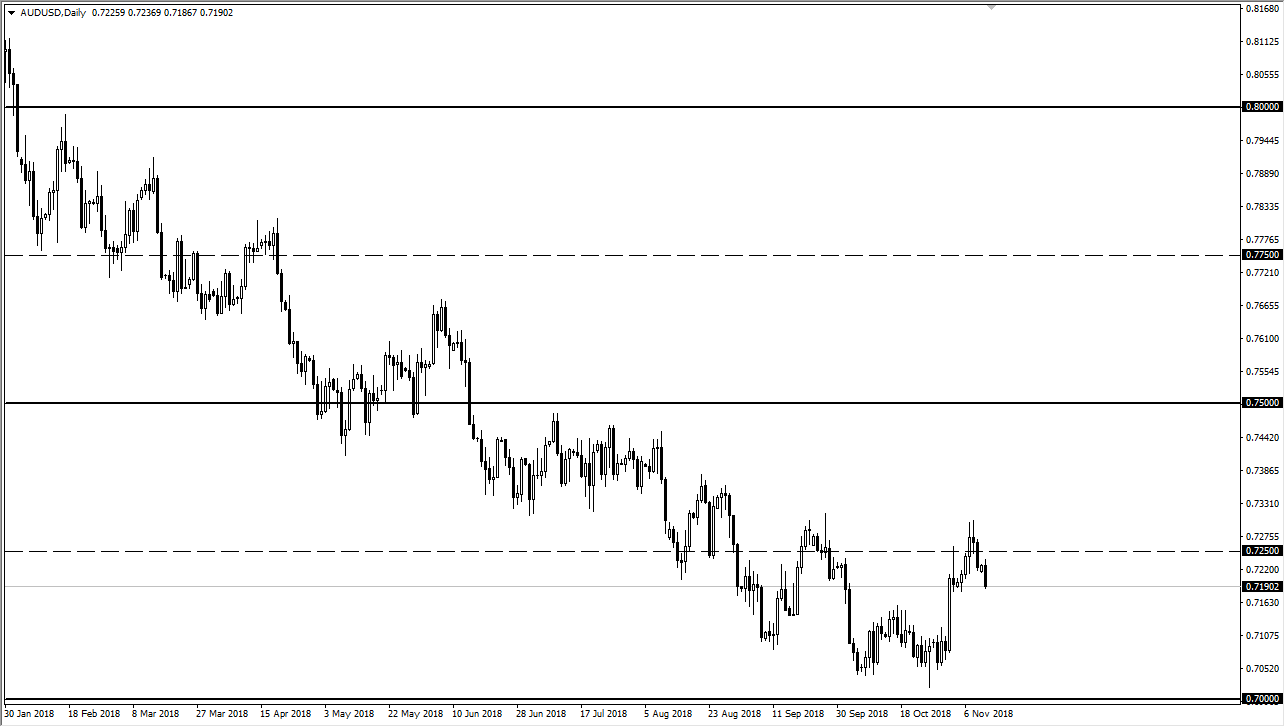

AUD/USD

The Australian dollar has broken down during the trading session on Monday, as we continue to see a lot of weakness when it comes to the Australian dollar, and strength when it comes to the US dollar as we have several interest rates coming down the road. The 0.73 level above is massive resistance, and I think it’s only a matter time before sellers come in on signs of exhaustion. However, if we break down below the bottom of the daily candle stick, then we will probably drive down to the 0.71 handle. However, if we turn around to break above the 0.73 level, then the market probably goes to the 0.75 level after that. I believe that the United States is still going to continue to press the issue with trade tariffs, so I expect the Aussie to continue to struggle in general.